Redbox 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.physical home video formats to consumers, whether on a rental or sell-through basis. In addition, and pursuant to

the terms of the Warner Agreement, Redbox voluntarily dismissed its lawsuit against Warner relating to

Redbox’s access to Warner titles.

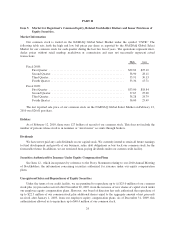

Management of Business Segments

In early 2008, we assessed our business segments due to changes in our business and product lines as well

as our organizational structure. We redefined our business segments from North America and International to

Coin and Entertainment services, DVD services, Money Transfer services and E-payment services. With the sale

of the Entertainment Business during the third quarter of 2009, we now report Coin services as its own segment.

Our business segments now include Coin services, DVD services, Money Transfer services, and E-payment

services.

We manage our business by evaluating the financial results of these segments, focusing primarily on

segment revenue and segment operating income (loss) from continuing operations before depreciation and

amortization, stock compensation expense and share-based payments (“segment operating income (loss)”).

Segment operating income (loss) contains the internally allocated costs including the shared service functions,

which consist primarily of corporate executive management, sales, finance, legal, human resources, and

information technology.

We utilize segment revenue and segment operating income (loss) because we believe they provide useful

information for effectively allocating resources among business segments, evaluating the health of our business

segments based on metrics that management can actively influence, and gauging our investments and our ability

to service, incur or pay down debt. Specifically, our CEO evaluates segment revenue and segment operating

income (loss), and assesses the performance of each business segment based on these measures, as well as,

among other things, the prospects of each of the segments and how they fit into our overall strategy. Our CEO

then decides how resources should be allocated among our business segments. For example, if a segment’s

revenue decreases more than expected, our CEO may consider allocating less financial or other resources to that

segment in the future.

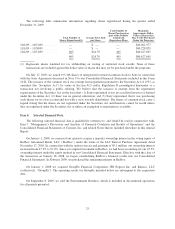

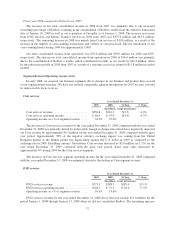

Coin services

We are the leader in the self-service coin-counting services market in the United States. We own and

operate the only multi-national fully automated network of self-service coin-counting machines across the United

States, Canada, Puerto Rico, Ireland and the United Kingdom. We estimate that at any one time, there is $7.0

billion to $10.0 billion worth of coin sitting idle in households in the United States. In 2009, consumers

processed more than $2.9 billion worth of coin through our coin-counting machines.

We own and service all of our coin-counting machines, providing a convenient and trouble free service to

retailers. Coin-counting revenue is generated through transaction fees from our consumers and retailers.

Consumers feed loose change into the machines, which count the change and then dispense vouchers or, in some

cases, issue E-payment products, at the consumer’s election. Each voucher lists the dollar value of coins counted,

less our transaction fee. When consumers elect to have a stored value card or e-certificate issued, the transaction

fee normally charged to the consumer is charged instead to the card issuers for the coin-counting services.

Since inception, our coin-counting machines have counted and processed more than 440.6 billion coins

worth more than $24.5 billion in more than 661.5 million self-service coin-counting transactions. We own and

operate more than 19,200 coin-counting machines in the United States, Canada, Puerto Rico, Ireland and the

United Kingdom (approximately 12,500 of which are E-payment enabled). Coin services revenue comprised 23%

of total consolidated revenue for 2009.

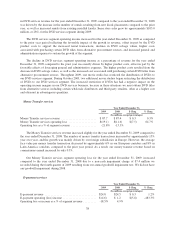

DVD services

Through our subsidiaries Redbox and DVDXpress we offer self-service DVD rentals through 22,400 kiosks

where consumers can rent or purchase movies. Our DVD kiosks are installed primarily at leading grocery stores,

29