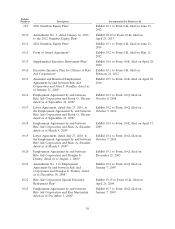

Rite Aid 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

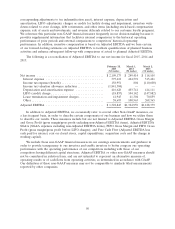

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Our future earnings, cash flow and fair values relevant to financial instruments are dependent

upon prevalent market rates. Market risk is the risk of loss from adverse changes in market prices and

interest rates. Our major market risk exposure is changing interest rates. Increases in interest rates

would increase our interest expense. We enter into debt obligations to support capital expenditures,

acquisitions, working capital needs and general corporate purposes. Our policy is to manage interest

rates through the use of a combination of variable-rate credit facilities, fixed-rate long-term obligations

and derivative transactions. We currently do not have any derivative transactions outstanding.

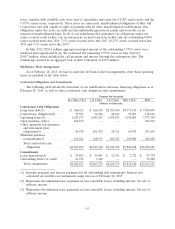

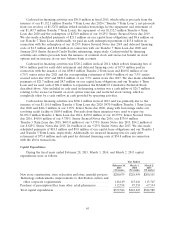

The table below provides information about our financial instruments that are sensitive to changes

in interest rates. The table presents principal payments and the related weighted average interest rates

by expected maturity dates as of February 28, 2015.

Fair Value at

February 28,

2016 2017 2018 2019 2020 Thereafter Total 2015

(Dollars in thousands)

Long-term debt, including

current portion, excluding

capital lease obligations

Fixed Rate .............. $69,535 $ — $ — $ — $ — $2,785,000 $2,854,535 $3,230,801

Average Interest Rate ....... 7.92% 0.00% 0.00% 0.00% 0.00% 7.96% 7.96%

Variable Rate ............ $ — $ — $ — $ — $1,725,000 $ 970,000 $2,695,000 $2,649,825

Average Interest Rate ....... 0.00% 0.00% 0.00% 0.00% 2.14% 5.30% 3.28%

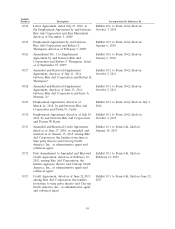

Our ability to satisfy interest payment obligations on our outstanding debt will depend largely on

our future performance, which, in turn, is subject to prevailing economic conditions and to financial,

business and other factors beyond our control. If we do not have sufficient cash flow to service our

interest payment obligations on our outstanding indebtedness and if we cannot borrow or obtain equity

financing to satisfy those obligations, our business and results of operations could be materially

adversely affected. We cannot be assured that any replacement borrowing or equity financing could be

successfully completed.

The interest rate on our variable rate borrowings, which include our revolving credit facility,

Tranche 1 Term Loan and our Tranche 2 Term Loan, are all based on LIBOR. However, the interest

rate on our Tranche 1 Term Loan and Tranche 2 Term Loan have a LIBOR floor of 100 basis points. If

the market rates of interest for LIBOR changed by 100 basis points as of February 28, 2015, our

annual interest expense would change by approximately $19.0 million.

A change in interest rates does not have an impact upon our future earnings and cash flow for

fixed-rate debt instruments. As fixed-rate debt matures, however, and if additional debt is acquired to

fund the debt repayment, future earnings and cash flow may be affected by changes in interest rates.

This effect would be realized in the periods subsequent to the periods when the debt matures.

Increases in interest rates would also impact our ability to refinance existing maturities on favorable

terms.

Item 8. Financial Statements and Supplementary Data

Our consolidated financial statements and notes thereto are included elsewhere in this report and

are incorporated by reference herein. See Item 15 of Part IV.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

Not applicable

51