Suzuki 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

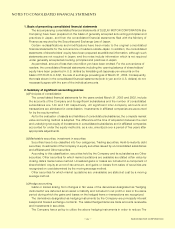

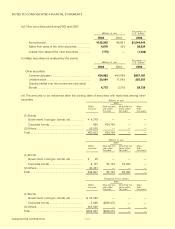

(i)Accrued retirement & severance benefits

In order to allow for payment of employees' retirement benefits, based on estimated amount of

retirement benefits liabilities and pension assets at the end of this fiscal year, the allowable

amount is appropriated.

Prior service cost is being amortized by the straight-line method over periods of mainly 15 years,

which are the estimated average remaining service years of the employees. Actuarial gain and

loss are amortized by the straight-line method over periods of mainly 15 years from the next year

of the arising, which are the estimated average remaining service years of the employees.

In order to allow for payment of directors' retirement bonus, the amount payable accrued at the

balance sheet date is appropriated based on the retirement bonus rule for directors.

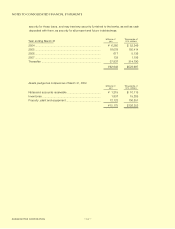

(Accounting change)

Suzuki Employee Pension Fund Plan has had operation substituting for the portion of Japanese

Welfare Pension Insurance Law. However, the deterioration of recent financial market conditions

has resulted in a greater gap between the expected yield and the actual investment yield, which

ultimately must be covered by the Company. Accordingly, in the application of enactment of a

new law concerning the defined benefit plan in June 2001, aiming at easing the financial burden,

the Company and some of domestic subsidiaries made a decision to return the substitute

component of their pension funds to the Government, and were given approval of exemption from

payment obligation of benefit for future service associated with the substitute component by

Minister of Health, Labor and Welfare (the Company: on April 18, 2002, domestic subsidiaries: on

April 23, 2002). Upon this approval, the Company and some of domestic subsidiaries adopted the

transitional treatment provided in Article 47-2 of the "Practical Guideline on Accounting for

Postretirement Benefits (Interim Report)" (The 13th report prepared by the Accounting System

Committee of the Japan Institute of Certified Public Accountants), and regarded the liabilities

(projected benefit obligation or PBO) and the pension assets corresponding to the expected

returning amount of the substitute component as disappearing from the Company's balance

sheet. The expected returning amount appropriated as of the end of current fiscal year is 57,410

million yen.

Under this situation, in order to establish a solid financial position, the Company has changed

the accounting policy for the unrecognized transition liabilities from amortizing the straight-line

method over five-year period to treating in full as expenses. And the all remaining balance of the

liabilities other than substitute component of pension funds has been charged to expense in the

current fiscal year. As a result of this change, in comparison with the case where the Company

might adopt the previous method, the "Income before income taxes" is decreased by 8,605 million

yen.

(j)Revenue recognition

Sales of products are generally recognized in the accounts as delivery is made.

(k)Accounting measure in respect of treasury stock and the reversal of legal reserve

Effective from the year ended March 31, 2003, the Company adopted the Statement of Financial

Accounting Standard No.1 "Accounting for Treasury Stock and Reversal of Capital and Legal

Reserves" issued by the Accounting Standard Board of Japan. However, the effect on net income

for the period of adopting this new statement was immaterial.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

28