Rite Aid 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 28, 2015, March 1, 2014 and March 2, 2013

(In thousands, except per share amounts)

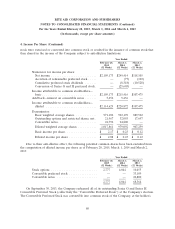

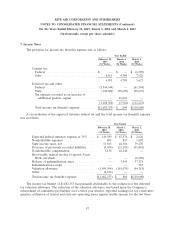

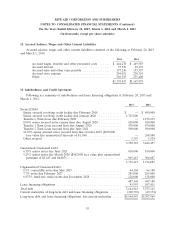

7. Income Taxes (Continued)

Net Operating Losses and Tax Credits

At February 28, 2015, the Company had federal net operating loss (NOL) carryforwards of

approximately $3,173,128. Of these, $1,588,642 will expire, if not utilized, between fiscal 2020 and 2026.

An additional $1,567,808 will expire, if not utilized, between fiscal 2027 and 2032.

At February 28, 2015, the Company had state NOL carryforwards of approximately $4,920,730, the

majority of which will expire between fiscal 2020 and 2024.

The Company’s federal and state net operating loss carryforwards include federal deductions of

$18,365 and state deductions of $66,973 for windfall tax benefits that have not yet been recognized in

the financial statements at February 28, 2015. These tax benefits will be credited to additional paid-in

capital when they reduce current taxable income consistent with the tax law ordering approach.

At February 28, 2015, the Company had federal business tax credit carryforwards of $49,091, the

majority of which will expire between 2019 and 2021. In addition to these credits, the Company had

alternative minimum tax credit carryforwards of $3,221.

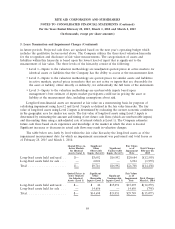

Valuation Allowances

The valuation allowances as of February 28, 2015 and March 1, 2014 apply to the net deferred tax

assets of the Company. The Company maintained a valuation allowance of $231,679 at February 28,

2015 primarily comprised of state deferred tax assets and a full valuation allowance against net deferred

tax assets of $2,060,811 at March 1, 2014 as a result of a three year cumulative loss.

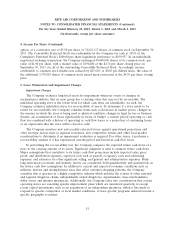

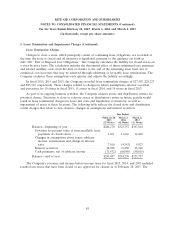

8. Accounts Receivable

The Company maintains an allowance for doubtful accounts receivable based upon the expected

collectability of accounts receivable. The allowance for uncollectible accounts at February 28, 2015 and

March 1, 2014 was $31,247 and $26,873 respectively. The Company’s accounts receivable are due

primarily from third-party payors (e.g., pharmacy benefit management companies, insurance companies

or governmental agencies) and are recorded net of any allowances provided for under the respective

plans. Since payments due from third-party payors are sensitive to payment criteria changes and

legislative actions, the allowance is reviewed continually and adjusted for accounts deemed uncollectible

by management.

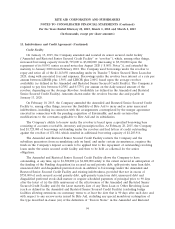

9. Inventory

At February 28, 2015 and March 1, 2014, inventories were $997,528 and $1,018,581, respectively,

lower than the amounts that would have been reported using the first-in, first-out (‘‘FIFO’’) cost flow

assumption. The Company calculates its FIFO inventory valuation using the retail method for store

inventories and the cost method for distribution facility inventories. The Company recorded a LIFO

credit for fiscal year 2015 of $18,857, compared to a LIFO charge of $104,142 for fiscal year 2014 and

a LIFO credit of $147,882 for fiscal year 2013. During fiscal 2015, 2014 and 2013, a reduction in

inventories related to working capital initiatives resulted in the liquidation of applicable LIFO inventory

quantities carried at lower costs in prior years. This LIFO liquidation resulted in a $38,867, $13,894 and

$4,316 cost of sales decrease, with a corresponding reduction to the adjustment to LIFO for fiscal 2015,

fiscal 2014 and fiscal 2013, respectively.

90