Symantec 1997 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1997 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 SYMANTEC CORPORATION

products. While Symantec plans to continue to improve its

products with a view toward providing enhanced functionality

over what may be provided in operating systems, there is no

assurance that these efforts will be successful or that such

improved products will be commercially accepted by software

users. Symantec will also attempt to work with operating

system vendors in an effort to make its products compatible

with those operating systems, yet differentiate those utility

products from features included in the operating systems.

However, there is no assurance that these efforts will be

successful. (See further discussion in Item 7: Management’s

Discussion and Analysis of Financial Condition and Results

of Operations - Business Risks - Operating System.)

The Company competes with at least one product from

many of the major independent software vendors, including

Borland International, Inc. (“Borland”), CyberMedia

(“CyberMedia”), Dr Solomon’s (“Dr Solomon’s”), ELAN

Software Corporation (“ELAN”), International Business

Machines Corporation (“IBM”), McAfee Associates, Inc.

(“McAfee”), Microcom, Inc. (“Microcom”), Microsoft,

Norton-Lambert Corporation (“Norton-Lambert”), Phoenix

Technologies Ltd. (“Phoenix”), TouchStone Software

Corporation (“TouchStone”), Traveling Software, Inc.

(“Traveling Software”), Starfish Software, Inc. (“Starfish”)

and SofNet, Inc. (“SofNet”).

For example, Norton Utilities competes with operating

systems, such as Microsoft’s Windows 95 and MS-DOS and

IBM’s DOS, which offer file recovery, anti-virus and backup

features, First Aid from CyberMedia and other products from

various other utilities vendors. Norton AntiVirus competes

with PC-cillin 95 from TouchStone, Dr Solomon’s Anti-Virus

Toolkit from Dr Solomon’s and Viruscan from McAfee.

Symantec’s pcANYWHERE competes mainly with Laplink

from Traveling Software, Carbon Copy from Microcom,

Close Up from Norton Lambert and NetRemote from

McAfee. ACT! competes with Lotus Organizer for Windows

from IBM, Outlook from Microsoft, GoldMine from ELAN,

Sidekick from Starfish and many other personal information

managers produced by various software developers. Delrina

WinFax PRO competes with products offered by Phoenix,

Traveling Software and SofNet, as well as Microsoft’s

Windows 95 operating system. Café mainly competes with

products from Microsoft. In addition, these and other

Company products compete less directly with a number of

other products that offer levels of functionality different from

those offered by Symantec’s products or that were designed

Discussion and Analysis of Financial Condition and Results

of Operations - Business Risks - Management of Expanding

Operations.)

The Company is devoting substantial efforts to

the development of software products that are designed to

operate on various operating systems. Symantec’s total

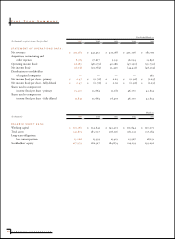

research and development expenses were approximately $89

million, $95 million and $71 million in fiscal 1997, 1996 and

1995, respectively. Research and development expenditures

are charged to operations as incurred. In fiscal 1997,

Symantec capitalized approximately $8 million of capitalized

software development costs, primarily related to network

administration technology, which was sold to Hewlett-

Packard in March 1997, resulting in the write off of

approximately $7 million of unamortized costs during fiscal

1997. No material software development costs have been

capitalized by the Company in fiscal 1996, while prior to

being acquired by Symantec, Delrina capitalized approxi-

mately $6 million in software development costs in fiscal year

1995. (See further discussion in Item 7: Management’s

Discussion and Analysis of Financial Condition and Results

of Operations - Business Risks - Operating System and

Uncertainty of Research and Development Efforts.)

Competition

The microcomputer software market is intensely competitive

and is subject to rapid changes in both technology and

the strategic direction of major microcomputer hardware

manufacturers and operating system providers. The

Company’s competitiveness depends on its ability to enhance

its existing products and to offer new products on a timely

basis. The Company has limited resources and must restrict

its product development efforts to a relatively small number

of projects. (See further discussion in Item 7: Management’s

Discussion and Analysis of Financial Condition and Results

of Operations - Business Risks - Rapid Technological Change

and Development Risks.)

Operating system vendors such as Microsoft have added

features to new versions of their products that provide some

of the same functionality traditionally offered in Symantec’s

products. Symantec believes this trend may continue.

Microsoft may incorporate advanced features in future

versions of operating systems that may decrease the demand

for certain of the Company’s products, including those

currently under development. A number of software develop-

ers have integrated antivirus capabilities into their Internet