Redbox 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COINSTAR, INC.

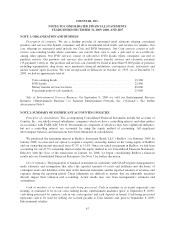

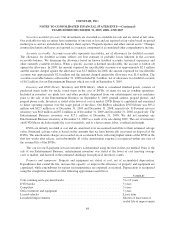

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2009, 2008, AND 2007

not actively traded in the market. The transaction costs directly associated with the issuance were proportionally

allocated to the liability and equity components. In addition, we recorded deferred tax assets according to FASB

ASC 740-10-45, Deferred Tax Accounts Related to an Asset or Liability. The amortization of the debt discount is

based on the interest rate method and is to be recognized as non-cash interest expense.

Recognition and reporting of business dispositions: When management commits to a plan to dispose of a

business component, it is necessary to determine how the results will be presented within the financial statements

and whether the net assets of that business are recoverable. Our significant accounting policies and judgments

associated with a decision to dispose of a business are as follows:

•Assets held for sale- We define a business component as held for sale if it meets the criteria of assets

held for sale within FASB ASC 360-10-45 at the balance sheet date. Upon being classified as held for

sale, the recoverability of the carrying value of the business must be assessed, and the business held for

sale is reported at the lower of its carrying value or fair value less cost to sell.

•Discontinued operations- We define a business component that has either been disposed of or is classified

as held for sale as discontinued operations if its operations and cash flows are clearly distinguishable from

the rest of the entity; its operations and cash flows have been or will be eliminated from ongoing

operations of the entity as a result of the disposal; and we have no significant continuing involvement in

the operations of the component after the disposal transaction. If a component is recorded as discontinued

operations, the results of operations of the disposed business through the date of sale and the gain or loss

on disposal are presented on a separate line in the income statement for all periods presented.

See discussion of the sale of our Entertainment Business in Note 4 to the Consolidated Financial Statements.

Recent accounting pronouncements: In July 2009 the FASB issued Statement of Financial Accounting

Standards No. 168, The Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting

Principles (“SFAS 168”). SFAS 168 became the source of authoritative GAAP recognized by the FASB to be

applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal

securities laws are also sources of authoritative GAAP for SEC registrants. On the effective date of SFAS 168,

the Codification superseded all then-existing non-SEC accounting and reporting standards. All other

nongrandfathered non-SEC accounting literature not included in the Codification became nonauthoritative. This

Statement is effective for financial statements issued for interim and annual periods ending after September 15,

2009. The adoption of SFAS 168 did not have a material impact on our consolidated financial position, results of

operations, or cash flows. We have made references to the accounting standards codification throughout the

disclosures in the Notes to the Consolidated Financial Statements.

In May 2009, the FASB issued FAS 165 which is now incorporated within FASB ASC 855. The new

guidance addresses accounting and disclosure requirements related to subsequent events. The objective of the

new guidance is to establish general standards of accounting for and disclosure of events that occur after the

balance sheet date but before the financial statements are issued or available to be issued. FASB ASC 855 sets

forth:

1. The period after the balance sheet date during which management of a reporting entity should evaluate

events or transactions that may occur for potential recognition or disclosure in the financial statements;

2. The circumstances under which an entity should recognize events or transactions occurring after the

balance sheet date in its financial statements; and

3. The disclosures that an entity should make about events or transactions that occurred after the balance

sheet date.

73