Redbox 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

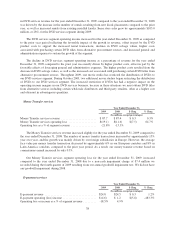

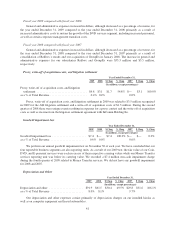

Net cash provided by operating activities from continuing operations

Year Ended December 31,

2009 2008 2007

(in millions)

OPERATING ACTIVITIES:

Net income (loss) .................................................. $ 57.3 $ 28.5 $(22.3)

Adjustments to reconcile net income (loss) to net cash provided by operating

activities from continuing operations:

Depreciation and other .......................................... 91.9 61.5 29.8

Amortization of intangible assets and deferred financing fees ............ 9.4 8.7 5.9

Write-off of acquisition costs ..................................... 1.3 1.0 —

Non-cash stock-based compensation for employees ................... 7.7 8.8 6.4

Share-based payments for DVD agreement .......................... 1.4 — —

Excess tax benefit on share-based awards ........................... — — (3.8)

Deferred income taxes .......................................... 14.4 12.1 (9.1)

Income from equity investments ................................... — 3.4 (1.6)

(Income) loss from discontinued operations, net of tax ................. (28.0) 5.0 45.0

Goodwill impairment loss ........................................ 7.4 — —

Loss on early retirement of debt ................................... 1.1 — 1.8

Other ........................................................ 2.5 1.1 (0.6)

Cash (used) provided by changes in operating assets and liabilities, net of effects

of business acquisitions ........................................... (50.7) 55.5 (27.0)

Net cash provided by operating activities from continuing operations ..... $115.7 $185.6 $ 24.5

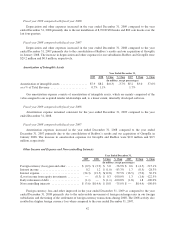

Net cash provided by operating activities from continuing operations was $115.7 million for the year ended

December 31, 2009, compared to net cash provided by operating activities of $185.6 million for the year ended

December 31, 2008, resulting in a total decrease of $69.9 million. The decrease was primarily due to an increase

in cash used by working capital of $106.2 million, offset by an increase of $28.8 million in net income and a $7.5

million increase in adjustments to reconcile net income to net cash provided by operating activities.

Cash used by working capital increased in 2009 compared to 2008 due to DVD services accounts payable

balances that grew during 2008 but stabilized in 2009 and an excise tax refund received in 2008. Cash used by

working capital also increased due to the timing of payments to vendors. These increases in cash used by

working capital over the prior year were offset by an increase in cash provided by working capital as a result of a

decline in the rate of inventory growth for DVD services as compared to the prior year. Adjustments to reconcile

net income to net cash provided by operating activities increased primarily due to higher depreciation expense in

2009 and higher deferred tax expense offset by the income from discontinued operations during 2009.

Net cash provided by operating activities from continuing operations was $185.6 million for the year ended

December 31, 2008, compared to net cash provided by operating activities of $24.5 million for the year ended

December 31, 2007, resulting in a total increase of $161.1 million. The increase was primarily due to an increase

in cash provided by working capital of $82.5 million, an increase of $50.8 million in net income and a $27.8

increase in adjustments to reconcile net income to net cash provided by operating activities. The increase in

working capital in 2008 compared to 2007 was the result of the consolidation of Redbox and the acquisition of

GroupEx, which both took place during 2008. The remaining increase in working capital was due to the

collection of the telecommunication refund and the timing of receivable collection and vendor payments. The

increase in adjustments to reconcile net income to net cash provided by operating activities was primarily due to

the consolidation of Redbox in 2008 offset by the loss from discontinued operations in 2007.

44