Redbox 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal year 2009 compared with fiscal year 2008

General and administrative expenses increased in dollars, although decreased as a percentage of revenue, for

the year ended December 31, 2009 compared to the year ended December 31, 2008 primarily as a result of

increased administrative costs to sustain the growth of the DVD services segment, including increased personnel,

as well as certain corporate management transition costs.

Fiscal year 2008 compared with fiscal year 2007

General and administrative expenses increased in dollars, although decreased as a percentage of revenue, for

the year ended December 31, 2008 compared to the year ended December 31, 2007 primarily as a result of

consolidation of Redbox’s results and our acquisition of GroupEx in January 2008. The increase in general and

administrative expenses for our subsidiaries Redbox and GroupEx were $35.3 million and $5.5 million,

respectively.

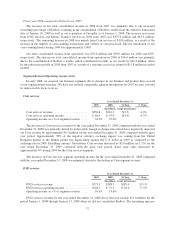

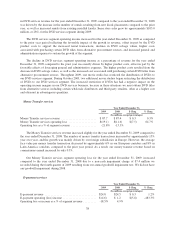

Proxy, write-off of acquisition costs, and litigation settlement

Year Ended December 31,

2009 2008 $ Chng % Chng 2007 $ Chng % Chng

(In millions, except percentages)

Proxy, write-off of acquisition costs, and litigation

settlement .................................. $4.8 $3.1 $1.7 54.8% $— $3.1 100.0%

as a % of Total Revenue ......................... 0.4% 0.4% 0.0%

Proxy, write-off of acquisition costs, and litigation settlement in 2009 was related to $3.5 million recognized

in 2009 for the ASI litigation settlement and a write-off of acquisition costs of $1.3 million. During the second

quarter of 2008 there were unique events resulting in expenses for a proxy contest and the write-off of acquisition

costs as well as income from the litigation settlement agreement with InComm Holding Inc.

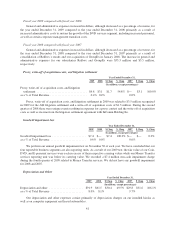

Goodwill impairment loss

Year Ended December 31,

2009 2008 $ Chng % Chng 2007 $ Chng % Chng

(In millions, except percentages)

Goodwill impairment loss ....................... $7.4 $— $7.4 100.0% $— $— 0.0%

as a % of Total Revenue ........................ 0.6% 0.0% 0.0%

We perform our annual goodwill impairment test on November 30 of each year. We have concluded that our

four reportable business segments are also reporting units. As a result of our 2009 test, the fair value of our Coin,

DVD, and E-payment services were each in excess of their respective carrying values while our Money Transfer

services reporting unit was below its carrying value. We recorded a $7.4 million non-cash impairment charge

during the fourth quarter of 2009 related to Money Transfer services. We did not have any goodwill impairment

for 2008 and 2007.

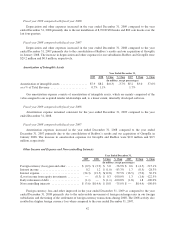

Depreciation and Other

Year Ended December 31,

2009 2008 $ Chng % Chng 2007 $ Chng % Chng

(In millions, except percentages)

Depreciation and other ....................... $91.9 $61.5 $30.4 49.5% $29.8 $31.6 106.1%

as a % of Total Revenue ...................... 8.0% 8.1% 9.7%

Our depreciation and other expenses consist primarily of depreciation charges on our installed kiosks as

well as on computer equipment and leased automobiles.

41