Redbox 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2009, 2008, AND 2007

and 2007, respectively. Our Redbox subsidiary also sponsors a separate 401(k) plan, and contributes to the plan

matching 25% of employee contributions up to 4% of their compensation. Matching contributions for the Redbox

401(k) plan were $0.5 million in 2009 and $0.3 million in 2008.

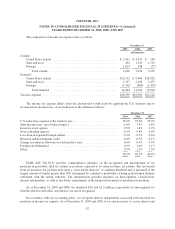

NOTE 15: BUSINESS SEGMENT INFORMATION

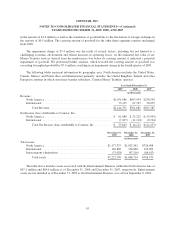

FASB ASC 280, Segment Reporting, requires that companies report separately in the financial statements

certain financial and descriptive information about segment revenues, income and assets. The method for

determining what information is reported is based on the way that management organizes the operating segments

for making operational decisions and assessments of financial performance. Our chief operating decision maker

is considered to be the Chief Executive Officer (“CEO”). In early 2008, we assessed our business segments due

to changes in our business and product lines as well as our organizational structure. We redefined our business

segments from North America and International to Coin and Entertainment services, DVD services, Money

Transfer services and E-payment services. With the sale of the Entertainment Business on September 8, 2009 we

now report Coin services as its own segment. The amounts shown below for revenue and income exclude the

Entertainment Business for all periods presented. The amounts shown for assets include both Coin and

Entertainment assets for the periods prior to the sale of Entertainment. The following table demonstrated our

revenues by product lines:

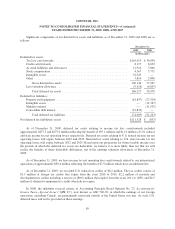

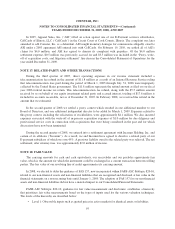

Year Ended December 31,

2009 2008 2007

(in thousands)

Revenue:

Coin services ................................... $ 258,839 $261,303 $250,876

DVD services .................................. 773,511 388,453* 9,530*

Money transfer services .......................... 87,656 87,424 24,155

E-payment services .............................. 24,785 24,501 22,824

Consolidated revenue ................................ $1,144,791 $761,681 $307,385

* DVD services revenue above for 2008 does not include $11.0 million for the period January 1, 2008 through

January 17, 2008 and $134.1 million for 2007 when we did not consolidate the operating results of Redbox.

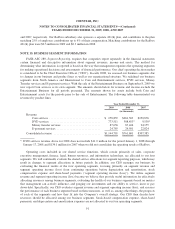

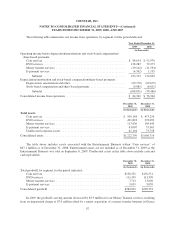

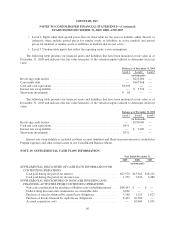

Operating costs included in our shared service functions, which consist primarily of sales, corporate

executive management, finance, legal, human resources, and information technology, are allocated to our four

segments. We will continually evaluate the shared service allocations for segment reporting purposes, which may

result in changes to segment allocations in future periods. In addition, our CEO manages our business by

evaluating the financial results of the four operating segments, focusing primarily on segment revenue and

segment operating income (loss) from continuing operations before depreciation and amortization, stock

compensation expense and share-based payments (“segment operating income (loss)”). We utilize segment

revenue and segment operating income (loss) because we believe they provide useful information for effectively

allocating resources among business segments, evaluating the health of our business segments based on metrics

that management can actively influence, and gauging our investments and our ability to service, incur or pay

down debt. Specifically, our CEO evaluates segment revenue and segment operating income (loss), and assesses

the performance of each business segment based on these measures, as well as, among other things, the prospects

of each of the segments and how they fit into the Company’s overall strategy. Our CEO then decides how

resources should be allocated among our business segments. Stock-based compensation expense, share-based

payments, and depreciation and amortization expenses are not allocated to our four operating segments.

91