Rite Aid 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The announcement and pendency of the acquisition may cause disruptions in the business of EnvisionRx,

which could have an adverse effect on their business, financial condition or results of operations and,

post-closing, our business, financial condition or results of operations.

The announcement and pendency of the acquisition could cause disruptions of the business of

EnvisionRx. Specifically:

• current and prospective customers of EnvisionRx may experience uncertainty about the ability of

EnvisionRx to meet their needs, which might cause customers to obtain PBM and other services

elsewhere; and

• while we have entered into employment contracts with a number of key executives from

EnvisionRx, current and prospective associates of EnvisionRx may experience uncertainty about

their future roles with Rite Aid, which might adversely affect the ability of EnvisionRx to attract

and retain key personnel.

These disruptions could be exacerbated by a delay in the completion of the acquisition and could

have an adverse effect on the business, financial condition or results of operations of EnvisionRx prior

to the completion of the acquisition and on Rite Aid following the completion of the acquisition.

The pending acquisition is subject to approvals from government entities. Failure to complete the pending

acquisition could have a material adverse effect on us.

We cannot complete the acquisition of EnvisionRx unless we receive various consents, approvals

and clearances from various authorities in the United States. While we believe that we will receive the

requisite approvals from these authorities, there can be no assurance of this.

If the acquisition is not completed for any reason, we will have incurred substantial expenses and

may incur additional expenses, which may be material, without realizing the anticipated benefits of the

acquisition.

Subject to certain limitations, certain holders of equity interests in EnvisionRx may sell Rite Aid common

stock following the completion of the acquisition of EnvisionRx, which could cause our stock price to decrease.

The shares of Rite Aid common stock that certain holders of equity interests in EnvisionRx will

receive following the completion of the acquisition of EnvisionRx are restricted, but these holders may

sell these shares following the acquisition under certain circumstances, including pursuant to a

registered underwritten public offering under the Securities Act or in accordance with Rule 144 under

the Securities Act. We have entered into a registration rights agreement with these holders, which will

give these holders the right to require us to register all or a portion of their shares at certain times,

subject to certain conditions and restrictions. The sale of a substantial number of our shares by these or

other stockholders within a short period of time could cause our stock price to decrease, make it more

difficult for us to raise funds through future offerings of Rite Aid common stock or acquire other

businesses using Rite Aid common stock as consideration.

Item 1B. Unresolved SEC Staff Comments

None

Item 2. Properties

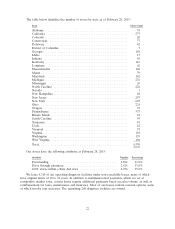

As of February 28, 2015, we operated 4,570 retail drugstores. The average selling square feet of

each store in our chain is approximately 10,000 square feet. The average total square feet of each store

in our chain is approximately 12,600. The stores in the eastern part of the U.S. average 8,900 selling

square feet per store (11,200 average total square feet per store). The stores in the western part of the

U.S. average 14,800 selling square feet per store (19,400 average total square feet per store).

21