Redbox 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

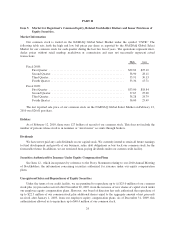

The following table summarizes information regarding shares repurchased during the quarter ended

December 31, 2009:

Total Number of

Shares Repurchased(1)

Average Price Paid

per Share

Total Number of

Shares Purchased as

part of the Publicly

Announced

Repurchase Plans

Maximum

Approximate Dollar

Value of Shares that

May Yet be Purchased

Under the Programs

10/1/09 – 10/31/09 ......... — $ — — $40,061,977

11/1/09 – 11/30/09 ......... — $ — — $40,228,829

12/1/09 – 12/31/09 ......... 405 $24.70 405 $40,427,665

405 $24.70 405 $40,427,665

(1) Represents shares tendered for tax withholding on vesting of restricted stock awards. None of these

transactions are included against the dollar value of shares that may yet be purchased under the programs.

On July 17, 2009, we issued 193,348 shares of unregistered restricted common stock to Sony in connection

with the Sony Agreement discussed in Note 9 to our Consolidated Financial Statements included in this Form

10-K. The issuance of the common stock was exempt from registration pursuant to the Securities Act of 1933, as

amended (the “Securities Act”) by virtue of Section 4(2) and/or Regulation D promulgated thereunder as a

transaction not involving a public offering. We believe that the issuance is exempt from the registration

requirements of the Securities Act on the basis that: (1) Sony represented it was an accredited investor as defined

under the Securities Act; (2) there was no general solicitation; and (3) Sony represented that it was purchasing

such shares for its own account and not with a view towards distribution. The shares of common stock carry a

legend stating that the shares are not registered under the Securities Act and therefore cannot be resold unless

they are registered under the Securities Act or unless an exemption to registration is available.

Item 6. Selected Financial Data.

The following selected financial data is qualified by reference to, and should be read in conjunction with,

Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the

Consolidated Financial Statements of Coinstar, Inc. and related Notes thereto included elsewhere in this Annual

Report.

On January 1, 2008, we exercised our option to acquire a majority ownership interest in the voting equity of

Redbox Automated Retail, LLC (“Redbox”) under the terms of the LLC Interest Purchase Agreement dated

November 17, 2005. In conjunction with the option exercise and payment of $5.1 million, our ownership interest

increased from 47.3% to 51.0%. Since our original investment in Redbox, we had been accounting for our 47.3%

ownership interest under the equity method in our Consolidated Financial Statements. Effective with the close of

the transaction on January 18, 2008, we began consolidating Redbox’s financial results into our Consolidated

Financial Statements. In February 2009, we purchased the remaining interests in Redbox.

On January 1, 2008 we acquired GroupEx Financial Corporation, JRJ Express Inc. and Kimeco, LLC

(collectively, “GroupEx”). The operating results for GroupEx included below are subsequent to the acquisition

date.

On September 8, 2009, we sold the Entertainment Business, which is included in discontinued operations

for all periods presented.

25