Red Lobster 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT

Notes to Consolidated Financial Statements

Darden Restaurants

22 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT

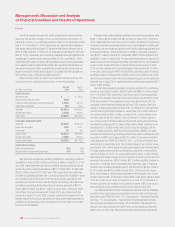

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

This discussion and analysis below for Darden Restaurants, Inc. (Darden, the

Company, we, us or our) should be read in conjunction with our consolidated

financial statements and related financial statement notes found elsewhere in

this report.

We operate on a 52/53 week fiscal year, which ends on the last Sunday

in May. Fiscal 2010 and 2008 consisted of 52 weeks of operation, while fiscal

2009 consisted of 53 weeks of operation. We have included in this discussion

certain financial information for fiscal 2009 on a 52-week basis to assist users in

making comparisons to our other fiscal years. For fiscal 2009, results presented

on a 52-week basis exclude the last week of the fiscal year

OVERVIEW OF OPERATIONS

Our business operates in the full-service dining segment of the restaurant

industry, primarily in the United States. At May 30, 2010, we operated

1,824 Red Lobster®, Olive Garden®, LongHorn Steakhouse®, The Capital

Grille®, Bahama Breeze® and Seasons 52® restaurants in the United

States and Canada. Through subsidiaries, we own and operate all of our

restaurants in the United States and Canada, except for three restaurants

located in Central Florida that are owned by joint ventures and managed by

us. The joint ventures pay management fees to us, and we control the joint

ventures’ use of our service marks. None of our restaurants in the United

States or Canada are franchised. As of May 30, 2010, we franchised 5

LongHorn Steakhouse restaurants in Puerto Rico to an unaffiliated franchisee,

and 25 Red Lobster restaurants in Japan to an unaffiliated Japanese

corporation, under area development and franchise agreements.

Our sales from continuing operations were $7.11 billion in fiscal 2010

compared to $7.22 billion in fiscal 2009. The 1.4 percent decrease was

primarily driven by the impact of the 53rd week in fiscal 2009 and the

combined same-restaurant sales decrease for Olive Garden, Red Lobster

and LongHorn Steakhouse, partially offset by the addition of 32 net new

Olive Gardens, 10 net new LongHorn Steakhouses, 4 net new Red Lobsters,

3 new The Capital Grilles, 3 new Seasons 52s and 1 new Bahama Breeze.

Although our combined same-restaurant sales for Olive Garden, Red Lobster

and LongHorn Steakhouse declined 2.6 percent, this compares to a decline

of 4.9 percent for the Knapp-TrackTM benchmark of U.S. same-restaurant

sales excluding Darden. During fiscal 2010, as a result of a significantly

higher trend in gift card redemptions, we changed our estimate of gift card

breakage and adjusted unearned revenue with a corresponding reduction

in gift card breakage income of $20.4 million, which is included in sales.

Net earnings from continuing operations for fiscal 2010 were $407.0 mil-

lion ($2.86 per diluted share) compared with net earnings from continuing

operations for fiscal 2009 of $371.8 million ($2.65 per diluted share). Net

earnings from continuing operations for fiscal 2010 increased 9.5 percent

and diluted net earnings per share from continuing operations increased

7.9 percent compared with fiscal 2009. Diluted net earnings per share

growth for fiscal 2010 was reduced by approximately nine cents as a result

of adjustments to our gift card redemption rate, referred to above.

Our net losses from discontinued operations were $2.5 million ($0.02 per

diluted share) for fiscal 2010, compared with earnings from discontinued

operations of $0.4 million ($0.00 per diluted share) for fiscal 2009. When

combined with results from continuing operations, our diluted net earnings

per share were $2.84 and $2.65 for fiscal 2010 and 2009, respectively.

During the second quarter of fiscal 2008, we completed the acquisition

of RARE Hospitality International, Inc. (RARE) for $1.27 billion in total

purchase price. RARE owned two principal restaurant brands, LongHorn

Steakhouse and The Capital Grille, of which 288 and 29 locations, respec-

tively, were in operation as of the date of acquisition. The acquisition was

completed on October 1, 2007 and the acquired operations are included in

our consolidated financial statements from the date of acquisition.

During fiscal 2007 and 2008 we closed or sold all Smokey Bones and

Rocky River Grillhouse restaurants and we closed nine Bahama Breeze

restaurants. These restaurants and their related activities have been

classified as discontinued operations. Therefore, for the fiscal 2010, 2009

and 2008 years, all impairment losses and disposal costs, gains and

losses on disposition, along with the sales, costs and expenses and income

taxes attributable to these restaurants have been aggregated in a single

caption entitled “(Losses) earnings from discontinued operations, net of

tax (benefit) expense” on the consolidated statements of earnings found

elsewhere in this report.

In fiscal 2011, we expect a net increase of approximately 70 to 75

restaurants. We expect combined U.S. same-restaurant sales in fiscal 2011

to increase 2 percent to 3 percent for Red Lobster, Olive Garden and LongHorn

Steakhouse. We expect fiscal 2011 sales to increase between 5.5 percent

and 6.5 percent and diluted net earnings per share growth from continuing

operations for fiscal 2011 to range from 14 percent to 17 percent.

In June 2010, we announced a quarterly dividend of 32 cents per

share, payable on August 2, 2010. Previously, our quarterly dividend was

25 cents per share, or $1.00 per share on an annual basis. Based on the

32 cent quarterly dividend declaration, our expected annual dividend is

$1.28 per share, a 28 percent increase. Dividends are subject to the

approval of the Company’s Board of Directors and, accordingly, the timing

and amount of our dividends are subject to change.

Our mission is to be the best in full-service dining, now and for

generations. We believe we can achieve this goal by continuing to build

on our strategy to be a multi-brand restaurant growth company, which is

grounded in:

•Competitivelysuperiorleadership;

•Strongbrandbuildingthatreflectsbrandmanagementand

restaurantoperatingexcellence;and

•Brandsupportexcellence.