Rite Aid 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

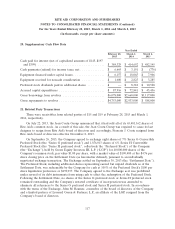

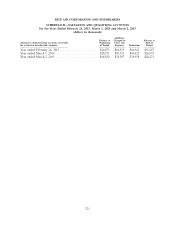

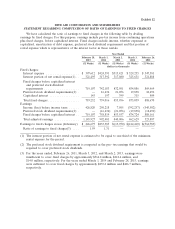

Exhibit 12

RITE AID CORPORATION AND SUBSIDIARIES

STATEMENT REGARDING COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES

We have calculated the ratio of earnings to fixed charges in the following table by dividing

earnings by fixed charges. For this purpose, earnings include pre-tax income from continuing operations

plus fixed charges, before capitalized interest. Fixed charges include interest, whether expensed or

capitalized, amortization of debt expense, preferred stock dividend requirement and that portion of

rental expense which is representative of the interest factor in those rentals.

Year Ended

February 28, March 1, March 2, March 3, February 26,

2015 2014 2013 2012 2011

(52 Weeks) (52 Weeks) (52 Weeks) (53 Weeks) (52 Weeks)

(dollars in thousands)

Fixed charges:

Interest expense ................... $ 397,612 $424,591 $515,421 $ 529,255 $ 547,581

Interest portion of net rental expense(1) . . 321,495 317,592 317,080 325,631 321,888

Fixed charges before capitalized interest

and preferred stock dividend

requirements .................... 719,107 742,183 832,501 854,886 869,469

Preferred stock dividend requirements(2) . — 16,636 21,056 19,838 18,692

Capitalized interest ................. 145 197 399 315 509

Total fixed charges .................. 719,252 759,016 853,956 875,039 888,670

Earnings:

Income (loss) before income taxes ...... 426,820 250,218 7,505 (392,257) (545,582)

Preferred stock dividend requirements(2) . — (16,636) (21,056) (19,838) (18,692)

Fixed charges before capitalized interest . . 719,107 758,819 853,557 874,724 888,161

Total adjusted earnings .............. 1,145,927 992,401 840,006 462,629 323,887

Earnings to fixed charges excess (deficiency) $ 426,675 $233,385 $ (13,950) $(412,410) $(564,783)

Ratio of earnings to fixed charges(3) .... 1.59 1.31 — — —

(1) The interest portion of net rental expense is estimated to be equal to one-third of the minimum

rental expense for the period.

(2) The preferred stock dividend requirement is computed as the pre- tax earnings that would be

required to cover preferred stock dividends.

(3) For the years ended, February 26, 2011, March 3, 2012, and March 2, 2013, earnings were

insufficient to cover fixed charges by approximately $564.8 million, $412.4 million, and

$14.0 million, respectively. For the years ended March 1, 2014 and February 28, 2015, earnings

were sufficient to cover fixed charges by approximately $233.4 million and $426.7 million,

respectively.