Redbox 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2009, 2008, AND 2007

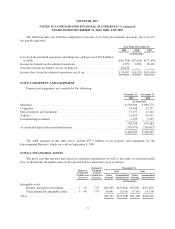

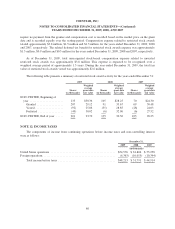

The amounts in the table above for 2008 include $9.8 million of gross intangibles and $5.5 of accumulated

amortization of intangibles for the Entertainment Business which was sold on September 8, 2009.

Based on identifiable intangible assets recorded as of December 31, 2009, and assuming no subsequent

impairment of the underlying assets, the annual estimated aggregate future amortization expenses are as follows:

(in thousands)

2010 .................................................................. $ 7,578

2011 .................................................................. 5,568

2012 .................................................................. 4,991

2013 .................................................................. 4,382

2014 .................................................................. 3,564

Thereafter .............................................................. 4,810

$30,893

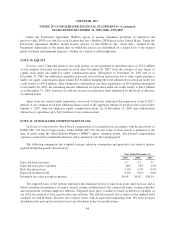

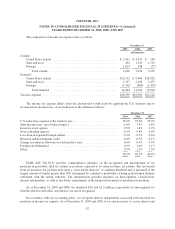

NOTE 7: ACCRUED LIABILITIES

Accrued liabilities consisted of the following as of December 31:

2009 2008

(in thousands)

Payroll related expenses ............................................ $29,265 $24,627

Interest payable ................................................... 4,959 2,268

Taxes payable .................................................... 20,619 17,214

Accrued professional fees ........................................... 5,078 4,177

Service contract providers ........................................... 5,876 5,031

Accrued medical insurance .......................................... 982 1,608

Accrued workers’ compensation and auto insurance ...................... 3,145 3,417

Accrued acquisition costs ........................................... — 10,000

Interest rate swap .................................................. 5,374 7,467

Other ........................................................... 16,115 11,691

$91,413 $87,500

The amounts in the table above for 2008 include $10.0 million of accrued liabilities for the Entertainment

Business which was sold on September 8, 2009.

NOTE 8: LONG-TERM DEBT

Long-term debt consisted of the following as of December 31:

2009 2008

(in thousands)

Revolving line of credit (matures November 2012) ..................... $225,000 $257,000

Convertible debt (matures September 2014) ........................... 167,109 —

Long-term debt ................................................. $392,109 $257,000

78