Salesforce.com 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In December 2007, the FASB issued Statement No. 160, "Non-controlling Interests in Consolidated Financial Statements, an amendment of ARB

No. 51" or SFAS 160. The standard changes the accounting for non-controlling (minority) interests in consolidated financial statements including the

requirements to classify non-controlling interests as a component of consolidated stockholders' equity, and the elimination of "minority interest" accounting in

results of operations with earnings attributable to non-controlling interests reported as part of consolidated earnings. Additionally, SFAS 160 revises the

accounting for both increases and decreases in a parent's controlling ownership interest. Should we increase our ownership interest in Salesforce Japan, the

cost would be recorded as a reduction of our stockholders' equity as opposed to accounting for the purchase as a step acquisition which requires an allocation

of the purchase price. SFAS 160 is effective for fiscal years beginning after December 15, 2008. We believe that the adoption of SFAS 160 will not have a

material impact on our results of operations and consolidated balance sheet.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

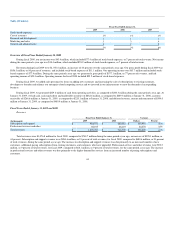

Foreign currency exchange risk

Our results of operations and cash flows are subject to fluctuations due to changes in foreign currency exchange rates, particularly changes in the Euro,

British Pound Sterling, Canadian dollar, Japanese Yen and Australian dollar. We seek to minimize the impact of certain foreign currency fluctuations by

hedging certain balance sheet exposures with foreign currency forward contracts. Any gain or loss from settling these contracts is offset by the loss or gain

derived from the underlying balance sheet exposures. The hedging contracts by policy have maturities of less than three months. Additionally, by policy, we

do not enter into any hedging contracts for trading or speculative purposes.

Prior to October 31, 2008, our practice was to settle foreign currency contracts prior to each quarter end because the maturities of the foreign currency

contracts were less than 3 months. We have continued our practice of entering into foreign currency contracts with maturities less than 3 months. As of

January 31, 2009 the contracts that were not settled are recorded at fair value on the consolidated balance sheet.

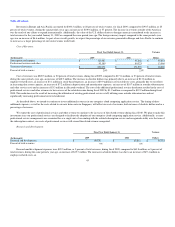

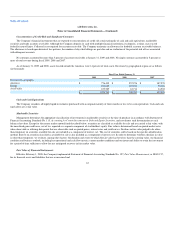

Interest rate sensitivity

We had cash, cash equivalents and marketable securities totaling $882.6 million at January 31, 2009. These amounts were invested primarily in money

market funds and instruments, corporate notes and bonds, government securities and other debt securities with credit ratings of at least single A or better. The

cash, cash equivalents and short-term marketable securities are held for working capital purposes. Our investments are made for capital preservation purposes.

We do not enter into investments for trading or speculative purposes.

We account for our investment instruments in accordance with SFAS No. 115, Accounting for Investments in Debt and Equity Securities. All of our

cash and cash equivalents and marketable securities are treated as "available for sale" under SFAS No. 115. Our marketable securities include corporate notes

and obligations, U.S. treasuries, U.S. agency obligations, time deposits, asset-backed securities and money market mutual funds.

Our cash equivalents and our portfolio of marketable securities are subject to market risk due to changes in interest rates. Fixed rate interest securities

may have their market value adversely impacted due to a rise in interest rates, while floating rate securities may produce less income than expected if interest

rates fall. Due in part to these factors, our future investment income may fall short of expectation due to changes in interest rates or we may suffer losses in

principal if we are forced to sell securities that decline in the market value due to changes in interest rates. However because we classify our debt securities as

"available for sale," no gains or losses are recognized due to changes in interest rates unless such securities are sold prior to maturity or declines in fair value

are determined to be other-than-temporary. Our fixed-income portfolio is subject to interest rate risk. An immediate increase or decrease in interest rates of

100-basis points at January 31, 2009 could result in a $2.3 million market value reduction or increase of the same amount. This estimate is based on a

sensitivity model

53