Rite Aid 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 28, 2015, March 1, 2014 and March 2, 2013

(In thousands, except per share amounts)

1. Summary of Significant Accounting Policies (Continued)

portion of the deferred tax assets will not be realized. Changes in valuation allowances from period to

period are included in the tax provision in the period of change.

The Company has net operating loss (‘‘NOL’’) carryforwards that can be utilized to offset future

income for federal and state tax purposes. These NOLs generate a significant deferred tax asset. The

Company regularly reviews the deferred tax assets for recoverability considering historical profitability,

projected taxable income, the expected timing of the reversals of existing temporary differences and tax

planning strategies.

The Company recognizes tax liabilities in accordance with ASC 740, ‘‘Income Taxes’’ and the

Company adjusts these liabilities with changes in judgment as a result of the evaluation of new

information not previously available. Due to the complexity of some of these uncertainties, the ultimate

resolution may result in a payment that is materially different from the current estimate of the tax

liabilities.

Sales Tax Collected

Sales taxes collected from customers and remitted to various governmental agencies are presented

on a net basis (excluded from revenues) in the Company’s statement of operations.

Use of Estimates

The preparation of the financial statements in conformity with accounting principles generally

accepted in the United States of America requires management to make estimates and assumptions

that affect the amounts reported in the financial statements and accompanying notes. Actual results

could differ from those estimates.

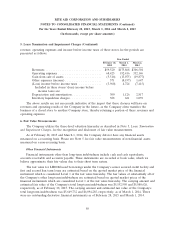

Significant Concentrations

The Company’s pharmacy sales were primarily to customers covered by health plan contracts,

which typically contract with a third party payor that agrees to pay for all or a portion of a customer’s

eligible prescription purchases. During fiscal 2015, the top five third party payors accounted for

approximately 69.7% of the Company’s pharmacy sales. The largest third party payor, Express Scripts,

represented 27.8%, 31.6% and 35.3% of pharmacy sales during fiscal 2015, 2014 and 2013, respectively.

Third party payors are entities such as an insurance company, governmental agency, health

maintenance organization or other managed care provider, and typically represent several health care

contracts and customers.

During fiscal 2015, state sponsored Medicaid agencies and related managed care Medicaid payors

accounted for approximately 18.6% of the Company’s pharmacy sales, the largest of which was

approximately 1.3% of the Company’s pharmacy sales. During fiscal 2015, approximately 32.1% of the

Company’s pharmacy sales were to customers covered by Medicare Part D. Any significant loss of

third- party payor business could have a material adverse effect on the Company’s business and results

of operations.

76