Red Lobster 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in any undistributed earnings. This guidance is effective for fiscal years

beginning after December 15, 2008, which required us to adopt these

provisions in fiscal 2010. The adoption of this guidance did not have a

significant impact on our consolidated financial statements.

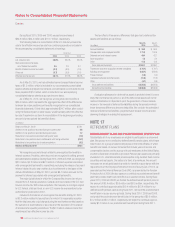

In December 2008, the FASB issued FSP 132(R)-1, “Employers’

Disclosures about Postretirement Benefit Plan Assets,” which expands the

disclosure requirements about fair value measurements of plan assets for

pension plans, postretirement medical plans, and other funded postretirement

plans. This guidance has been incorporated into the Compensation-Retirement

Benefits Topic of the FASB ASC (Topic 715) and is effective for fiscal years

ending after December 15, 2009, which required us to adopt these provisions

during the fourth quarter of fiscal 2010. The additional disclosures are included

inNote17–RetirementPlans.

In April 2009, the FASB issued FSP SFAS No. 107-1 and Accounting

Principles Board (APB) Opinion No. 28-1, “Interim Disclosures about Fair

Value of Financial Instruments,” which amends SFAS No. 107, “Disclosures

about Fair Value of Financial Instruments” and APB Opinion No. 28, “Interim

Financial Reporting,” to require disclosures about the fair value of instruments

for interim reporting periods. This FSP has been codified into the Financial

Instruments Topic of the FASB ASC, within Subtopic 825-10. This guidance

is effective for interim reporting periods ending after June 15, 2009, which

required us to adopt these provisions during the first quarter of fiscal 2010.

In May 2009, the FASB issued SFAS No. 165, “Subsequent Events,”

which has been incorporated into the Subsequent Events Topic of the FASB

ASC, within Subtopic 855-10. Subtopic 855-10 establishes general stan-

dards of accounting for and disclosing events that occur after the balance

sheet date but before financial statements are issued or are available to be

issued. This guidance is effective for interim and annual periods ending after

June 15, 2009, which required that we adopt these provisions in the first

fiscal quarter of 2010. In February 2010, the FASB issued ASU 2010-09,

“SubsequentEvents(Topic855)–AmendmentstoCertainRecognitionand

Disclosure Requirements.” This update removes the definition of a public

entity from the ASC and amends disclosure requirements by only requiring

those entities that do not file or furnish financial statements with the Securities

Exchange Commission to disclose the date through which subsequent events

have been evaluated.

In July 2009, the FASB issued SFAS No. 168, “FASB Accounting Standards

Codification,” as the single source of authoritative nongovernmental U.S. GAAP.

As a result, all existing accounting standard documents have been superseded.

All other accounting literature not included in the ASC will be considered

non-authoritative. The ASC did not change GAAP but instead combined all

authoritative guidance into a comprehensive, topically organized structure.

Upon adoption of the ASC, this statement is now codified in FASB ASC Topic

105, “Generally Accepted Accounting Principles.” This statement is effective

for interim and annual periods ending after September 15, 2009, which required

us to adopt this statement during the second fiscal quarter of 2010. The adoption

of this Statement did not impact the consolidated financial statements but does

require that all references to authoritative accounting literature be referenced

in accordance with the FASB ASC.

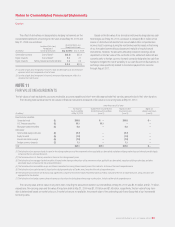

In January 2010, the FASB issued Accounting Standards Update (ASU)

2010-06, Fair Value Measurements and Disclosures (Topic 820), Improving

Disclosures about Fair Value Measurements, which required additional

disclosure of significant transfers in and out of instruments categorized as

Level 1 and 2 in the Fair Value hierarchy. This update also clarified existing

disclosure requirements by defining the level of disaggregation of instruments

into classes as well as additional disclosure around the valuation techniques

and inputs used to measure fair value. This update is effective for interim and

annual reporting periods beginning after December 15, 2009, which required

us to adopt this update during the fourth quarter of 2010. The additional

disclosuresareincludedinNote11–FairValueMeasurements.

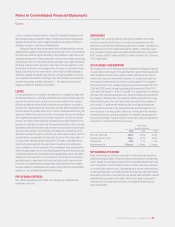

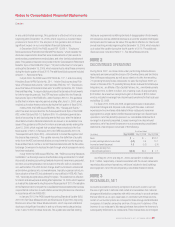

NOTE 2

DISCONTINUED OPERATIONS

During fiscal 2007, we closed nine under-performing Bahama Breeze

restaurants and announced the closure of 54 Smokey Bones and two Rocky

River Grillhouse restaurants, as well as our intention to offer the remaining

73 operating Smokey Bones restaurants for sale. During fiscal 2008, we

closed on the sale of the 73 operating Smokey Bones restaurants to Barbeque

Integrated, Inc., an affiliate of Sun Capital Partners, Inc., a worldwide private

investment firm, for $82.0 million, net of selling costs of approximately

$1.8 million. As a result we recognized a gain on the sale of $18.0 million,

which is included in earnings from discontinued operations for the fiscal year

ended May 25, 2008.

For fiscal 2010, 2009 and 2008, all gains and losses on disposition,

impairment charges and disposal costs, along with the sales, costs and

expenses and income taxes attributable to these restaurants have been

aggregated to a single caption entitled (losses) earnings from discontinued

operations, net of tax (benefit) expense in our consolidated statements of

earnings for all periods presented. (Losses) earnings from discontinued

operations, net of tax (benefit) expense on our accompanying consolidated

statements of earnings are comprised of the following:

Fiscal Year Ended

(in millions)

May 30, 2010 May 31, 2009 May 25, 2008

Sales $ – $ – $120.7

(Losses) earnings before income taxes (4.0) 0.6 10.7

Income tax benefit (expense) 1.5 (0.2) (3.0)

Net (losses) earnings from

discontinued operations $(2.5) $0.4 $ 7.7

As of May 30, 2010 and May 31, 2009, we had $11.0 million and

$14.7 million, respectively, of assets associated with the closed restaurants

reported as discontinued operations, which are included in land, buildings

and equipment, net on the accompanying consolidated balance sheets.

NOTE 3

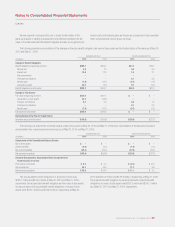

RECEIVABLES, NET

Accounts receivable is primarily comprised of amounts owed to us from

the sale of gift cards in national retail outlets and receivables from national

storage and distribution companies with which we contract to provide services

that are billed to us on a per-case basis. In connection with these services,

certain of our inventory items are conveyed to these storage and distribution

companies to transfer ownership and risk of loss prior to delivery of the

inventory to our restaurants. We reacquire these items when the inventory is

subsequently delivered to our restaurants. These transactions do not impact

DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT 49

Notes to Consolidated Financial Statements

Darden