Salesforce.com 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

The Company has entered into service level agreements with a small number of its customers warranting certain levels of uptime reliability and

performance and permitting those customers to receive credits or terminate their agreements in the event that the Company fails to meet those levels. As of

January 31, 2009 and January 31, 2008, the reserve balance was approximately $0.4 million.

The Company has also agreed to indemnify its directors and executive officers for costs associated with any fees, expenses, judgments, fines and

settlement amounts incurred by any of these persons in any action or proceeding to which any of those persons is, or is threatened to be, made a party by

reason of the person's service as a director or officer, including any action by the Company, arising out of that person's services as the Company's director or

officer or that person's services provided to any other company or enterprise at the Company's request. The Company maintains director and officer insurance

coverage that would generally enable the Company to recover a portion of any future amounts paid.

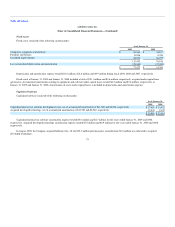

Advertising Expenses

Advertising is expensed as incurred. Advertising expense was $43.7 million, $25.6 million and $14.7 million for fiscal 2009, 2008 and 2007,

respectively.

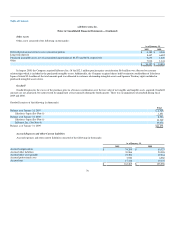

Recent Accounting Pronouncement

In April 2008, the Financial Accounting Standards Board (FASB) issued FSP No. 142-3, "Determination of the Useful Life of Intangible Assets" (FSP

No. 142-3) that amends the factors considered in developing renewal or extension assumptions used to determine the useful life of a recognized intangible

asset under SFAS No. 142. FSP No. 142-3 requires a consistent approach between the useful life of a recognized intangible asset under SFAS No. 142 and the

period of expected cash flows used to measure the fair value of an asset under SFAS No. 141(R). The FSP also requires enhanced disclosures when an

intangible asset's expected future cash flows are affected by an entity's intent and/or ability to renew or extend the arrangement. FSP No. 142-3 is effective for

financial statements issued for fiscal years beginning after December 15, 2008 and is applied prospectively. The Company does not expect the adoption of

FSP No.142-3 to have a material impact on its consolidated results of operations or financial condition.

In March 2008, the FASB issued SFAS No. 161, "Disclosures about Derivative Instruments and Hedging Activities—an amendment of FASB Statement

No. 133" (SFAS 161). The standard requires additional quantitative disclosures (provided in tabular form) and qualitative disclosures for derivative

instruments. The required disclosures include how derivative instruments and related hedged items affect an entity's financial position, financial performance,

and cash flows; the relative volume of derivative activity; the objectives and strategies for using derivative instruments; the accounting treatment for those

derivative instruments formally designated as the hedging instrument in a hedge relationship; and the existence and nature of credit-risk-related contingent

features for derivatives. SFAS 161 does not change the accounting treatment for derivative instruments. SFAS 161 is effective beginning in the first quarter of

fiscal 2010.

In February 2008, FASB issued FASB Staff Position 157-1, "Application of FASB Statement No. 157 to FASB Statement No. 13 and Other Accounting

Pronouncements That Address Fair Value Measurements for Purposes of Lease Classification or Measurement under Statement 13" (FSP 157-1) and FSP

157-2, "Effective Date of FASB Statement No. 157" (FSP 157-2). FSP 157-1 amends SFAS No. 157 to remove certain leasing transactions from its scope, and

was effective upon initial adoption of SFAS No. 157. FSP 157-2 delays the effective date of SFAS 157 for all non-financial assets and non-financial

liabilities, except for items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually), until the beginning

of the first quarter of fiscal 2010. The adoption of SFAS 157 is not expected to have a significant impact on the Company's consolidated

72