Symantec 1997 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 1997 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

SYMANTEC CORPORATION

Directors or committee may determine). The purpose of

these plans are to attract, retain and motivate eligible persons

whose present and potential contributions are important to

the success of the Company by offering them an opportunity

to participate in the Company’s future performance through

awards of stock options and stock bonuses. Under the terms

of these plans, the option exercise price may not be less than

100% of the fair market value on the date of grant, the

options have a maximum term of ten years and generally vest

over a four-year period.

On May 14, 1996, Symantec stockholders approved the

1996 Equity Incentive Plan (the “96 Plan”) which superseded

the 1988 Option Plan (the “88 Plan”) and made available

approximately 2.7 million shares. On September 25, 1996,

stockholders approved an amendment to the 96 Plan to make

available for issuance up to approximately 1.3 million addi-

tional shares representing the number of options previously

granted pursuant to the 88 Plan that had expired, were canceled

or were unexercisable for any reason without having been

exercised in full.

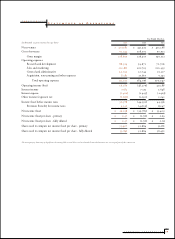

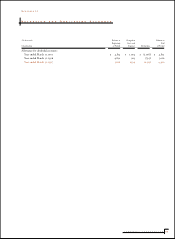

Stock option and warrant activity was as follows:

Weighted

Average

Number Exercise

(In thousands, except exercise price per share) of Shares Price

Outstanding at March 31, 1994 8,685 $ 12.28

Granted 3,799 19.02

Exercised (1,813) 9.53

Canceled (1,682) 20.20

Outstanding at March 31, 1995 8,989 14.36

Granted 5,990 16.56

Exercised (1,601) 10.40

Canceled (3,660) 22.14

Outstanding at March 31, 1996 9,718 13.43

Granted 2,681 13.90

Exercised (684) 9.89

Canceled (2,673) 14.21

Outstanding at March 31, 1997 9,042 13.61

March 31,

(In thousands) 1997 1996

Balances are as follows:

Authorized but unissued 11,901 10,418

Available for future grants 2,859 700

Exercisable and vested 4,066 3,894

Exercised, subject to repurchase —1

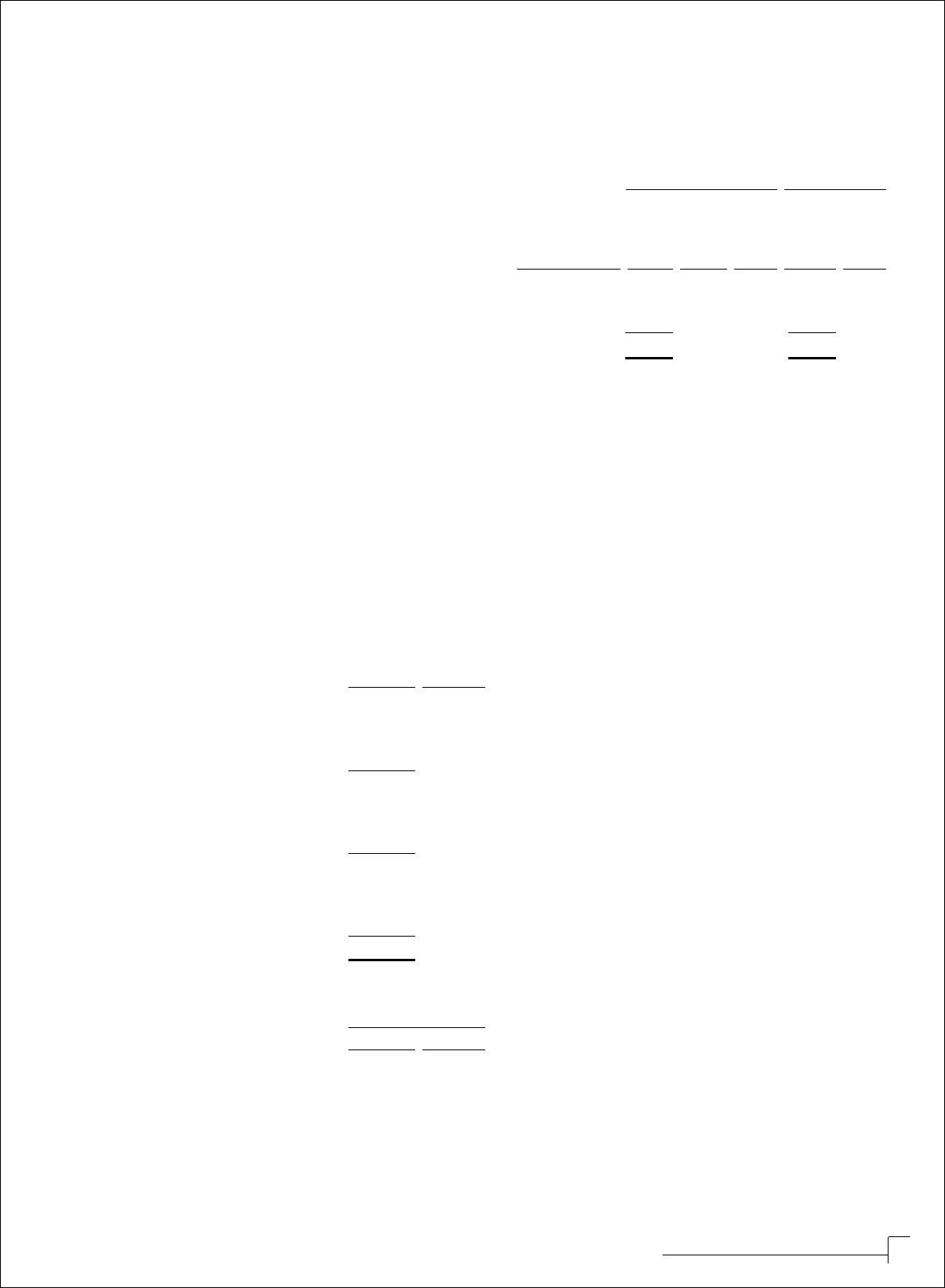

The following tables summarize information about

options outstanding at March 31, 1997:

Outstanding options Exercisable options

Weighted

average Weighted Weighted

Number of contractual average Number of average

shares (in life exercise shares (in exercise

Range of Exercise Prices thousands) (in years) price thousands) price

$ 1.00 - $ 12.50 2,995 7.27 $ 10.18 1,368 $ 9.71

$ 12.56 - $ 14.25 3,104 7.98 13.19 1,415 13.15

$ 14.31 - $ 39.13 2,943 7.64 17.54 1,283 19.42

9,042 7.63 13.61 4,066 13.97

These options will expire if not exercised at specific dates

ranging from April 1997 to March 2007. Prices for options

exercised during the three-year period ended March 31, 1997

ranged from $0.05 to $24.00.

Stock Award Plan During fiscal 1996, the Company regis-

tered 400,000 shares to be issued under the terms of the 1994

Patent Incentive Plan (the “94 Patent Plan”). The purpose of

this plan is to increase awareness of the importance of patents

to the Company’s business and to provide employees with

incentives to pursue patent protection for new technologies

that may be valuable to the Company. The Company’s exec-

utive officers are not eligible for awards under the 1994 Patent

Incentive Plan. As of March 31, 1997, approximately 9,000

shares had been issued under this plan.

Pro Forma Information The Company has elected to follow

APB Opinion No. 25, “Accounting for Stock Issued to

Employees,” in accounting for its employee stock options

because, as discussed below, the alternative fair value accounting

provided for under SFAS No. 123, “Accounting for Stock-

Based Compensation,” requires the use of option valuation

models that were not developed for use in valuing employee

stock options. Under APB No. 25, because the exercise price

of the Company’s employee stock options generally equals

the market price of the underlying stock on the date of grant,

no compensation expense is recognized in the Company’s

financial statements.

Pro forma information regarding net income and

earnings per share is required by SFAS No. 123. This infor-

mation is required to be determined as if the Company had

accounted for its employee stock options (including shares

issued under the Employee Stock Purchase Plan, collectively

called “options”) granted subsequent to March 31, 1995 under

the fair value method of that statement. The fair value of

options granted in fiscal years 1996 and 1997 reported below