Rite Aid 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 28, 2015, March 1, 2014 and March 2, 2013

(In thousands, except per share amounts)

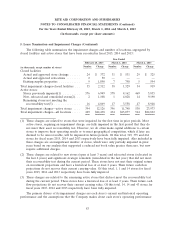

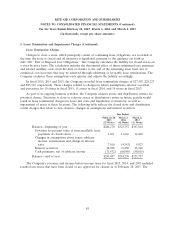

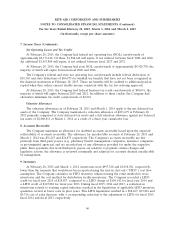

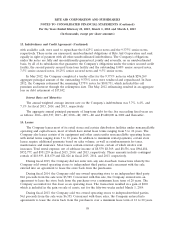

10. Property, Plant and Equipment

Following is a summary of property, plant and equipment, including capital lease assets, at

February 28, 2015 and March 1, 2014:

2015 2014

Land ...................................... $ 232,785 $ 233,098

Buildings ................................... 761,262 753,633

Leasehold improvements ........................ 2,078,974 1,890,369

Equipment .................................. 2,377,481 2,194,339

Construction in progress ........................ 95,672 69,388

5,546,174 5,140,827

Accumulated depreciation ....................... (3,454,805) (3,183,498)

Property, plant and equipment, net ................. $2,091,369 $ 1,957,329

Depreciation expense, which included the depreciation of assets recorded under capital leases, was

$298,523, $284,603 and $286,374 in fiscal 2015, 2014 and 2013, respectively.

Included in property, plant and equipment was the carrying amount, which approximates fair value,

of assets to be disposed of totaling $6,317 and $1,887 at February 28, 2015 and March 1, 2014,

respectively.

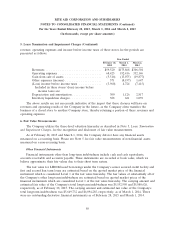

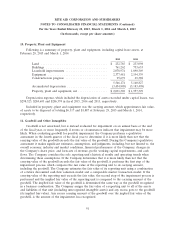

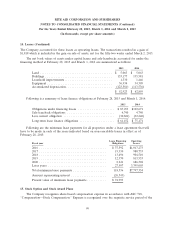

11. Goodwill and Other Intangibles

Goodwill is not amortized, but is instead evaluated for impairment on an annual basis at the end

of the fiscal year, or more frequently if events or circumstances indicate that impairment may be more

likely. When evaluating goodwill for possible impairment, the Company performs a qualitative

assessment in the fourth quarter of the fiscal year to determine if it is more likely than not that the

carrying value of the goodwill exceeds the fair value of the goodwill. During the Company’s qualitative

assessment it makes significant estimates, assumptions, and judgments, including, but not limited to, the

overall economy, industry and market conditions, financial performance of the Company, changes in

the Company’s share price, and forecasts of revenue, profit, working capital requirements, and cash

flows. The Company considers the sole reporting unit’s historical results and operating trends when

determining these assumptions. If the Company determines that it is more likely than not that the

carrying value of the goodwill exceeds the fair value of the goodwill, it performs the first step of the

impairment process, which compares the fair value of the reporting unit to its carrying amount,

including the goodwill. The Company estimates the fair value of its reporting unit using a combination

of a future discounted cash flow valuation model and a comparable market transaction model. If the

carrying value of the reporting unit exceeds the fair value, the second step of the impairment process is

performed and the implied fair value of the reporting unit is compared to the carrying amount of the

goodwill. The implied fair value of the goodwill is determined the same way as the goodwill recognized

in a business combination. The Company assigns the fair value of a reporting unit to all of the assets

and liabilities of that unit (including unrecognized intangible assets) and any excess goes to the goodwill

(its implied fair value). Any excess carrying amount of the goodwill over the implied fair value of the

goodwill, is the amount of the impairment loss recognized.

91