Red Lobster 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

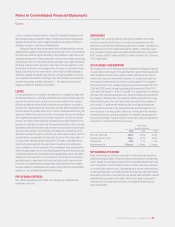

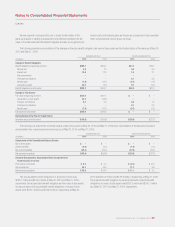

ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

The components of accumulated other comprehensive income (loss) are as

follows:

May 30, May 31,

(in millions) 2010 2009

Foreign currency translation adjustment $ (2.2) $ (3.7)

Unrealized gains (losses) on marketable securities, net of tax 0.3 0.3

Unrealized gains (losses) on derivatives, net of tax 1.1 1.1

Benefit plan funding position, net of tax (70.3) (54.9)

Total accumulated other comprehensive income (loss) $(71.1) $(57.2)

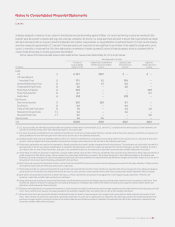

NOTE 14

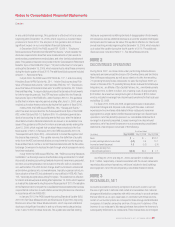

LEASES

An analysis of rent expense incurred related to restaurants in continuing

operations is as follows:

Fiscal Year

(in millions) 2010 2009 2008

Restaurant minimum rent $111.7 $102.4 $ 88.1

Restaurant percentage rent 5.1 6.6 7.7

Restaurant rent averaging expense 10.6 10.5 8.6

Transportation equipment 3.3 3.4 2.9

Office equipment 0.8 1.2 1.2

Office space 4.5 6.6 6.8

Warehouse space 0.5 0.5 0.4

Total rent expense $136.5 $131.2 $115.7

Rent expense included in discontinued operations was $0.6 million,

$1.3 million and $4.5 million for fiscal 2010, 2009 and 2008, respectively.

The annual future lease commitments under capital lease obligations and

noncancelable operating leases, including those related to restaurants

reported as discontinued operations, for each of the five fiscal years

subsequent to May 30, 2010 and thereafter is as follows:

(in millions)

Fiscal Year Capital Operating

2011 $ 5.1 $126.6

2012 5.2 115.8

2013 5.3 103.0

2014 5.4 86.6

2015 5.5 73.5

Thereafter 78.6 250.9

Total future lease commitments 105.1 $756.4

Less imputed interest (at 6.5%) (46.2)

Present value of future lease commitments 58.9

Less current maturities (1.3)

Obligations under capital leases, net of current maturities $ 57.6

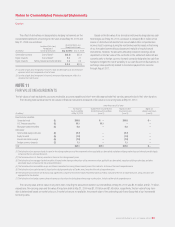

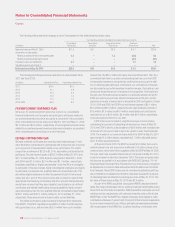

NOTE 15

INTEREST, NET

The components of interest, net are as follows:

Fiscal Year

(in millions) 2010 2009 2008

Interest expense $95.7 $113.7 $89.2

Imputed interest on capital leases 3.9 3.9 2.6

Capitalized interest (4.4) (9.3) (4.9)

Interest income (1.3) (0.9) (1.2)

Interest, net $93.9 $107.4 $85.7

Capitalized interest was computed using our average borrowing rate.

We paid $95.3 million, $103.6 million and $73.6 million for interest (net of

amounts capitalized) in fiscal 2010, 2009 and 2008, respectively.

NOTE 16

INCOME TAXES

Total income tax expense for fiscal 2010, 2009 and 2008 was allocated

as follows:

Fiscal Year

(in millions) 2010 2009 2008

Earnings from continuing operations $136.6 $140.7 $145.2

(Losses) earnings from discontinued operations (1.5) 0.2 3.0

Total consolidated income tax expense $135.1 $140.9 $148.2

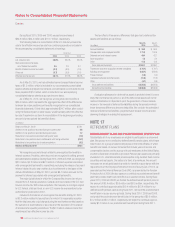

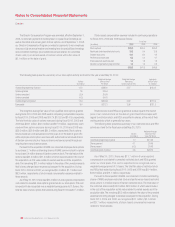

The components of earnings before income taxes from continuing

operations and the provision for income taxes thereon are as follows:

Fiscal Year

(in millions) 2010 2009 2008

Earnings from continuing operations

before income taxes:

U.S. $534.5 $508.1 $509.6

Canada 9.1 4.4 5.1

Earnings from continuing operations

before income taxes $543.6 $512.5 $514.7

Income taxes:

Current:

Federal $126.5 $ 38.1 $ 98.3

State and local 28.7 10.5 21.0

Canada 0.1 0.1 0.1

Total current 155.3 48.7 119.4

Deferred (principally U.S.):

Federal (10.6) 84.3 24.9

State and local (8.1) 7.7 0.9

Total deferred (18.7) 92.0 25.8

Total income taxes $136.6 $140.7 $145.2

DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT 57

Notes to Consolidated Financial Statements

Darden