Rite Aid 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 2014 compared to Fiscal 2013: The 0.5% increase in revenue was due primarily to an

increase in pharmacy same store sales, partially offset by a decrease in front end sales. The increase in

pharmacy same stores sales was driven primarily by brand drug inflation, partially offset by a decrease

in same store prescription count, negative impact from generic introductions and continued

reimbursement rate pressures.

Pharmacy same store sales increased 1.2%. Pharmacy same store sales were positively impacted by

brand drug inflation. The increases were partially offset by a decrease of 0.3% in same store

prescription count and the continued impact of generic drug introductions, which have a substantially

lower selling price than their brand counterparts but higher gross profit. Pharmacy same store sales

were also negatively impacted by continued reimbursement rate pressures.

Front end same store sales decreased 0.2%. The decrease in same store front end sales was

impacted by consumer spending habits and the heavy promotional environment, partially offset by the

positive impact of our wellness + loyalty program, incremental sales from our Wellness format stores,

and other management initiatives to increase front end sales.

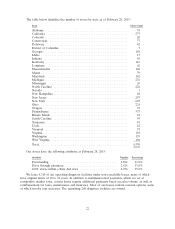

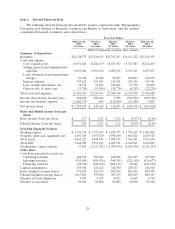

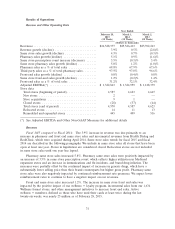

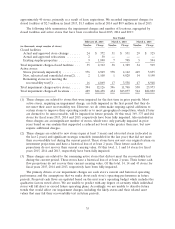

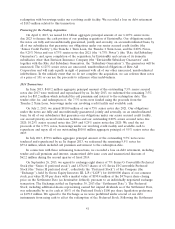

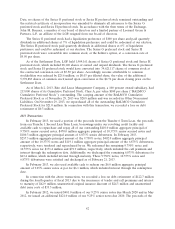

Costs and Expenses

Year Ended

February 28, March 1, March 2,

2015 2014 2013

(52 Weeks) (52 Weeks) (52 Weeks)

(Dollars in thousands)

Costs of goods sold ............................. $18,951,645 $18,202,679 $18,073,987

Gross profit .................................. 7,576,732 7,323,734 7,318,276

Gross margin ................................. 28.6% 28.7% 28.8%

FIFO gross profit(*) ............................ 7,557,875 7,427,876 7,170,394

FIFO gross margin(*) ........................... 28.5% 29.1% 28.2%

Selling, general and administrative expenses ........... $ 6,695,642 $ 6,561,162 $ 6,600,765

Selling, general and administrative expenses as a

percentage of revenues ........................ 25.2% 25.7% 26.0%

Lease termination and impairment charges ............ 41,945 41,304 70,859

Interest expense ............................... 397,612 424,591 515,421

Loss on debt retirements, net ..................... 18,512 62,443 140,502

Gain on sale of assets, net ........................ (3,799) (15,984) (16,776)

(*) See Adjusted EBITDA and Other Non-GAAP Measures for additional details

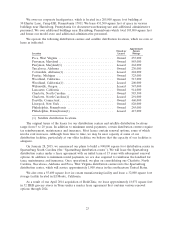

Gross Profit and Cost of Goods Sold

Gross profit increased by $253.0 million in fiscal 2015 compared to fiscal 2014. Pharmacy gross

profit was higher due to the increase in pharmacy revenues resulting primarily from increased

prescription count, and purchasing efficiencies realized through our Purchasing and Delivery

Arrangement, partially offset by reimbursement rate pressures and a prior year favorable

reimbursement rate adjustment relating to the decision by California to exclude certain drugs from the

retroactive California Department of Healthcare Services (MediCal) reimbursement rate adjustments.

Front end gross profit was higher mainly due to higher sales. Gross profit was also positively impacted

by a LIFO credit of $18.9 million versus a LIFO charge of $104.1 million in fiscal 2014, and additional

revenues from Health Dialog and RediClinic.

Overall gross margin was 28.6% for fiscal 2015 compared to 28.7% in fiscal 2014. Gross margin

was lower due primarily to continued pharmacy reimbursement rate pressures and the prior year

MediCal decision, partially offset by a LIFO credit of $18.9 million versus a LIFO charge of

32