Red Lobster 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

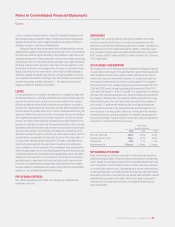

the consolidated statements of earnings. Receivables from national retail

outlets and national storage and distribution companies amounted to $42.7

million and $34.4 million at May 30, 2010 and May 31, 2009, respectively.

The allowance for doubtful accounts associated with all of our receivables

amounted to $3.6 million at May 30, 2010 and May 31, 2009.

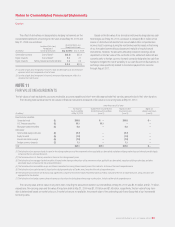

NOTE 4

ASSET IMPAIRMENT, NET

During fiscal 2010 we recorded $6.2 million of long-lived asset impairment

charges primarily related to the write-down of assets held for disposition

based on updated valuations, the permanent closure of three Red Lobsters

and three LongHorn Steakhouses and the write-down of two LongHorn

Steakhouses and one Olive Garden based on an evaluation of expected cash

flows. During fiscal 2009 we recorded $12.0 million of long-lived asset

impairment charges primarily related to the write-down of assets held for

disposition, the permanent closure of one LongHorn Steakhouse and the

write-down of another LongHorn Steakhouse based on an evaluation of

expected cash flows. During fiscal 2008 we recorded no long-lived asset

impairment charges. These costs are included in asset impairment, net as

a component of earnings from continuing operations in the accompanying

consolidated statements of earnings for fiscal 2010, 2009 and 2008. Impair-

ment charges were measured based on the amount by which the carrying

amount of these assets exceeded their fair value. Fair value is generally

determined based on appraisals or sales prices of comparable assets and

estimates of future cash flows.

The results of operations for all Red Lobster, Olive Garden and LongHorn

Steakhouse restaurants permanently closed in fiscal 2010, 2009 and 2008

that would otherwise have met the criteria for discontinued operations reporting

are not material to our consolidated financial position, results of operations or

cash flows and, therefore, have not been presented as discontinued operations.

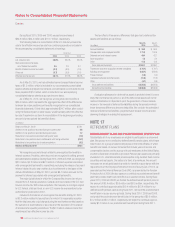

NOTE 5

LAND, BUILDINGS AND EQUIPMENT, NET

The components of land, buildings and equipment, net, are as follows:

(in millions) May 30, 2010 May 31, 2009

Land $ 775.2 $ 769.1

Buildings 3,371.6 3,078.8

Equipment 1,385.5 1,302.8

Assets under capital leases 68.6 68.6

Construction in progress 135.6 209.8

Total land, buildings and equipment 5,736.5 5,429.1

Less accumulated depreciation and amortization (2,323.3) (2,116.5)

Less amortization associated

with assets under capital leases (9.5) (5.9)

Land, buildings and equipment, net $ 3,403.7 $ 3,306.7

Our restaurant support center facility houses all of our executive offices,

shared service functions and brand administrative personnel. On August 24,

2006, we completed the sale and leaseback of our previous restaurant

support center facility for $45.2 million. The transaction was completed in

anticipation of moving the restaurant support center facility to a new facility

which occurred approximately three years from the date of sale. As a result of

the sale and subsequent leaseback of the restaurant support center facility,

we recorded a $15.2 million deferred gain, which was recognized over the

three-year leaseback period on a straight-line basis. During fiscal 2010, fiscal

2009 and fiscal 2008, we recognized gains of $2.7 million, $4.6 million and

$5.1 million, respectively, on the sale of the restaurant support center facility,

which is included as a reduction of selling, general and administrative

expenses in our consolidated statements of earnings.

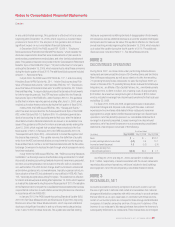

NOTE 6

OTHER ASSETS

The components of other assets are as follows:

(in millions) May 30, 2010 May 31, 2009

Trust-owned life insurance $ 52.8 $ 35.7

Capitalized software costs, net 23.6 22.7

Liquor licenses 42.3 40.9

Acquired below-market leases, net 18.9 21.5

Loan costs, net 14.3 16.8

Marketable securities 31.7 38.6

Miscellaneous 10.3 14.4

Total other assets $193.9 $190.6

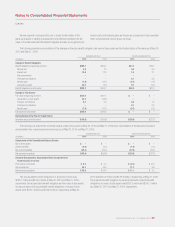

NOTE 7

SHORT-TERM DEBT

As of May 30, 2010 we had no short-term debt outstanding. As of May 31,

2009, short-term debt consisted of $150.0 million of borrowings under the

RevolvingCreditAgreement(asdefinedinNote9–Long-TermDebt).

NOTE 8

OTHER CURRENT LIABILITIES

The components of other current liabilities are as follows:

(in millions) May 30, 2010 May 31, 2009

Non-qualified deferred compensation plan $158.1 $132.1

Sales and other taxes 51.5 61.0

Insurance-related 80.7 75.6

Miscellaneous 50.3 63.1

Employee benefits 32.9 23.5

Accrued interest 17.7 17.0

Total other current liabilities $391.2 $372.3

50 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT

Notes to Consolidated Financial Statements

Darden