Salesforce.com 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

financial statements when it is applied to non-financial assets and non-financial liabilities that are not measured at fair value on a recurring basis.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), "Business Combinations" (SFAS 141(R)). Under SFAS 141(R), an entity is

required to recognize the assets acquired, liabilities assumed, contractual contingencies, and contingent consideration at their fair value on the acquisition

date. It further requires that acquisition-related costs be recognized separately from the acquisition and expensed as incurred; that restructuring costs generally

be expensed in periods subsequent to the acquisition date; and that changes in accounting for deferred tax asset valuation allowances and acquired income tax

uncertainties after the measurement period be recognized as a component of provision for taxes. In addition, acquired in-process research and development is

capitalized as an intangible asset and amortized over its estimated useful life. SFAS 141(R) is effective on a prospective basis for all business combinations

for which the acquisition date is on or after the beginning of February 1, 2009, The adoption of SFAS 141(R) is not expected to have a significant impact on

the Company's consolidated financial statements.

In December 2007, the FASB issued Statement No. 160, Non-controlling Interests in Consolidated Financial Statements, an amendment of ARB No. 51

or SFAS 160. The standard changes the accounting for non-controlling (minority) interests in consolidated financial statements including the requirements to

classify non-controlling interests as a component of consolidated stockholders' equity, and the elimination of "minority interest" accounting in results of

operations with earnings attributable to non-controlling interests reported as part of consolidated earnings. Additionally, SFAS 160 revises the accounting for

both increases and decreases in a parent's controlling ownership interest. Should the Company increase its ownership interest in Salesforce Japan, the cost

would be recorded as a reduction of the Company's stockholders' equity as opposed to accounting for the purchase as a step acquisition which requires an

allocation of the purchase price. SFAS 160 is effective for fiscal years beginning after December 15, 2008. The Company does not believe that the adoption of

SFAS 160 will have a material impact on the Company's results of operations and consolidated balance sheet.

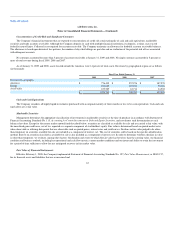

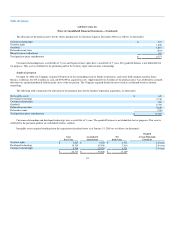

2. Balance Sheet Accounts

Marketable Securities

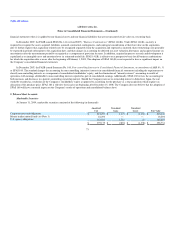

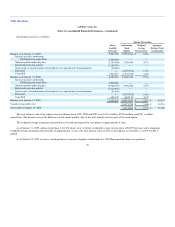

At January 31, 2009, marketable securities consisted of the following (in thousands):

Amortized

Cost

Unrealized

Gains

Unrealized

Losses Fair Value

Corporate notes and obligations $ 215,297 $ 1,173 $ (1,330) $ 215,140

Money market mutual fund (see Note 1) 18,294 — — 18,294

U.S. agency obligations 163,584 1,721 (8) 165,297

$ 397,175 $ 2,894 $ (1,338) $ 398,731

73