Redbox 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COINSTAR, INC.

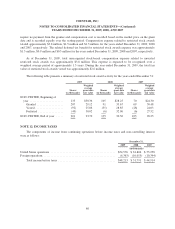

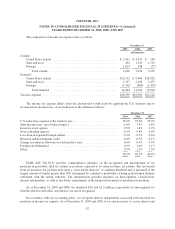

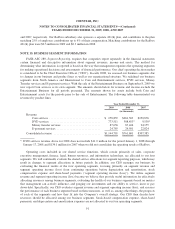

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2009, 2008, AND 2007

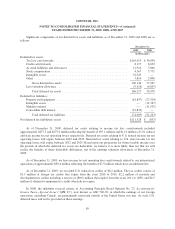

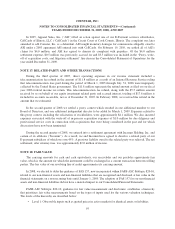

In 2005, Apparel Sales, Inc. (“ASI”) filed an action against one of our E-Payment services subsidiaries,

CellCards of Illinois, LLC (“CellCards”) in the Circuit Court of Cook County, Illinois. The complaint was later

amended to add Coinstar, Inc. as a defendant. ASI sought monetary damages for commissions allegedly owed to

ASI under a 2003 agreement ASI entered into with CellCards. On February 19, 2010, we settled all of ASI’s

claims for $4.0 million, and ASI has agreed to dismiss its complaint with prejudice. Of the $4.0 million

settlement expense, $0.5 million was previously accrued for and $3.5 million was included in the “Proxy, write-

off of acquisition costs, and litigation settlement” line item in the Consolidated Statement of Operations for the

year ended December 31, 2009.

NOTE 17: RELATED PARTY AND OTHER TRANSACTIONS

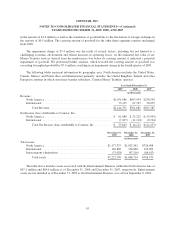

During the third quarter of 2007, direct operating expenses in our income statement included a

telecommunication fee refund in the amount of $11.8 million as a result of an Internal Revenue Service ruling

that telecommunication fees paid during the period of March 1, 2003 through July 31, 2006 were improperly

collected by the United States government. The $11.8 million represents the refund amount as filed on our fiscal

year 2006 federal income tax return. This telecommunication fee refund, along with the $5.5 million amount

received by us on behalf of our equity investment related party and accrued interest, totaling of $17.6 million is

included in accounts receivable, net as of December 31, 2007. In February 2008, we received the refund in the

amount that we estimated.

In the second quarter of 2008 we settled a proxy contest which resulted in one additional member to our

Board of Directors, and one additional independent director to be added by March 1, 2009. Expenses related to

this proxy contest, including the solicitation of stockholders, were approximately $4.1 million. We also incurred

expenses associated with the write-off of in-process acquisition expenses of $1.0 million for due diligence and

professional service costs in connection with acquisitions that were being considered in the past and for which

discussions have now been terminated.

During the second quarter of 2008, we entered into a settlement agreement with Incomm Holding, Inc. and

certain of its affiliates (“Incomm”). As a result, we and Incomm have agreed to dissolve a related party of our

E-payment subsidiary of which we own 49%. A previous liability owed to the related party was relieved. The net

settlement, after attorney fees, was approximately $2.0 million of income.

NOTE 18: FAIR VALUE

The carrying amounts for cash and cash equivalents, our receivables and our payables approximate fair

value, which is the amount for which the instrument could be exchanged in a current transaction between willing

parties. The fair value of our revolving line of credit approximates its carrying amount.

In 2008, we elected to defer the guidance of FAS 157, now incorporated within FASB ASC Subtopic 820-10,

related to our non-financial assets and non-financial liabilities that are recognized and disclosed at fair value in the

financial statements on a non-recurring basis until January 1, 2009. The adoption of FAS 157 for our non-financial

assets and non-financial liabilities did not have a material impact to our Consolidated Financial Statements.

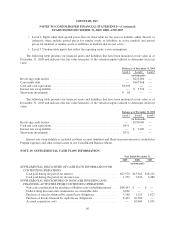

FASB ASC Subtopic 820-10, guidance for fair value measurement and disclosure, establishes a hierarchy

that prioritizes fair value measurements based on the types of inputs used for the various valuation techniques.

The levels of the hierarchy are described below:

• Level 1: Observable inputs such as quoted prices in active markets for identical assets or liabilities

95