Salesforce.com 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

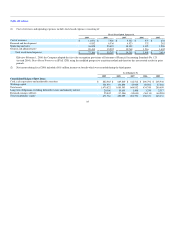

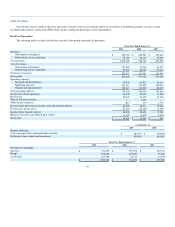

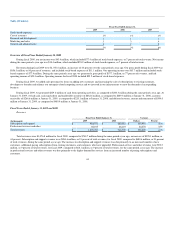

(1) Cost of revenues and operating expenses include stock-based expenses, consisting of:

Fiscal Year Ended January 31,

2009 2008 2007 2006 2005

Cost of revenues $ 11,051 $ 7,926 $ 5,522 $ 575 $ 634

Research and development 9,852 6,336 4,523 332 282

Marketing and sales 36,028 25,423 18,392 1,325 1,296

General and administrative 20,435 15,522 10,768 1,216 1,402

Total stock-based expenses $ 77,366 $ 55,207 $ 39,205 $ 3,448 $ 3,614

Effective February 1, 2006, the Company adopted the fair value recognition provisions of Statement of Financial Accounting Standards No. 123

(revised 2004), Share-Based Payment, or SFAS 123R, using the modified prospective transition method and therefore has not restated results for prior

periods.

(2) Net income during fiscal 2006 included a $6.8 million income tax benefit which was recorded during the third quarter.

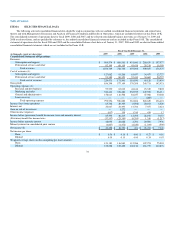

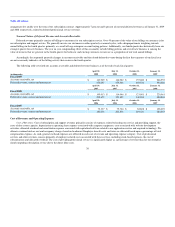

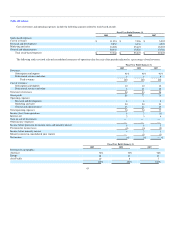

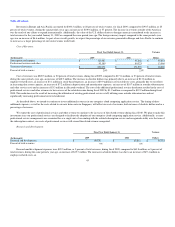

As of January 31,

2009 2008 2007 2006 2005

Consolidated Balance Sheet Data:

Cash, cash equivalents and marketable securities $ 882,565 $ 669,800 $ 412,512 $ 296,792 $ 205,938

Working capital 301,591 134,894 45,905 68,592 47,044

Total assets 1,479,822 1,089,593 664,832 434,749 280,499

Long-term obligations excluding deferred revenue and minority interest 20,106 10,601 1,408 1,339 2,317

Retained earnings (deficit) 25,842 (17,586) (35,633) (36,114) (64,588)

Total stockholders' equity 671,784 452,059 281,791 196,371 145,131

35