Redbox 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

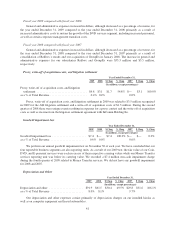

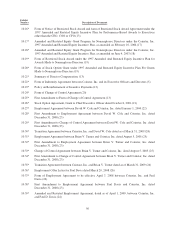

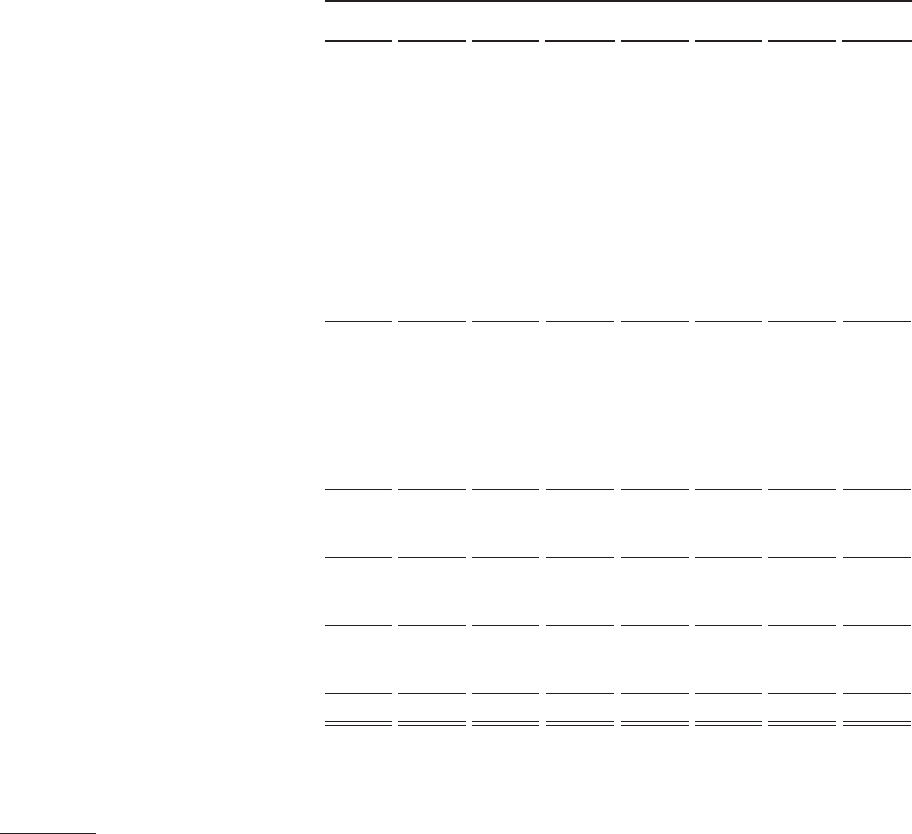

Supplemental Quarterly Financial Information

The following table sets forth selected unaudited quarterly financial information for the last eight quarters.

This information has been prepared on the same basis as our audited Consolidated Financial Statements and

includes, in the opinion of management, all normal and recurring adjustments that management considers

necessary for a fair presentation of the quarterly results for the periods. The operating results for any quarter are

not necessarily indicative of the results for future periods. Certain reclassifications have been made to the prior

period balances to conform with the current year presentation.

Three Month Periods Ended

Dec. 31,

2009(2)

Sept. 30,

2009(1)

June 30,

2009

March 31,

2009(2)

Dec. 31,

2008

Sept. 30,

2008

June 30,

2008(2)

March 31,

2008(3)

(in thousands, except per share data)

(unaudited)

Consolidated Statement of Operations:

Revenue ............................$328,005 $295,970 $282,048 $238,768 $227,864 $203,452 $184,071 $146,294

Expenses:

Direct operating .................. 234,390 203,650 193,941 161,463 150,079 134,342 117,592 92,298

Marketing ....................... 6,152 5,833 5,671 5,101 5,251 7,372 3,788 2,786

Research and development ......... 1,396 1,360 1,299 1,257 1,180 1,157 1,175 1,246

General and administrative ......... 31,771 32,570 32,379 30,313 28,503 22,997 23,554 19,238

Depreciation and other ............. 24,994 23,432 22,844 20,588 19,472 15,384 14,130 12,483

Amortization of intangible assets .... 1,971 2,029 1,961 1,951 1,983 2,041 2,068 2,114

Proxy, write-off of acquisition costs,

and litigation settlement .......... 3,500 — — 1,262 — — 3,084 —

Goodwill impairment loss .......... 7,371 — — — — — — —

Income from operations ................ 16,460 27,096 23,953 16,833 21,396 20,159 18,680 16,129

Foreign currency (loss) gain and other,

net .......................... (585) (270) 93 (162) (1,153) (717) (895) (1,163)

Interest income ................... 24 30 46 108 155 180 625 258

Interest expense .................. (9,821) (9,372) (8,628) (6,510) (5,453) (5,394) (5,847) (4,832)

Income (loss) from equity investments

and other ..................... — — — — 1 (1) 243 (580)

Early retirement of debt ............ — (1,082) — — — — — —

Income from continuing operations before

income taxes ...................... 6,078 16,402 15,464 10,269 14,946 14,227 12,806 9,812

Income taxes .................... (2,719) (6,761) (6,510) (2,960) (5,018) (6,357) (3,856) (3,059)

Income from continuing operations ....... 3,359 9,641 8,954 7,309 9,928 7,870 8,950 6,753

Income (loss) from discontinued operations,

netoftax ......................... — 31,722 (1,996) (1,719) (2,061) (12) (2,001) (879)

Net income .......................... 3,359 41,363 6,958 5,590 7,867 7,858 6,949 5,874

Less: Net income attributable to

non-controlling interests ............. — — — (3,627) (3,647) (3,347) (4,269) (3,173)

Net income attributable to Coinstar, Inc . . . $ 3,359 $ 41,363 $ 6,958 $ 1,963 $ 4,220 $ 4,511 $ 2,680 $ 2,701

Earnings per share attributable to Coinstar,

Inc:

Basic ..............................$ 0.11 $ 1.36 $ 0.23 $ 0.07 $ 0.15 $ 0.16 $ 0.10 $ 0.10

Diluted .............................$ 0.11 $ 1.34 $ 0.23 $ 0.07 $ 0.15 $ 0.16 $ 0.09 $ 0.10

(1) In the third quarter of 2009 we sold the Entertainment Business, which is included in discontinued operations above for all periods

presented.

(2) Proxy, write-off of acquisition costs, and litigation settlement in the fourth quarter of 2009 related to $3.5 million recognized for a

litigation settlement. In the first quarter of 2009 we wrote off acquisition costs of $1.3 million. In the second quarter of 2008, we

recognized $3.1 million in expense related to a proxy contest, the write-off of in-process acquisition costs and a litigation settlement.

(3) In the first quarter of 2008, we acquired GroupEx and the majority ownership interest of Redbox.

Seasonality

We have historically experienced seasonality in our revenue with higher revenue in the second half of the

year than in the first half of the year. Our Coin product line generally experiences its highest revenue in the

51