Salesforce.com 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

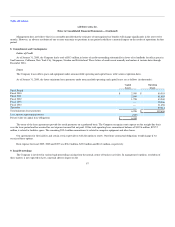

Management does not believe that it is reasonably possible that the estimates of unrecognized tax benefits will change significantly in the next twelve

months. However, an adverse resolution of one or more uncertain tax positions in any period could have a material impact on the results of operations for that

period.

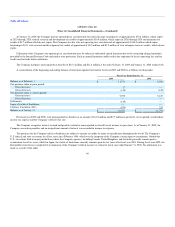

8. Commitments and Contingencies

Letters of Credit

As of January 31, 2009, the Company had a total of $8.3 million in letters of credit outstanding substantially in favor of its landlords for office space in

San Francisco, California, New York City, Singapore, Sweden and Switzerland. These letters of credit renew annually and mature at various dates through

December 2016.

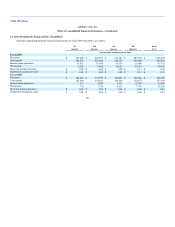

Leases

The Company leases office space and equipment under noncancelable operating and capital leases with various expiration dates.

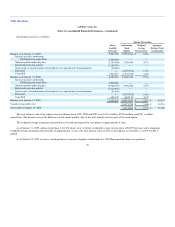

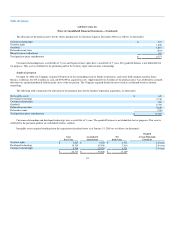

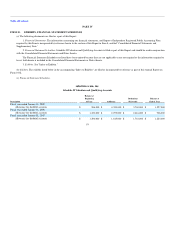

As of January 31, 2009, the future minimum lease payments under noncancelable operating and capital leases are as follows (in thousands):

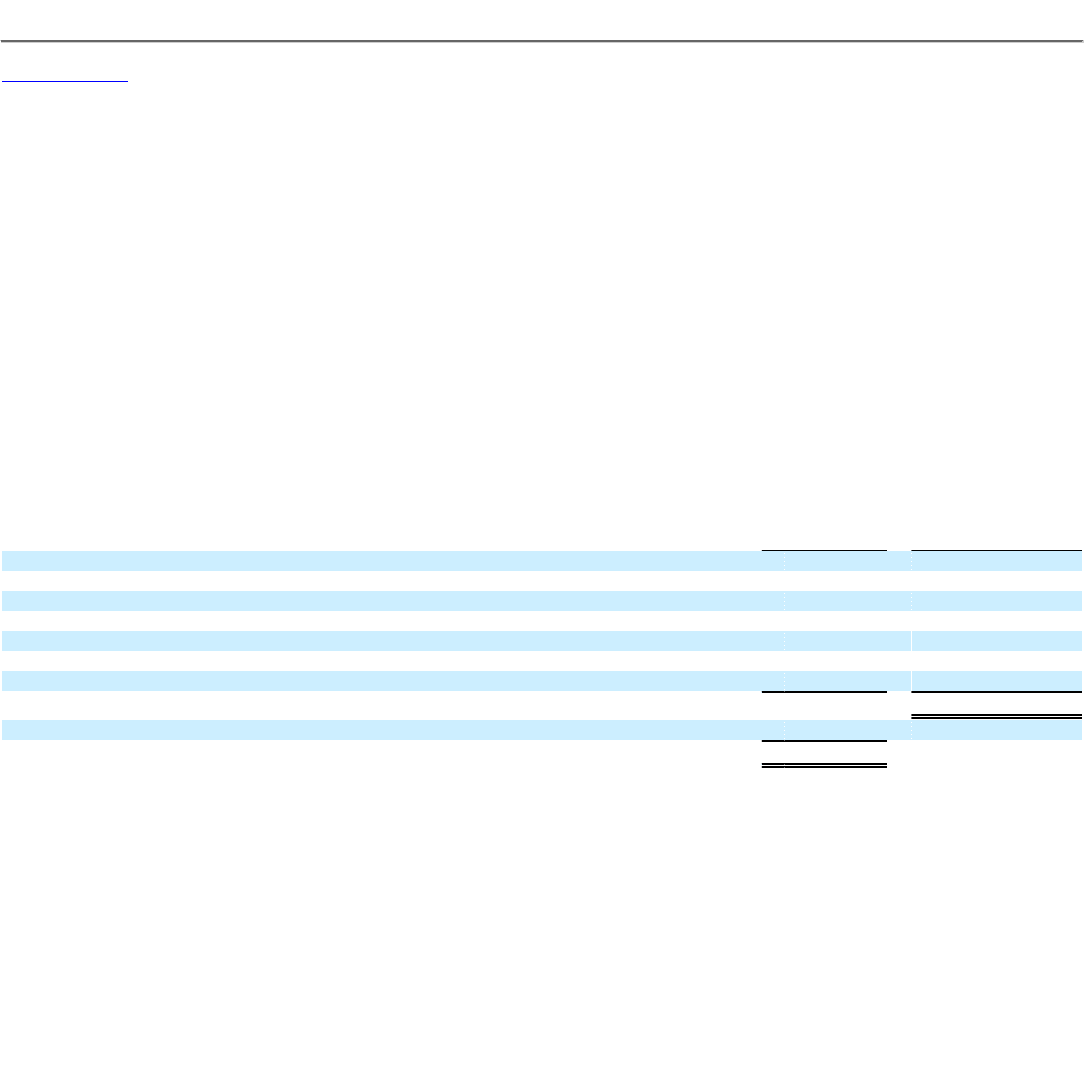

Capital

Leases

Operating

Leases

Fiscal Period:

Fiscal 2010 $ 2,599 $ 80,503

Fiscal 2011 2,599 61,655

Fiscal 2012 1,798 43,940

Fiscal 2013 — 35,566

Fiscal 2014 — 31,458

Thereafter — 59,514

Total minimum lease payments 6,996 $ 312,636

Less: amount representing interest (552)

Present value of capital lease obligations $ 6,444

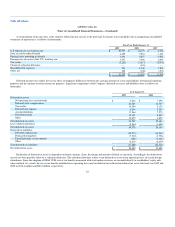

The terms of the lease agreements provide for rental payments on a graduated basis. The Company recognizes rent expense on the straight-line basis

over the lease period and has accrued for rent expense incurred but not paid. Of the total operating lease commitment balance of $312.6 million, $257.2

million is related to facilities space. The remaining $55.4 million commitment is related to computer equipment and other leases.

Our agreements for the facilities and certain services provide us with the option to renew. Our future contractual obligations would change if we

exercised these options.

Rent expense for fiscal 2009, 2008 and 2007 was $36.0 million, $23.0 million and $16.8 million, respectively.

9. Legal Proceedings

The Company is involved in various legal proceedings arising from the normal course of business activities. In management's opinion, resolution of

these matters is not expected to have a material adverse impact on the

87