Red Lobster 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During fiscal 2010, 2009 and 2008, we paid income taxes of

$94.8 million, $64.4 million and $119.7 million, respectively.

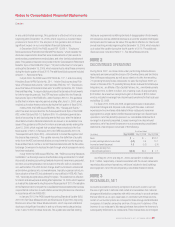

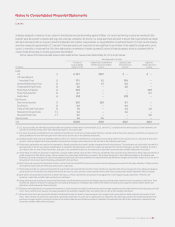

The following table is a reconciliation of the U.S. statutory income tax

rate to the effective income tax rate from continuing operations included in

the accompanying consolidated statements of earnings:

Fiscal Year

2010 2009 2008

U.S. statutory rate 35.0% 35.0% 35.0%

State and local income taxes,

net of federal tax benefits 2.5 2.3 2.7

Benefit of federal income tax credits (8.7) (8.9) (7.9)

Other, net (3.7) (0.9) (1.6)

Effective income tax rate 25.1% 27.5% 28.2%

As of May 30, 2010, we had estimated current prepaid federal income

taxes of $1.5 million, which is included in our accompanying consolidated

balance sheets as prepaid income taxes, and estimated current state income

taxes payable of $1.0 million, which is included in our accompanying

consolidated balance sheets as accrued income taxes.

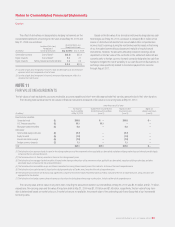

As of May 30, 2010, we had gross unrecognized tax benefits of

$30.4 million, which represents the aggregate tax effect of the differences

between tax return positions and benefits recognized in our consolidated

financial statements. Of this total, approximately $24.7 million, after consid-

ering the federal impact on state issues, would favorably affect the effective

tax rate if resolved in our favor. A reconciliation of the beginning and ending

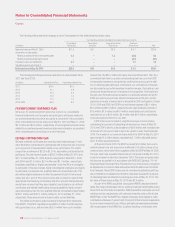

amount of unrecognized tax benefits follows:

(in millions)

Balance at May 31, 2009 $ 58.1

Additions to tax positions recorded during the current year 2.8

Additions to tax positions recorded during prior years 1.2

Reductions to tax positions recorded during prior years (1.3)

Reductions to tax positions due to settlements with taxing authorities (25.2)

Reductions to tax positions due to statute expiration (5.2)

Balance at May 30, 2010 $30.4

We recognize accrued interest related to unrecognized tax benefits in

interest expense. Penalties, when incurred, are recognized in selling, general

and administrative expense. During fiscal 2010, 2009 and 2008, we recognized

$2.5 million, $4.2 million and $2.0 million of interest expense associated

with unrecognized tax benefits, respectively, excluding the release of accrued

interest related to prior year matters due to settlement or the lapse of the

statute of limitations. At May 30, 2010, we had $6.1 million accrued for the

payment of interest associated with unrecognized tax benefits.

The major jurisdictions in which the Company files income tax returns

include the U.S. federal jurisdiction, Canada, and most states in the U.S. that

have an income tax. With a few exceptions, the Company is no longer subject

to U.S. federal, state and local, or non-U.S. income tax examinations by tax

authorities for years before 2001.

Included in the balance of unrecognized tax benefits at May 30, 2010

is $0.3 million related to tax positions for which it is reasonably possible

that the total amounts could change during the next twelve months based on

the outcome of examinations or as a result of the expiration of the statute

of limitations for specific jurisdictions. The $0.3 million relates to items that

would impact our effective income tax rate.

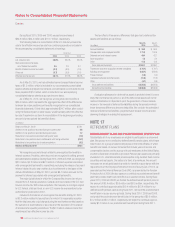

The tax effects of temporary differences that give rise to deferred tax

assets and liabilities are as follows:

May 30, May 31,

(in millions) 2010 2009

Accrued liabilities $ 34.3 $ 56.4

Compensation and employee benefits 171.6 152.6

Deferred rent and interest income 49.4 42.1

Asset disposition 1.5 5.4

Other 11.3 12.2

Gross deferred tax assets $ 268.1 $ 268.7

Trademarks and other acquisition related intangibles (178.7) (179.7)

Buildings and equipment (238.7) (259.5)

Prepaid interest (1.0) (1.0)

Capitalized software and other assets (11.8) (11.3)

Other (4.7) (3.8)

Gross deferred tax liabilities $(434.9) $(455.3)

Net deferred tax liabilities $(166.8) $(186.6)

A valuation allowance for deferred tax assets is provided when it is more

likely than not that some portion or all of the deferred tax assets will not be

realized. Realization is dependent upon the generation of future taxable

income or the reversal of deferred tax liabilities during the periods in which

those temporary differences become deductible. We consider the scheduled

reversal of deferred tax liabilities, projected future taxable income and tax

planning strategies in making this assessment.

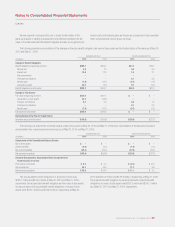

NOTE 17

RETIREMENT PLANS

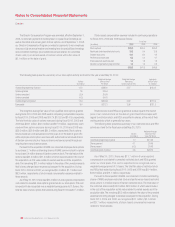

DEFINED BENEFIT PLANS AND POSTRETIREMENT BENEFIT PLAN

Substantially all of our employees are eligible to participate in a retirement

plan. We sponsor non-contributory defined benefit pension plans, which have

been frozen, for a group of salaried employees in the United States, in which

benefits are based on various formulas that include years of service and

compensationfactors;andforagroupofhourlyemployeesintheUnitedStates,

in which a fixed level of benefits is provided. Pension plan assets are primarily

invested in U.S., international and private equities, long duration fixed-income

securities and real assets. Our policy is to fund, at a minimum, the amount

necessary on an actuarial basis to provide for benefits in accordance with the

requirements of the Employee Retirement Income Security Act of 1974, as

amended and the Internal Revenue Code (IRC), as amended by the Pension

Protection Act of 2006. We also sponsor a contributory postretirement benefit

plan that provides health care benefits to our salaried retirees. During fiscal

years 2010, 2009 and 2008, we funded the defined benefit pension plans in

the amount of $0.4 million, $0.5 million and $0.5 million, respectively. We

expect to contribute approximately $10.4 mil lion to $12.4 million to our

defined benefit pension plans during fiscal 2011. We fund the postretirement

benefit plan on a pay-as-you-go basis. During fiscal 2010, 2009 and 2008,

we funded the postretirement benefit plan in the amounts of $0.6 million,

$1.2 million and $1.2 million, respectively. We expect to contribute approxi-

mately $1.0 million to our postretirement benefit plan during fiscal 2011.

58 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT

Notes to Consolidated Financial Statements

Darden