Suzuki 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

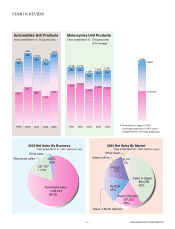

The Japanese Market

The number of motorcycles put out by the four Japanese

makers in the domestic market during fiscal year 2002 (April

2002 to March 2003) amounted to 776,000 units (105% of the

previous year) in total volume, thus reversing the trend of

recent years of a continued decline. A breakdown of the

figure by displacement classes shows volume for the 125cc-

and-under class of 637,000 units (106% of the previous year)

and for the 126cc-and-over class of 139,000 units (104% of

the previous year), thus marking growth for both classes.

Growth in the 125cc-and-under class can be attributed to

the introduction, by various makers, of low-priced 50cc

scooters (420,000 units, 109% of the previous year) that

succeeded in stimulating demand.

Meanwhile, strong sales of 126cc-and-over scooters

(47,000 units, 143% of the previous year), introduced from

various makers, helped growth in the larger 126cc-and-over

class.

Total volume for Suzuki in fiscal year 2002 grew to 123,000

units (112% of the previous year). A breakdown of the figure

by displacement classes shows volume for the 125cc-and-

under class of 96,000 units (114% of the previous year) and

for the 126cc-and-over class of 28,000 units (106% of the

previous year), showing growth in both classes.

Growth in the 125cc-and-under class can be attributed to

the introduction of low-priced 50cc scooters (72,000 units,

128% of the previous year) such as the Let's II Standard and

Choinori. Growth in the 126cc-and-over class can be

attributed to two factors in the scooter category (13,000 units,

134% of the previous year): The continued popularity of the

SKYWAVE 250 and 400, and the introduction of the

SKYWAVE 650.

MOTORCYCLES

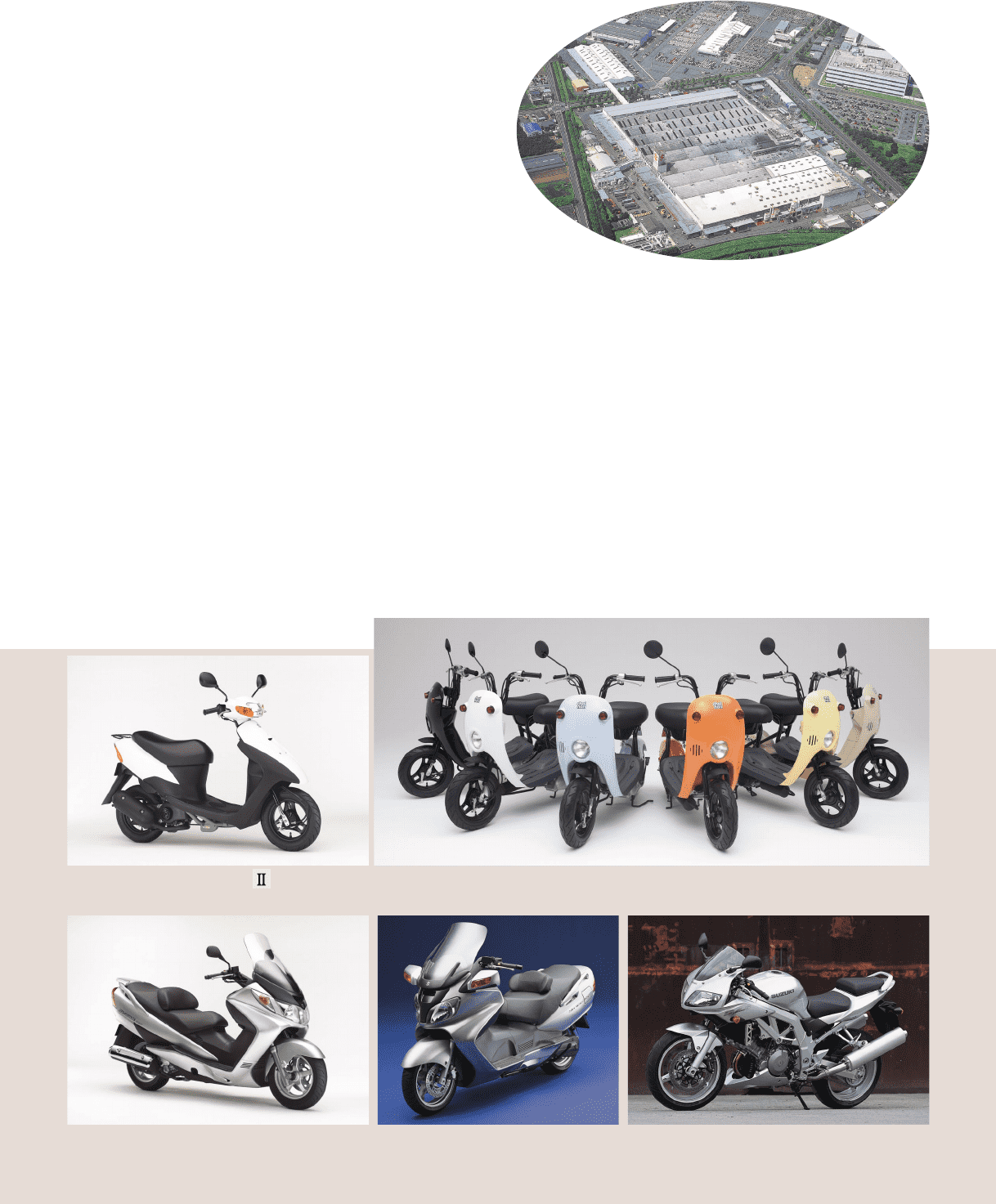

SV1000S

SKYWAVE 650

(Export name:Burgman 650)

SKYWAVE 250

(Export name:Burgman 250)

Toyokawa Plant

Motorcycles and outboard motors assembling plant

CHOINORI

The low price of the Let's II Standard was achieved through

extensive cost reduction and came without a reduction in

features or performance in comparison to similarly

domestically produced scooters. The Choinori, which is also

domestically produced, went on the market at a low price

around just below 60,000 yen -- about half that of similarly

domestically produced scooters -- received preorders for as

many as 20,000 units before it went on sale. The SKYWAVE

250 and 400 underwent a model change - a fuel injection

system was added to the new models improving both fuel

efficiency and running performance and the bodywork was

thoroughly modified to improve storage function. The

SKYWAVE 650 is the world's largest-displacement scooter; it

features a manual-mode-equipped CVT, and can manage

high-speed, long-range cruising rides with ease.

SUZUKI MOTOR CORPORATION

7

Let's STANDARD