Rite Aid 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

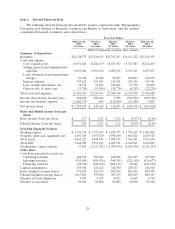

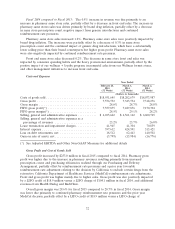

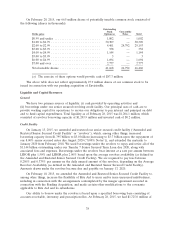

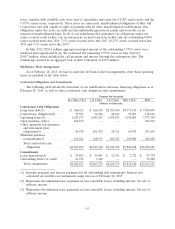

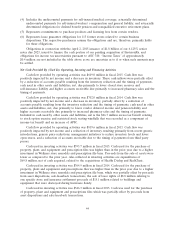

On February 28, 2015, our 66.5 million shares of potentially issuable common stock consisted of

the following (shares in thousands):

Outstanding

Stock Convertible

Strike price Options(a) Notes Total

$0.99 and under .......................... 1,002 — 1,002

$1.00 to $1.99 ............................ 30,309 — 30,309

$2.00 to $2.99 ............................ 4,401 24,792 29,193

$3.00 to $3.99 ............................ 338 — 338

$4.00 to $4.99 ............................ 1,144 — 1,144

$5.00 to $5.99 ............................ 3 — 3

$6.00 to $6.99 ............................ 1,694 — 1,694

$7.00 and over ........................... 2,777 — 2,777

Total issuable shares ....................... 41,668 24,792 66,460

(a) The exercise of these options would provide cash of $87.3 million.

The above table does not reflect approximately 27.9 million shares of our common stock to be

issued in connection with our pending acquisition of EnvisionRx.

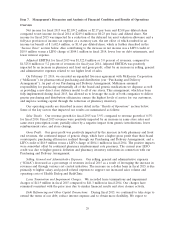

Liquidity and Capital Resources

General

We have two primary sources of liquidity: (i) cash provided by operating activities and

(ii) borrowings under our senior secured revolving credit facility. Our principal uses of cash are to

provide working capital for operations, to service our obligations to pay interest and principal on debt

and to fund capital expenditures. Total liquidity as of February 28, 2015 was $1,204.1 million, which

consisted of revolver borrowing capacity of $1,203.9 million and invested cash of $0.2 million.

Credit Facility

On January 13, 2015, we amended and restated our senior secured credit facility (‘‘Amended and

Restated Senior Secured Credit Facility’’ or ‘‘revolver’’), which, among other things, increased

borrowing capacity from $1.795 billion to $3.0 billion (increasing to $3.7 billion upon the repayment of

our 8.00% senior secured notes due August 2020 (‘‘8.00% Notes’’)), and extended the maturity to

January 2020 from February 2018. We used borrowings under the revolver to repay and retire all of the

$1.144 billion outstanding under our Tranche 7 Senior Secured Term Loan due 2020, along with

associated fees and expenses. Borrowings under the revolver bear interest at a rate per annum between

LIBOR plus 1.50% and LIBOR plus 2.00% based upon the average revolver availability (as defined in

the Amended and Restated Senior Secured Credit Facility). We are required to pay fees between

0.250% and 0.375% per annum on the daily unused amount of the revolver, depending on the Average

Revolver Availability (as defined in the Amended and Restated Senior Secured Credit Facility).

Amounts drawn under the revolver become due and payable on January 13, 2020.

On February 10, 2015, we amended the Amended and Restated Senior Secured Credit Facility to,

among other things, increase the flexibility of Rite Aid to incur and/or issue unsecured indebtedness,

including in connection with the arrangements contemplated by the merger agreement executed in

connection with the Pending Acquisition, and made certain other modifications to the covenants

applicable to Rite Aid and its subsidiaries.

Our ability to borrow under the revolver is based upon a specified borrowing base consisting of

accounts receivable, inventory and prescription files. At February 28, 2015, we had $1,725.0 million of

38