Red Lobster 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

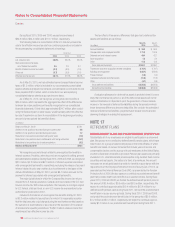

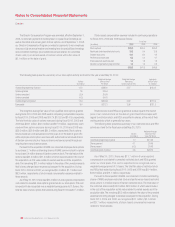

strategies designed to maximize returns, allow for diversification and provide a hedge against inflation. Our current positioning is neutral on investment style

between value and growth companies and large and small cap companies. We monitor our actual asset fund allocation to ensure that it approximates our target

allocation and believe that our long-term asset fund allocation will continue to approximate our target allocation. Investments held in U.S. fixed-income treasury

securities represented approximately 22.3 percent of total plan assets and represents the only significant concentration of risk related to a single entity, sector,

country, commodity or investment fund. No other single sector concentration of assets exceeded 5 percent of total plan assets, which is consistent with the

overall investment strategy to achieve appropriate diversification.

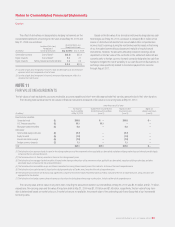

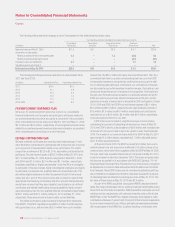

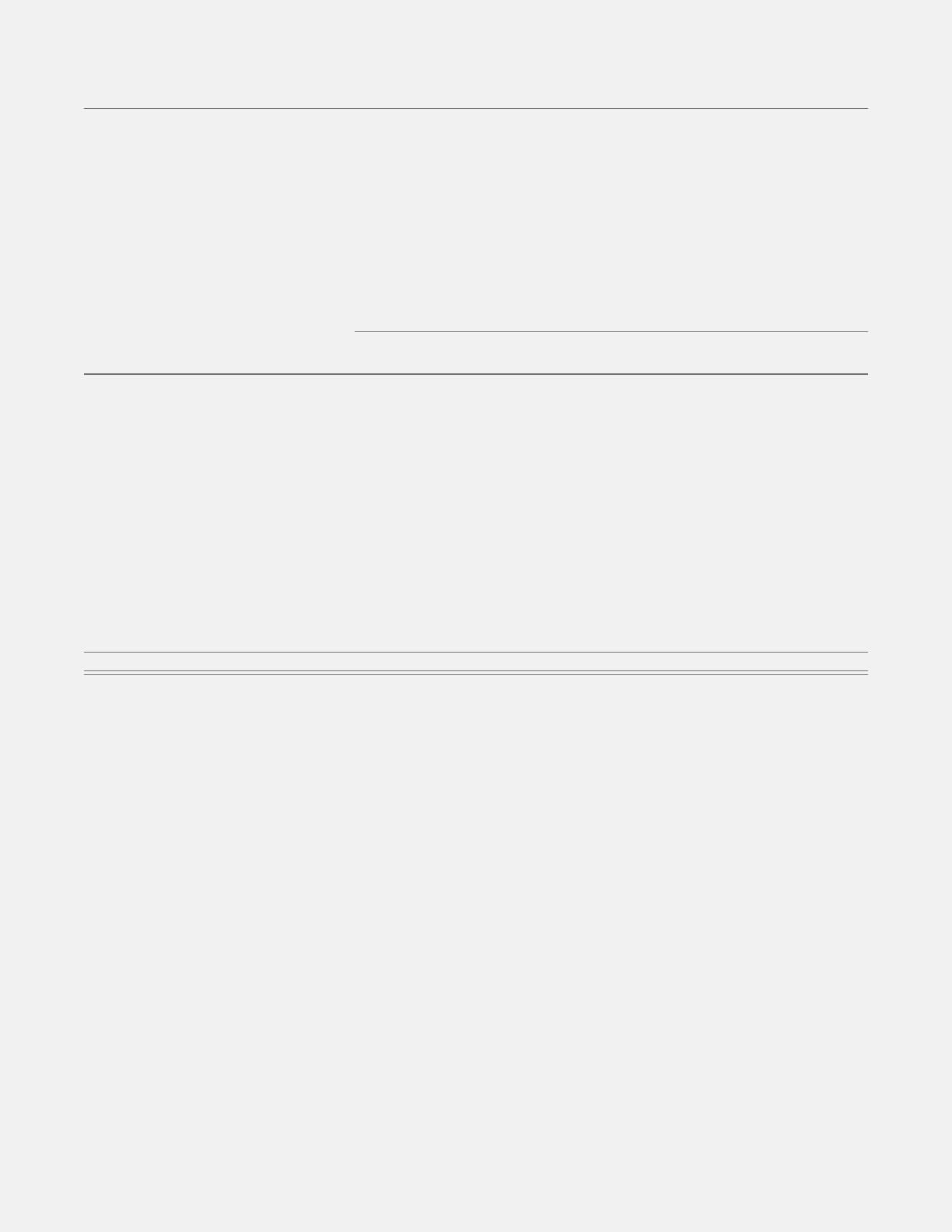

The fair values of the defined benefit pension plans assets at their measurement dates of May 30, 2010 are as follows:

Items Measured at Fair Value

Fair Value of Quoted Prices in Active Market Significant Other Significant

Assets (Liabilities) for Identical Assets (Liabilities) Observable Inputs Unobservable Inputs

(in millions) at May 30, 2010 (Level 1) (Level 2) (Level 3)

Equity:

U.S. (1) $ 28.7 $28.7 $ – $ –

U.S. Equity Mutual &

Commingled Funds (2) 17.1 1.2 15.9 –

Developed Market Equity Funds (3) 14.1 7.7 6.4 –

Emerging Market Equity Funds (3) 4.5 – 4.5 –

Private Equity Partnerships (4) 22.9 – – 22.9

Private Equity Securities (5) 0.1 – – 0.1

Equity Futures (6) (0.2) – (0.2) –

Fixed-Income:

Fixed-income Securities (7) 39.5 32.8 6.7 –

Bond Futures (8) 0.2 – 0.2 –

Energy & Real Estate Public Sector (9) 7.5 – 3.3 4.2

Real Asset Commingled Funds (10) 3.4 – 3.4 –

Real Asset Private Funds (11) 9.2 – – 9.2

Cash & Accruals 7.6 7.6 – –

Total $154.6 $78.0 $40.2 $36.4

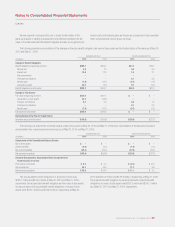

(1) U.S. equity securities and international equity securities are comprised of investments in common stock of U.S. and non-U.S. companies for total return purposes. These investments are

valued by the trustee at closing prices from national exchanges on the valuation date.

(2) U.S. equity mutual and commingled funds are comprised of investments in funds that purchase publicly traded U.S. common stock for total return purposes. Investments are valued at unit

values provided by the investment managers which are based on the fair value of the underlying investments.

(3) Emerging market equity funds and developed market securities are comprised of investments in funds that purchase publicly traded common stock of non-U.S. companies for total return

purposes. Funds are valued at unit values provided by the investment managers which are based on the fair value of the underlying investments.

(4) Private equity partnerships are comprised of investments in limited partnerships that invest in private companies for total return purposes. The investments are valued at fair value which is

generally based on the net asset value or capital balance as reported by the partnerships subject to the review and approval of the investment managers and their consultants. As there is

not a liquid market for some of these investments, realization of the estimated fair value of such investments is dependent upon transactions between willing sellers and buyers.

(5) Private equity securities are comprised of investments in publicly traded common stock that were received as a distribution from a private equity partnership as well as equity investments in

private companies for total return purposes. Stocks received from private equity distributions are valued by the trustee at closing prices from national exchanges on the valuation date.

Investments in private companies are valued by management based upon information provided by the respective third-party investment manager who considers factors such as the cost of

the investment, most recent round of financing, and expected future cash flows.

(6) Equity futures are comprised of investments in futures contracts that track the S&P 500 index and are used to maintain equity exposure consistent with policy allocations. Futures positions

are marked-to-market daily and reflect gains and losses on a daily basis.

(7) Fixed income securities are comprised of investments in government and corporate debt securities. These securities are valued by the trustee at closing prices from national exchanges or

pricing vendors on the valuation date. Unlisted investments are valued at prices quoted by various national markets, fixed income pricing models and/or independent financial analysts.

(8) Bond futures are comprised of investments in futures that track U.S. Treasury bond futures for purposes of managing fixed income exposure to policy allocations. The futures are

marked-to-market daily and reflect gains and losses on a daily basis.

(9) Energy and real estate securities are comprised of investments in publicly traded common stock of energy companies and real estate investment trusts for purposes of total return. These

securities are valued by the trustee at closing prices from national exchanges on the valuation date. Unlisted investments are valued at prices quoted by various national markets and

publications and/or independent financial analysts.

(10) Real asset commingled funds are comprised of investments in funds that purchase publicly traded common stock of energy companies or real estate investment trusts for purposes of total

return. These investments are valued at unit values provided by the investment managers which are based on the fair value of the underlying investments.

(11) Real asset private funds are comprised of interests in limited partnerships that invest in private companies in the energy industry and private real estate properties for purposes of total

return. These interests are valued at fair value which is generally based on the net asset value or capital balance as reported by the partnerships subject to the review and approval of the

investment managers and their consultants. As there is not a liquid market for some of these investments, realization of the estimated fair value of such investments is dependent upon

transactions between willing sellers and buyers.

DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT 61

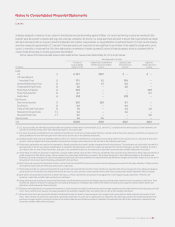

Notes to Consolidated Financial Statements

Darden