Redbox 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

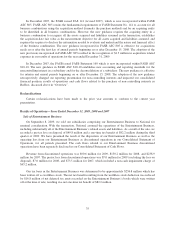

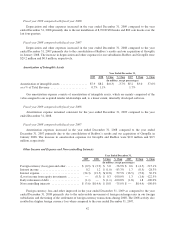

Net cash used by investing activities from continuing operations

Year Ended December 31,

2009 2008 2007

(in millions)

INVESTING ACTIVITIES:

Purchase of property and equipment .............................. $(153.5) $(150.8) $(54.9)

Acquisitions, net of cash acquired ................................ (1.2) (24.8) (7.2)

Loan to equity investee ........................................ — — (10.0)

Proceeds from sale of fixed assets ................................ 0.3 — 0.2

Net cash used by investing activities from continuing operations ............ $(154.4) $(175.6) $(71.9)

Net cash used by investing activities from continuing operations for the year ended December 31, 2009 was

$154.4 million compared to $175.6 million in the prior year. Net cash used by investing activities was higher in

2008 primarily due to the acquisition of GroupEx and the acquired increased ownership percentage in Redbox

from 47.3% to 51.0%, both of which took place in January 2008. Our purchase of property and equipment

increased during 2009 compared to 2008 primarily due to increased spending in our DVD segment.

Net cash used by investing activities from continuing operations for the year ended December 31, 2008 was

$175.6 million compared to $71.9 million in 2007. Net cash used by investing activities consisted primarily of

capital expenditures and the acquisitions of GroupEx and Redbox in January 2008. The increase in capital

expenditures year-over-year was primarily a result of the installation of coin and DVD machines, upgrades to our

machines, and other corporate infrastructure costs.

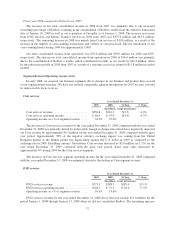

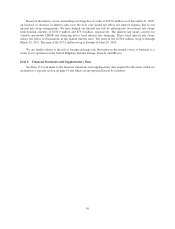

Net cash provided by financing activities from continuing operations

Year Ended December 31,

2009 2008 2007

(in millions)

FINANCING ACTIVITIES:

Principal payments on capital lease obligations and other debt ........... $ (27.3) $(17.0) $ (1.1)

Proceeds from capital lease financing .............................. 22.0 — —

Net borrowings on credit facility .................................. 42.5 13.0 70.0

Payoff of term loan ............................................. (87.5) — —

Convertible debt borrowings, net of underwriting discount and

commissions of $6,000 ........................................ 194.0 — —

Financing costs associated with revolving line of credit and convertible

debt ....................................................... (3.9) — (1.7)

Cash used to purchase remaining non-controlling interests in Redbox ..... (113.9) — —

Excess tax benefit on share-based awards ........................... — — 3.8

Repurchase of common stock .................................... — — (10.0)

Proceeds from exercise of stock options ............................ 16.0 8.6 4.3

Net cash provided by financing activities from continuing operations ......... $ 41.9 $ 4.6 $ 65.3

Net cash provided by financing activities for 2009 was $41.9 million. In 2009, net cash provided by

financing activities primarily represented the borrowings on convertible debt of $194.0 million, net of

underwriting discount and commissions of $6.0 million, net borrowings on our credit facility of $42.5 million,

proceeds from capital lease financing of $22.0 million and $16.0 million in proceeds from the exercise of

employee stock options. These increases were offset by cash used to purchase the remaining non-controlling

interest in Redbox of $113.9 million, the payoff of the term loan of $87.5 million, principal payments on capital

lease and other obligations of $27.3 million and $3.9 million in financing costs associated with our revolving line

45