Rite Aid 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

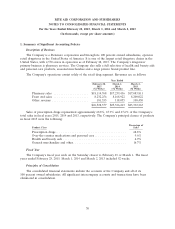

RITE AID CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

Year Ended

February 28, March 1, March 2,

2015 2014 2013

(52 Weeks) (52 Weeks) (52 Weeks)

Revenues ...................................... $26,528,377 $25,526,413 $25,392,263

Costs and expenses:

Cost of goods sold .............................. 18,951,645 18,202,679 18,073,987

Selling, general and administrative expenses ........... 6,695,642 6,561,162 6,600,765

Lease termination and impairment charges ............ 41,945 41,304 70,859

Interest expense ............................... 397,612 424,591 515,421

Loss on debt retirements, net ...................... 18,512 62,443 140,502

Gain on sale of assets, net ........................ (3,799) (15,984) (16,776)

26,101,557 25,276,195 25,384,758

Income before income taxes ........................ 426,820 250,218 7,505

Income tax (benefit) expense ........................ (1,682,353) 804 (110,600)

Net income ................................... $ 2,109,173 $ 249,414 $ 118,105

Computation of income attributable to common

stockholders:

Net income ................................... $ 2,109,173 $ 249,414 $ 118,105

Accretion of redeemable preferred stock .............. — (77) (102)

Cumulative preferred stock dividends ................ — (8,318) (10,528)

Conversion of Series G and H preferred stock ......... — (25,603) —

Income attributable to common stockholders—basic ..... 2,109,173 215,416 107,475

Add back-interest on convertible notes ............... 5,456 5,456 —

Income attributable to common stockholders—diluted .... $ 2,114,629 $ 220,872 $ 107,475

Basic income per share .......................... $ 2.17 $ 0.23 $ 0.12

Diluted income per share ......................... $ 2.08 $ 0.23 $ 0.12

The accompanying notes are an integral part of these consolidated financial statements.

66