Suzuki 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 23

(b) Compliance system for employees

In order to ensure that employees execute their duties in compliance with the law and the Articles of Incorporation of

the Company, the Company is making effort to keep everyone informed about the “Suzuki Employees’ Action Charter”

which lays out the norms of action of employees, the “Approval Procedures” and the “Job Description” which set up the

proceedings of execution of their duties in details, and other rules of the Company. It is revised whenever necessary.

Furthermore, in accordance with the “Suzuki Corporate Ethics Rules”, the Company has developed compliance system

for employees including internal report system, and has educated them through various training and in-house seminars

regarding compliance. And, in accordance with the “Rule of Internal Auditing”, the audit department audits on the

integrity and efficiency of various control systems, organizations and rules, and properness of function of internal

control, etc.

(c) Risk management system

The Company has set up the “Risk Management Procedure” as part of the “Suzuki Corporate Ethics Rules” to cope

with risks such as malpractices or illegal acts which could occur inside and outside the Company or such as natural

disasters and terrorism which the Company can not prevent. Whenever the “Corporate Ethics Committee” recognizes

risks that could cause urgent and serious damages to the Company’s management and business operations, the

committee immediately sets up “Risk Management Headquarters”, in accordance with the “Risk Management

Procedure”, as an organization that will decide on the measures to be taken against the occurred risk. “Risk

Management Headquarters” immediately discuss and decide policies and measures to be taken and can give

instructions to the appropriate divisions and departments. These divisions and departments are then able to

communicate with each other to resolve any issues at hand.

(d) System to ensure proper business operation of the corporate group

To ensure a proper business operation of the corporate group which consists of the Company and its subsidiaries,

the Company has established the “Rules of Business Control Supervision”. It is revised whenever necessary. The

subsidiaries and affiliates report to the Company on their business operation and consult with the Company on important

matters in accordance with those rules, and departments in charge give guidance and advice to them to enhance their

management structure. And our audit department helps to make rules for the subsidiaries and affiliates, conducts

guidance, supporting and auditing for their regulatory compliance. It also promotes efficiency and standardization of

their business.

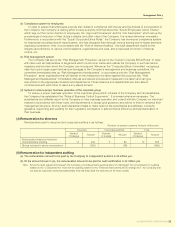

(4) Remuneration for directors

Remuneration paid to directors and corporate auditors is as follows:

(Number of payees: persons, Amount: million yen)

Management Policy

Directors Corporate Auditors Total

Number Amount Number Amount Number Amount

of payees of payees of payees

Remuneration based on resolution

of shareholders’ meeting 14 443 5 80 19 523

(Bonus included in above remuneration) (252) (28) (280)

(5) Remuneration for independent auditing

(a) The remuneration amount to be paid by the Company to independent auditors is 44 million yen.

(b) Of the amount shown in (a), the remuneration amount to be paid for audit certification is 44 million yen.

Note: Since the audit agreement between the Company and independent auditors does not distinguish the remuneration for auditing

based on the “Companies Act” from that for auditing based on the “Financial Instruments and Exchange Act”, the Company can

not specify respective amounts substantially and has described the total amount for those audits.