Salesforce.com 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

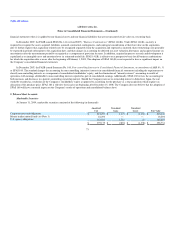

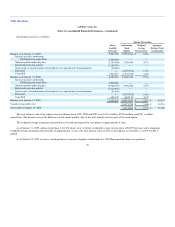

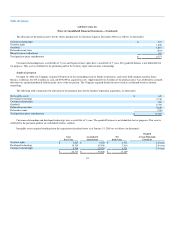

The allocation of the purchase price for the shares purchased in its Salesforce Japan in December 2006 is as follows (in thousands):

Customer relationships $ 235

Territory rights 1,008

Goodwill 1,851

Deferred income taxes (503)

Minority interest adjustment 186

Total purchase price consideration $ 2,777

Customer relationships have a useful life of 3 years and Japan territory rights have a useful life of 7 years. The goodwill balance is not deductible for

tax purposes. This asset is attributed to the premium paid for the territory rights and customer relationships.

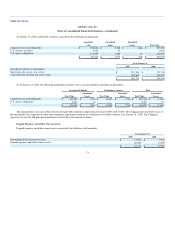

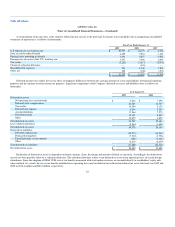

Sendia Corporation

On April 10, 2006, the Company acquired 100 percent of the outstanding stock of Sendia Corporation, a privately-held company based in Santa

Monica, California, for $15.2 million in cash and $304,000 in acquisition costs. Approximately $1.8 million of the purchase price was attributed to assumed

debt that was repaid immediately following the close of the transaction. The Company acquired Sendia because it had an established wireless solution

technology.

The following table summarizes the allocation of the purchase price for the Sendia Corporation acquisition, (in thousands):

Net tangible assets $ 447

Developed technology 5,710

Customer relationships 690

Goodwill 6,705

Deferred income taxes 2,650

Deferred revenue (700)

Total purchase price consideration $ 15,502

Customer relationships and developed technology have a useful life of 3 years. The goodwill balance is not deductible for tax purposes. This asset is

attributed to the premium paid for an established wireless solution.

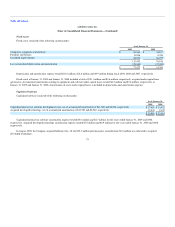

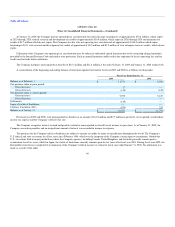

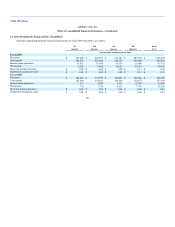

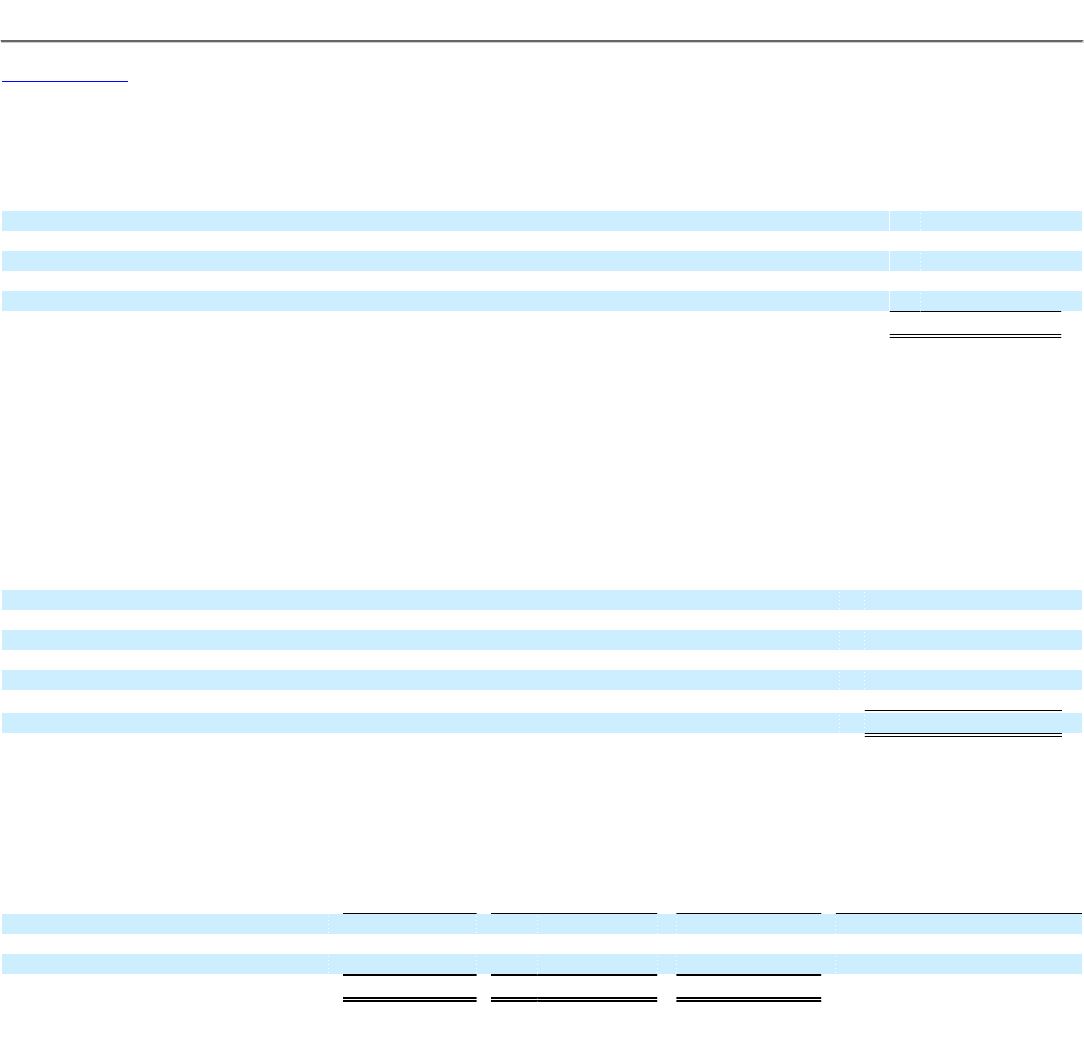

Intangible assets acquired resulting from the acquisitions described above as of January 31, 2009 are as follows (in thousands):

Gross

Fair Value

Accumulated

Amortization

Net

Book Value

Weighted

Average Remaining

Useful Life

Territory rights $ 3,203 $ (431) $ 2,772 6.1 years

Developed technology 14,320 (6,704) 7,616 2.4 years

Customer relationships 8,794 (2,073) 6,721 2.4 years

$ 26,317 $ (9,208) $ 17,109

83