Rite Aid 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 28, 2015, March 1, 2014 and March 2, 2013

(In thousands, except per share amounts)

14. Leases (Continued)

The Company accounted for these leases as operating leases. The transactions resulted in a gain of

$1,818 which is included in the gain on sale of assets, net for the fifty-two weeks ended March 2, 2013.

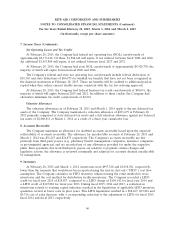

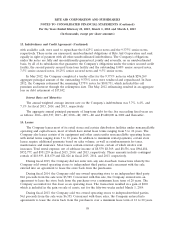

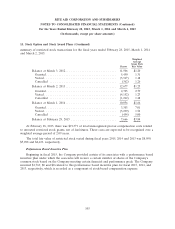

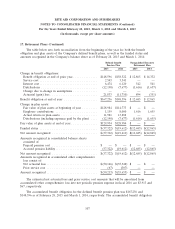

The net book values of assets under capital leases and sale-leasebacks accounted for under the

financing method at February 28, 2015 and March 1, 2014 are summarized as follows:

2015 2014

Land......................................... $ 5,063 $ 5,063

Buildings ...................................... 133,177 135,581

Leasehold improvements ........................... 1,330 1,446

Equipment ..................................... 36,934 34,305

Accumulated depreciation .......................... (123,581) (113,536)

$ 52,923 $ 62,859

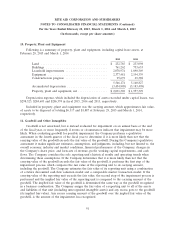

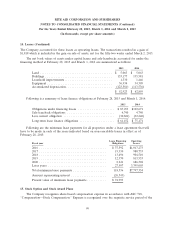

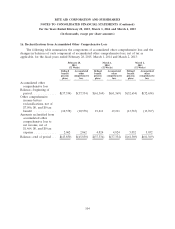

Following is a summary of lease finance obligations at February 28, 2015 and March 1, 2014:

2015 2014

Obligations under financing leases ..................... $87,253 $102,671

Sale-leaseback obligations ........................... 4,740 4,740

Less current obligation ............................. (30,841) (32,240)

Long-term lease finance obligations .................... $61,152 $ 75,171

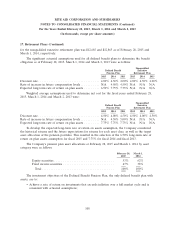

Following are the minimum lease payments for all properties under a lease agreement that will

have to be made in each of the years indicated based on non-cancelable leases in effect as of

February 28, 2015:

Lease Financing Operating

Fiscal year Obligations Leases

2016 ...................................... $ 37,592 $1,017,273

2017 ...................................... 19,330 980,733

2018 ...................................... 13,496 904,510

2019 ...................................... 12,370 813,533

2020 ...................................... 8,241 686,302

Later years ................................. 27,507 3,395,003

Total minimum lease payments ................... 118,536 $7,797,354

Amount representing interest .................... (26,543)

Present value of minimum lease payments ........... $ 91,993

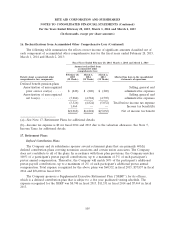

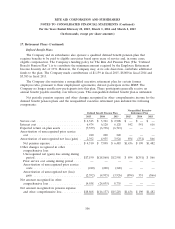

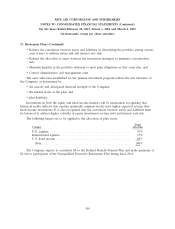

15. Stock Option and Stock Award Plans

The Company recognizes share-based compensation expense in accordance with ASC 718,

‘‘Compensation—Stock Compensation.’’ Expense is recognized over the requisite service period of the

99