Salesforce.com 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

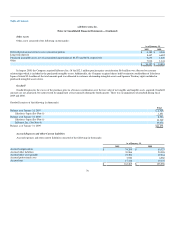

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

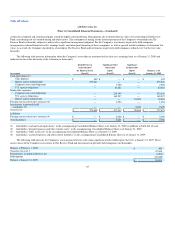

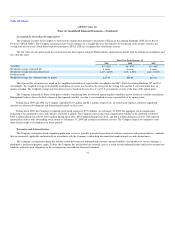

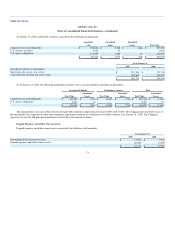

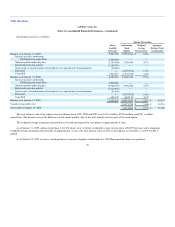

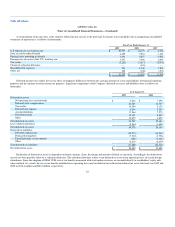

Fixed Assets

Fixed assets consisted of the following (in thousands):

As of January 31,

2009 2008

Computers, equipment and software $ 65,864 $ 34,197

Furniture and fixtures 13,096 8,354

Leasehold improvements 54,032 36,279

132,992 78,830

Less accumulated depreciation and amortization (55,965) (37,450)

$ 77,027 $ 41,380

Depreciation and amortization expense totaled $21.0 million, $16.8 million and $9.9 million during fiscal 2009, 2008 and 2007, respectively.

Fixed assets at January 31, 2009 and January 31, 2008 included a total of $10.1 million and $3.6 million, respectively, acquired under capital lease

agreements. Accumulated amortization relating to equipment and software under capital leases totaled $4.5 million and $3.6 million, respectively, at

January 31, 2009 and January 31, 2008. Amortization of assets under capital leases is included in depreciation and amortization expense.

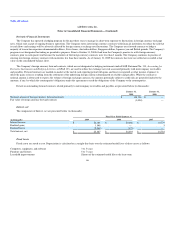

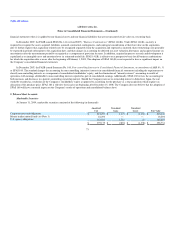

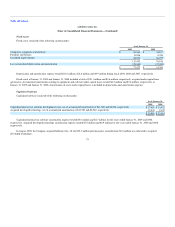

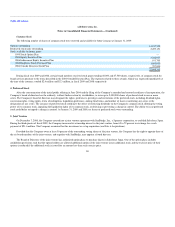

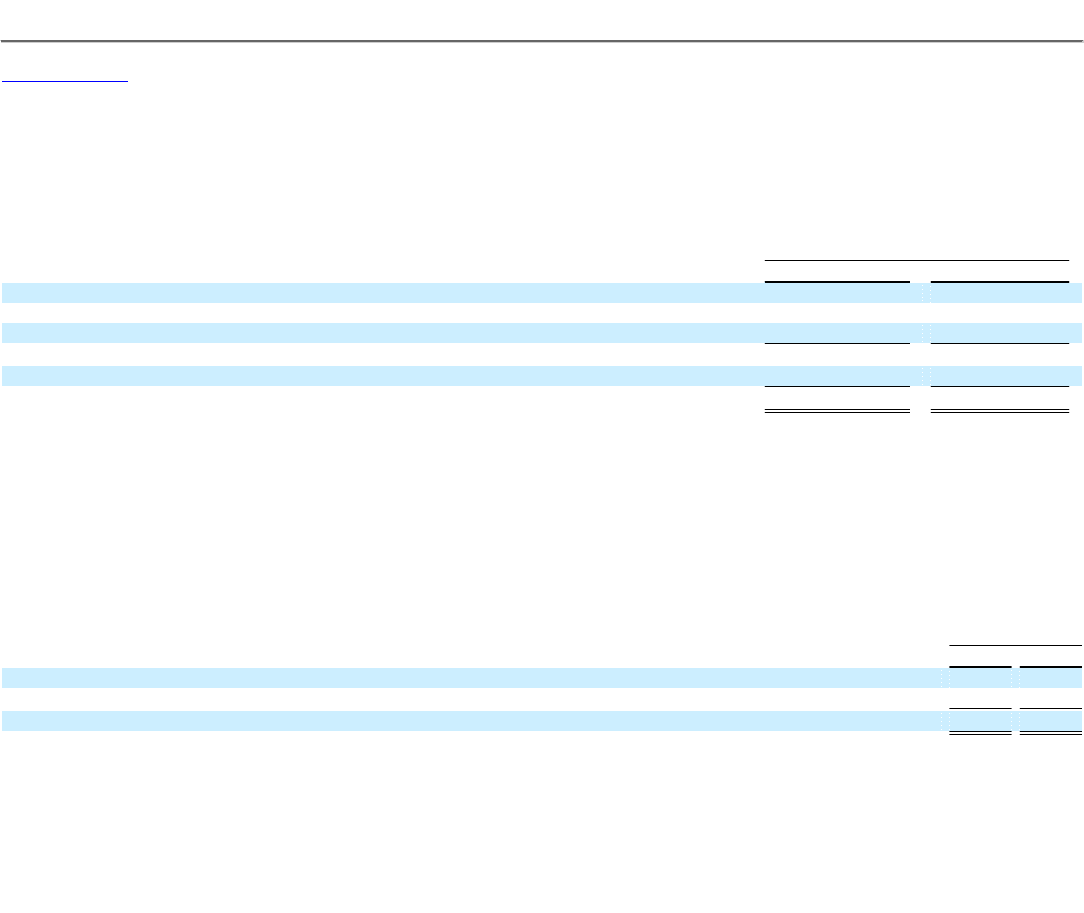

Capitalized Software

Capitalized software consisted of the following (in thousands):

As of January 31,

2009 2008

Capitalized internal-use software development costs, net of accumulated amortization of $11,540 and $4,898, respectively $ 17,450 $ 13,932

Acquired developed technology, net of accumulated amortization of $13,522 and $6,542, respectively 12,539 9,129

$ 29,989 $ 23,061

Capitalized internal use software amortization expense totaled $6.6 million and $2.7 million for the years ended January 31, 2009 and 2008,

respectively. Acquired developed technology amortization expense totaled $7.0 million and $4.9 million for the years ended January 31, 2009 and 2008,

respectively.

In August 2008, the Company acquired InStranet, Inc. Of the $32.3 million purchase price consideration, $8.6 million was allocated to acquired

developed technology.

75