Suzuki 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

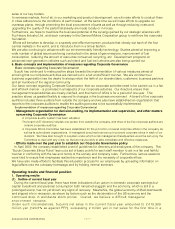

fiscal year. This was largely the result of strengthening production and sales bases both in the domestic and

overseas markets, efforts to upgrade productivity and reduce costs, and other measures to enhance the

competitiveness of our products and expand sales.

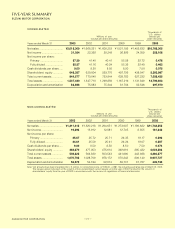

In terms of profits, operating income amounted to 74,204 million yen (126.9% as against PFY)

and ordinary income was 79,188 million yen (151.4% as against PFY). This was the result of

cost reduction measures and foreign exchange gain, through which we were able to absorb

increases in overhead costs and development expenses. Net income for the current fiscal year

amounted to 31,024 million yen (138.5% as against PFY).

Note: PFY = Previous Fiscal Year

<Operating results of geographical segmentation>

(Japan)

Net sales amounted to 1,540,623 million yen (107.2% as against PFY) and operating income increased to

66,240 million yen (118.0% as against PFY). These increases can be put down to the fact that we were able to

absorb both costs in making changes to our product lineup, etc, as well as increases in overhead costs and

R&D expenses, by implementing cost reduction measures and through foreign exchange gain.

(Europe)

Net sales amounted to 296,792 million yen (107.4% as against PFY) and operating income increased to 3,191

million yen (127.1% as against PFY) through measures such as making changes to our product lineup, and

through foreign exchange gain.

(North America)

Net sales amounted to 303,191 million yen (113.4% as against PFY), but operating income decreased to 414

million yen (47.6% as against PFY) due to an increase of overhead costs together with foreign exchange

losses.

(Asia outside of Japan)

Net sales amounted to 285,667 million yen (750.9% as against PFY), and our operating income was 7,055

million yen (495.1% as against PFY) - there were big increases in both revenue and income. There were

several contributing factors, but the primary reason was due to the fact that Maruti Udyog Limited in India

became one of our consolidated subsidiaries.

(Other areas)

Net sales amounted to 22,450 million yen (100.1% as against PFY) and operating income was 501 million yen.

(2) Outlook for the next fiscal year

It is anticipated that the unpredictable and severe business environment will not ease in the next few years

and difficult conditions for the global economy should continue. Under such circumstances, Suzuki, together

with its group companies, will work together for innovation in every area, and will be making efforts to further

evolve our business activities to achieve our goal of 2,120,000 million yen in net sales, 85,000 million yen in

ordinary income and 35,000 million yen in net income.

The figures above are based on a foreign exchange rate of 1 US dollar = 117 yen and 1 Euro = 125 yen.

* The outlook of business results, estimated based on the current information available and assumptions,

include risks and uncertainties. We ask for your understanding that actual results may vary extensively due to a

number of changing factors. Those factors, which may influence actual results, include economic conditions

and the demand trend in major markets and fluctuations in foreign exchange rates (mainly the yen/US dollar and

the yen/euro rates).

2. Financial position

At the end of the current fiscal year, our total assets amounted to 1,537,430 million yen (increased by 189,711

million yen from the end of PFY), our total liabilities were 835,273 million yen (increased by 117,894 million yen

from the end of PFY), our minority interests were 53,799 million yen (increased by 43,464 million yen from the

end of PFY), and total shareholders equity was 648,357 million yen (increased by 28,353 million yen from the

end of PFY).

A cash flow fund of 146,075 million yen was gained through operating activities during the current fiscal year,

and through investing activities, a fund of 98,365 million yen was used for acquisition of tangible fixed assets,

marketable securities, etc. As for our financing activities, a fund of 34,808 million yen was used for repaying

short-term loans and for acquisition of treasury stock. As a result, the remaining balance of cash and cash

equivalents at the end of the current fiscal year amounted to 238,743 million yen (increased by 15,726 million

yen from the end of PFY).

18