Suzuki 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

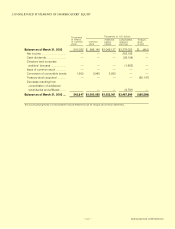

6. Accrued retirement & severance benefits

(a) Outline of an adopted retirement benefit system

In the case of the Company, as a defined benefit plan, Employee Pension Fund, Approved

Retirement Annuity System and Termination Allowance Plan are established.

The Company and some of domestic subsidiaries were given approval of exemption from payment

obligation of benefit for future service associated with the substitute component (the Company; on

April 18, 2002, domestic subsidiaries; on April 23, 2002)by Minister of Health, Labor and Welfare.

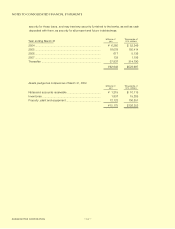

(b) Items related to a retirement benefit obligation

Remarks:1).

The premium retirement allowance paid on a temporary basis is not included.

2).

Some of subsidiaries adopt simplified methods for the calculation of retirement benefits.

3).

Associated with the substitute component, adopted the transitional treatment

provided in Articles 47-2 of the "Practical Guideline on Accounting for Postretirement

Benefit (Interim Report)" ( The 13th report prepared by the Accounting System

Committee of the Japan Institute of Certified Public Accountants), and regarded the

liabilities (projected benefit obligation or PBO) and the pension assets

corresponding to the expected returning amount of the substitute component as

disappearing from the Company's balance sheet. The expected returning amount

appropriated as of the end of current fiscal year is 57,410 million yen.

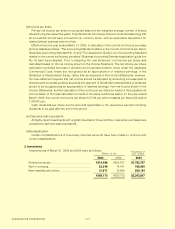

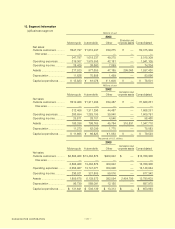

(c) Items related to retirement benefit cost

Remarks:1)

The amount of employees' contribution to Employees' Pension Fund is deducted.

2)

The retirement benefit cost of subsidiaries where simplified methods are adopted is

accounted for “a. Service cost”.

2003 2002 2003

a. Retirement benefit obligation ¥(136,959) ¥(251,620) $(1,139,434)

b. Pension assets 58,810 126,858 489,273

c.

Unrecognized retirement benefit obligation (a + b)

¥ (78,149) ¥(124,762) $ (650,160)

d. Unrecognized transition liability —32,337 —

e.

Unrecognized difference by an actuarial calculation

23,846 32,822 198,393

f

.

Unrecognized prior service cost(decrease of liabilities)

(63) (68) (525)

g.

Accrued retirement & severance benefits (c+d+e+f)

¥ (54,365) ¥ (59,670) $ (452,293)

Millions of

yen Thousands of

U.S. dollars

2003 2002 2003

a. Service cost ¥ 7,184 ¥ 8,392 $ 59,774

b. Interest cost 2,123 5,047 17,669

c. Assumed return on investment (1,644) (4,483) (13,683)

d. Amortized amount of transition liability 12,908 10,779 107,393

e. Amortized amount of actuarial difference 7,945 11,743 66,100

f. Amortized amount of prior service cost (4) (4) (40)

g. Retirement benefit cost (a+b+c+d+e+f) ¥28,513 ¥31,474 $237,215

h. Profit from the return of the substitute

components of Employees Pension Fund assets

(24,101) —(200,507)

i. Total(g+h) ¥ 4,412 ¥31,474 $ 36,707

Thousands of

U.S. dollars

Millions of

yen

34