Salesforce.com 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

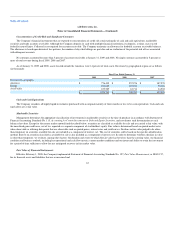

Notes to Consolidated Financial Statements—(Continued)

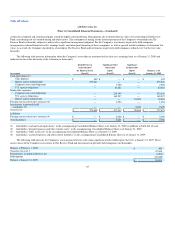

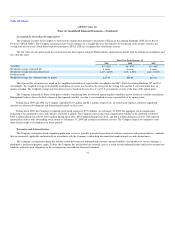

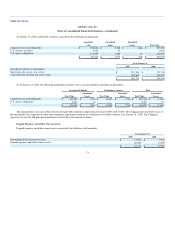

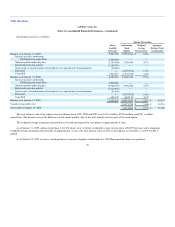

The components of accumulated other comprehensive loss were as follows (in thousands):

As of January 31,

2009 2008

Foreign currency translation and other adjustments $ (3,957) $ (4,217)

Net unrealized gain on marketable securities and cash equivalents 1,052 1,941

$ (2,905) $ (2,276)

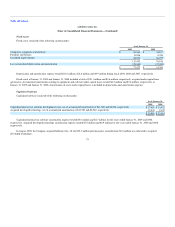

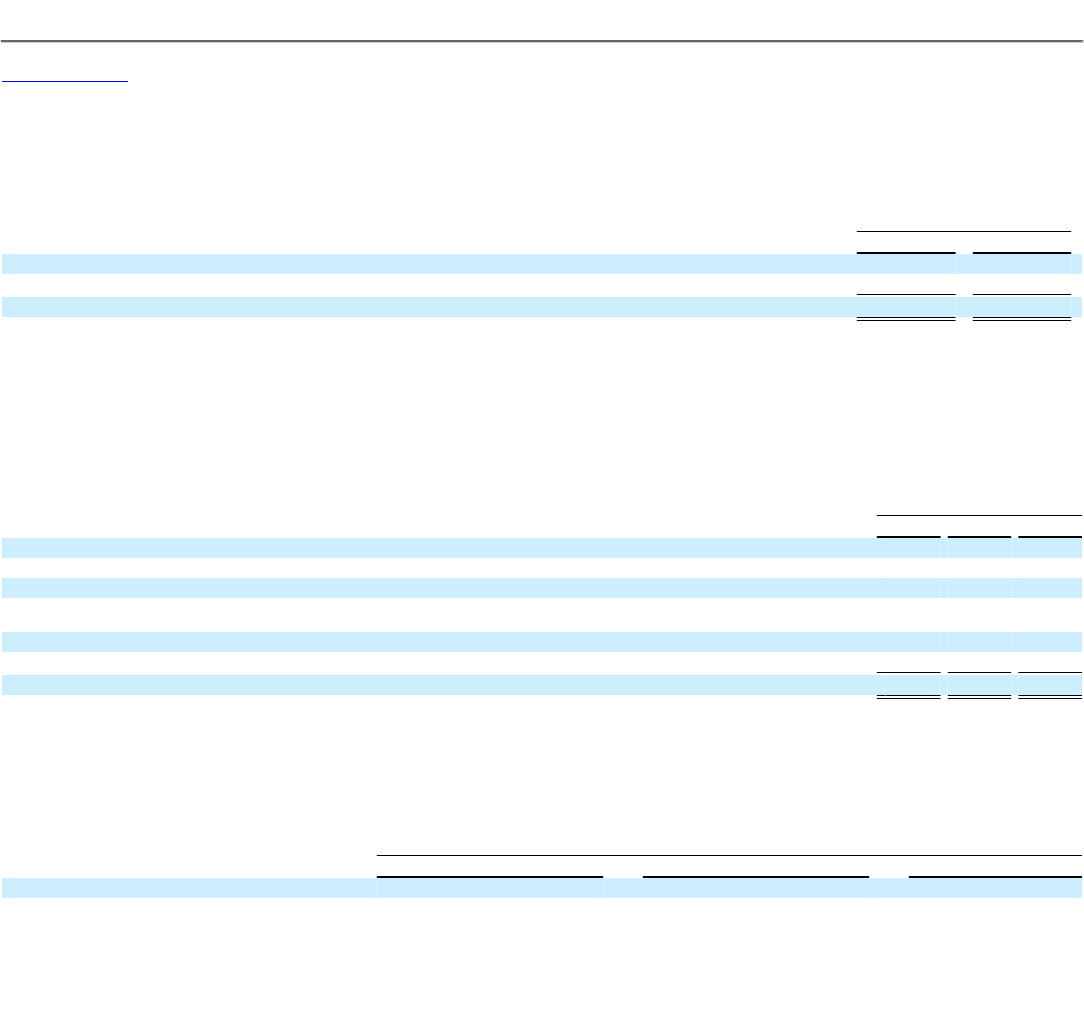

Net Income Per Share

Basic net income per share is computed by dividing net income by the weighted-average number of common shares outstanding for the fiscal period.

Diluted net income per share is computed giving effect to all potential dilutive common stock, including options and restricted stock units. The dilutive effect

of outstanding awards is reflected in diluted earnings per share by application of the treasury stock method.

A reconciliation of the denominator used in the calculation of basic and diluted net income per share is as follows (in thousands):

Fiscal Year Ended January 31,

2009 2008 2007

Numerator:

Net income $ 43,428 $ 18,356 $ 481

Denominator:

Weighted-average shares outstanding for basic earnings per share, net of weighted-average shares of common stock subject to

repurchase 121,183 116,840 112,386

Effect of dilutive securities:

Employee stock awards and warrants 4,045 5,582 7,768

Adjusted weighted-average shares outstanding and assumed conversions for diluted earnings per share 125,228 122,422 120,154

Outstanding unvested common stock purchased by employees is subject to repurchase by the Company and therefore is not included in the calculation

of the weighted-average shares outstanding for basic earnings per share.

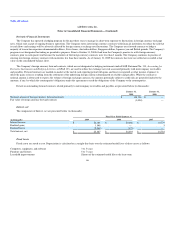

The following were excluded from the computation of diluted shares outstanding as they would have had an anti-dilutive impact (in thousands). The

dilutive securities are excluded when, for example, their exercise prices are greater than the average fair values of the Company's common stock.

Fiscal Year Ended January 31,

2009 2008 2007

Stock awards 3,797 3,175 4,019

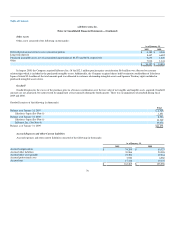

Income Taxes

The Company uses the liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities are determined based on

temporary differences between the financial statement and tax basis

68