Rite Aid 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes, together with available cash, were used to repurchase and repay the 8.625% senior notes and the

9.375% senior notes, respectively. These notes are unsecured, unsubordinated obligations of Rite Aid

Corporation and rank equally in right of payment with all other unsubordinated indebtedness. Our

obligations under the notes are fully and unconditionally guaranteed, jointly and severally, on an

unsecured unsubordinated basis, by all of our subsidiaries that guarantee our obligations under our

senior secured credit facility, our second priority secured term loan facility and our outstanding 8.00%

senior secured notes due 2020, 7.5% senior secured notes due 2017, 10.25% senior secured notes due

2019 and 9.5% senior notes due 2017.

In May 2012, $296.3 million aggregate principal amount of the outstanding 9.375% notes were

tendered and repurchased by us. We redeemed the remaining 9.375% notes in June 2012 for

$108.7 million, which included the call premium and interest through the redemption date. The

refinancing resulted in an aggregate loss on debt retirement of $17.8 million.

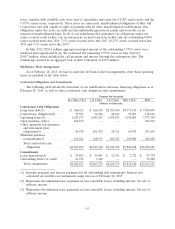

Off-Balance Sheet Arrangements

As of February 28, 2015, we had no material off balance sheet arrangements, other than operating

leases as included in the table below.

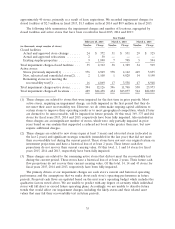

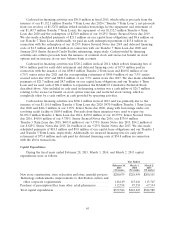

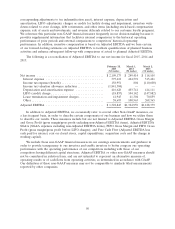

Contractual Obligations and Commitments

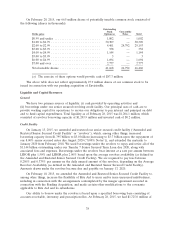

The following table details the maturities of our indebtedness and lease financing obligations as of

February 28, 2015, as well as other contractual cash obligations and commitments.

Payment due by period

Less Than 1 Year 1 to 3 Years 3 to 5 Years After 5 Years Total

(Dollars in thousands)

Contractual Cash Obligations

Long term debt(1) ........... $ 386,625 $ 628,630 $2,353,630 $4,171,193 $ 7,540,078

Capital lease obligations(2) ..... 37,592 32,826 20,611 27,507 118,536

Operating leases(3) ........... 1,017,273 1,885,243 1,499,835 3,395,003 7,797,354

Open purchase orders ......... 264,819 — — — 264,819

Other, primarily self insurance

and retirement plan

obligations(4) ............. 94,578 101,472 28,311 69,075 293,436

Minimum purchase

commitments(5) ........... 163,012 368,975 292,381 160,090 984,458

Total contractual cash

obligations .............. $1,963,899 $3,017,146 $4,194,768 $7,822,868 $16,998,681

Commitments

Lease guarantees(6) .......... $ 23,802 $ 39,085 $ 23,611 $ 7,272 $ 93,770

Outstanding letters of credit .... 61,736 9,348 — — 71,084

Total commitments ......... $2,049,437 $3,065,579 $4,218,379 $7,830,140 $17,163,535

(1) Includes principal and interest payments for all outstanding debt instruments. Interest was

calculated on variable rate instruments using rates as of February 28, 2015.

(2) Represents the minimum lease payments on non-cancelable leases, including interest, but net of

sublease income.

(3) Represents the minimum lease payments on non-cancelable leases, including interest, but net of

sublease income.

43