Red Lobster 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 Annual Report

Still Hungry?

1968

Table of contents

-

Page 1

Still Hungry? 1968 2010 Annual Report -

Page 2

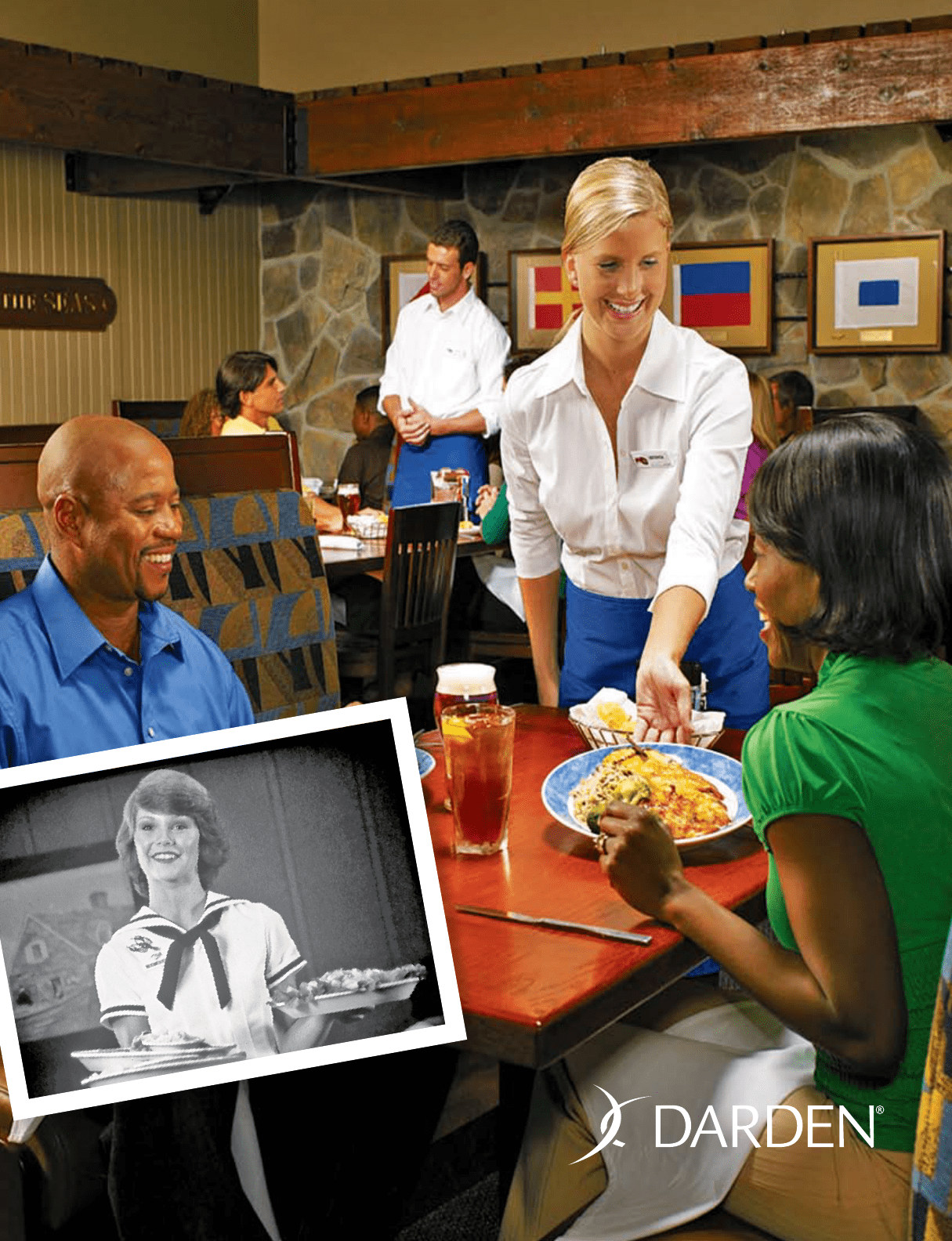

... back to the towns and cities where we live and work, and maintain the loyalty of thousands who have chosen to build their LETTER TO SHAREHOLDERS careers with us. And if a single guest leaves one of our restaurants any less than delighted, we still have work to do. At Darden we have an insatiable... -

Page 3

Clarence Otis, Jr. Chairman and Chief Executive Ofï¬cer Andrew H. Madsen President and Chief Operating Ofï¬cer Bill Darden Founder, Darden Restaurants, Inc. Joe Lee Former President and Chief Executive Ofï¬cer we are. DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT 1 -

Page 4

... (52 weeks vs. 52 weeks), which was offset partially by the addition of one new restaurant. Average annual sales per restaurant were฀$5.4฀million. Fiscal 2010 Financial Highlights Although absolute results from continuing operations for ï¬scal 2010 were below our long-range targets due to... -

Page 5

... Lee is named President of Red Lobster. Twenty years later, he would become Darden's ï¬rst Chairman & CEO. 1981 The ï¬rst LongHorn Steakhouse opens on Piedmont Road in Atlanta. •฀ ฀ Seasons฀52's฀total฀sales฀were฀$50฀million,฀average฀annual฀ sales฀per฀restaurant฀were... -

Page 6

... founder Bill Darden, Darden Restaurants, Inc. is spun off from General Mills as a publicly traded company on the New York Stock Exchange. 1996 The ï¬rst Bahama Breeze opens on International Drive in Orlando. 2010 Financial Highlights Fiscal Year Ended (In Millions, Except Per Share Amounts) May... -

Page 7

...ï¬ed Restaurant Support Center campus in Orlando. The new campus brings all RSC personnel under one roof for the ï¬rst time, allowing for a more collaborative work environment. OUR BRAND-BUILDING EFFECTIVENESS We are very good brand builders today. As our world and our industry continue to change... -

Page 8

... is our passion for listening to and learning from our guests and employees. Consumer and employee insights have played key roles in our success, and these disciplines take on even greater importance in today's increasingly competitive marketplace. 6 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT -

Page 9

.../managing฀partners฀plan฀to฀spend฀ their careers with Darden - versus the industry average of just 19 percent. That's a signiï¬cant competitive advantage when you consider our guests' experiences will never exceed our employees' experiences. DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT... -

Page 10

...experiences to remain relevant. It's one of the main reasons we've been able to successfully build an industry-leading portfolio of brands that have a combined history of more than 140 years. Today, evolving and growing our brands through disciplined and innovative brand management, grounded in cost... -

Page 11

..., the Wood-Fire Grill, introduced in ï¬scal 2009. Over 50 remodels were completed during ï¬scal 2010 and nearly 700฀restaurants฀will฀be฀redesigned฀by฀the฀end฀of฀fiscal฀2014. Menu Innovation From Red Lobster's regional culinary inspiration trips across America and Olive Garden... -

Page 12

... has grown into what is today the world's largest full-service restaurant company - and we're still growing. We're excited about the future and our dynamic plans for accelerated growth. Our plans are built on a solid foundation forged by more than 40 years of building and growing trusted, compelling... -

Page 13

... few years. Enhanced brand positioning work and the completion of its remodel program are also expected to drive meaningful same-restaurant sales growth, leading to appreciably higher average unit volumes. New Business Growth We continue to explore meaningful sources of new growth beyond our current... -

Page 14

Still Investing Darden has a long history of investing in our brands and the rest of our business. And, with scale and resources that are unmatched in the full-service restaurant industry, we continue to invest to drive sustainable growth. 1982 -

Page 15

... Capital Grille continues to maintain competitively superior average restaurant volumes and has increased its market share. To support its brand promise of a club-like dining experience that builds exceptional guest relationships through personalized service, it has continued to invest in customer... -

Page 16

...486 Olive Garden $3,321 (dollars in millions) Total sales increased at Olive Garden (+1.0%) and the Specialty Restaurant Group (+2.0%) despite an extra ï¬scal week in the prior year, and declined modestly at LongHorn Steakhouse (-0.7%) and more meaningfully at Red Lobster (-5.3%) in fiscal 2010... -

Page 17

... ฀ Darden's฀strong฀financial฀performance฀in฀fiscal฀2010฀was฀reflected฀ in our reported growth in earnings per share and meaningful increase in dividends per share. Diluted net earnings per share from continuing operations฀increased฀nearly฀8฀percent฀while฀the฀Company... -

Page 18

Still Leading At Darden, strong values are just as important as business acumen and operations skills. Building on our rich heritage of doing what's right, we continue to lead by example. For our employees, doing what's right means enhancing their capabilities and providing opportunities that will ... -

Page 19

...฀us฀save฀ energy and water and manage waste better. Because they're on the front lines, these teams are in the best position to see where we can improve. For example, an employee's suggestion for a process improvement in our Olive Garden restaurants is expected to฀save฀400,000฀rolls฀of... -

Page 20

...Business School, Texas A&M University. David H. Hughes Retired Chairman of the Board of Hughes Supply, Inc., a building supply company. Andrew H. Madsen President and Chief Operating Officer, Darden Restaurants, Inc. Charles A. Ledsinger, Jr. Chairman of Realty Investment Company, Inc., a private... -

Page 21

..., Specialty Restaurant Group David Pickens President, Olive Garden JJ Buettgen Senior Vice President, New Business Development Kim Lopdrup President, Red Lobster Patti Reilly-White Senior Vice President, Chief Information Officer John Caron Senior Vice President, Chief Marketing Officer Robert... -

Page 22

... reminder that Darden is as passionate as ever about attracting team members, delighting guests and rewarding shareholders, now and for generations. By building on our past and capitalizing on our opportunities, we believe our best days lie ahead. 20 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT -

Page 23

... Financial Reporting Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Statements of Earnings Consolidated Balance Sheets Consolidated Statements of Changes in Stockholders' Equity... -

Page 24

... same-restaurant sales for Olive Garden, Red Lobster and LongHorn Steakhouse declined 2.6 percent, this compares to a decline of 4.9 percent for the Knapp-TrackTM benchmark of U.S. same-restaurant sales excluding Darden. During fiscal 2010, as a result of a significantly higher trend in gift card... -

Page 25

... percent increase in average guest check. Average annual sales per restaurant for Olive Garden were $4.7 million in fiscal 2010 compared to $4.8 million in fiscal 2009 (52-week basis). Red Lobster sales of $2.49 billion in fiscal 2010 were 5.3 percent below last year. Red Lobster opened four net new... -

Page 26

... as pricing and lower employee medical costs. As a percent of sales, this decrease in restaurant labor costs was partially offset by an increase in wage rates and manager compensation. Restaurant expenses (which include lease, property tax, credit card, utility, workers' compensation, insurance, new... -

Page 27

... Financial Statements Management's Discussion and Analysis of Financial Condition and Results of Operations Darden Restaurants Darden integration costs and purchase accounting adjustments related to the RARE acquisition, partially offset by a decrease in credit card expense. Selling, general... -

Page 28

... same expected lease term used for lease accounting purposes. Many of our leases have renewal periods totaling five to 20 years, exercisable at our option, and require payment of property taxes, insurance and maintenance costs in addition to the rent payments. The consolidated financial statements... -

Page 29

... is discounted using a weightedaverage cost of capital that reflects current market conditions. The projection uses management's best estimates of economic and market conditions over the projected period including growth rates in sales, costs and number of units, estimates of future expected changes... -

Page 30

... in our stock price) as well as in the market capitalization of other companies in the restaurant industry, declines in sales at our restaurants, and significant adverse changes in the operating environment for the restaurant industry may result in a future impairment loss. Changes in circumstances... -

Page 31

... balance sheets. Penalties, when incurred, are recognized in selling, general and administrative expenses. We base our estimates on the best available information at the time that we prepare the provision. We generally file our annual income tax returns several months after our fiscal year... -

Page 32

...million฀commercial฀bank฀loan฀due฀ in December 2018 that is used to support a loan from us to the Employee Stock Ownership Plan portion of the Darden Savings Plan. Through our shelf registration statement on file with the SEC, depending on conditions prevailing in the public capital markets... -

Page 33

...-qualified deferred compensation plan through fiscal 2020. (5) Includes interest on unrecognized income tax benefits of $6.1 million. (6) Includes letters of credit for $97.3 million of workers' compensation and general liabilities accrued in our consolidated financial statements, $58.4 million of... -

Page 34

...฀Benefits.฀ We use certain assumptions including, but not limited to, the selection of a discount rate, expected long-term rate of return on plan assets and expected health care cost trend rates. We set the discount rate assumption annually for 32 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT -

Page 35

... applied that could differ from the assumptions used. A quarter-percentage point change in the defined benefit plans' discount rate and the expected long-term rate of return on plan assets would increase or decrease earnings before income taxes by $1.4 million and $0.5 million, respectively... -

Page 36

... in this report). The value at risk from an increase in the fair value of all of our long-term fixed rate debt, over a period of one year, was approximately $129.4 million. The fair value of our long-term fixed rate debt during fiscal 2010 averaged $1.62 billion, with a high of $1.73 billion and... -

Page 37

...earnings per share growth, and capital expenditures in fiscal 2011, and all other statements that are not historical facts, including without limitation statements with respect to the financial condition, results of operations, plans, objectives, future performance and business of Darden Restaurants... -

Page 38

... Company's independent registered public accounting firm KPMG LLP, has issued an audit report on the effectiveness of our internal control over financial reporting, which follows. Clarence Otis, Jr. Chairman of the Board and Chief Executive Officer 36 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT -

Page 39

... flows for each of the years in the three-year period ended May 30, 2010, and our report dated July 23, 2010 expressed an unqualified opinion on those consolidated financial statements. Orlando, Florida July 23, 2010 Certified Public Accountants DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT 37 -

Page 40

... Statements Report ofConsolidated Independent Financial Registered Public Accounting Firm Darden Restaurants The Board of Directors and Stockholders Darden Restaurants, Inc. We have audited the accompanying consolidated balance sheets of Darden Restaurants, Inc. and subsidiaries as of May 30, 2010... -

Page 41

Consolidated Statements of Earnings Darden Fiscal Year Ended (in millions, except per share data) May 30, 2010 May 31, 2009 May 25, 2008 Sales Costs and expenses: Cost of sales: Food and beverage Restaurant labor Restaurant expenses Total cost of sales, excluding restaurant depreciation and ... -

Page 42

Consolidated Balance Sheets Darden (in millions) May 30, 2010 May 31, 2009 Assets Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid income taxes Prepaid expenses and other current assets Deferred income taxes Total current assets Land, buildings and equipment, net ... -

Page 43

... shares) Stock-based compensation ESOP note receivable repayments Income tax benefits credited to equity Purchases of common stock for treasury (2.0 shares) Issuance of treasury stock under Employee Stock Purchase Plan and other plans (0.3 shares) Repayment of officer notes Balances at May 30, 2010... -

Page 44

... of loan costs Stock-based compensation expense Change in current assets and liabilities Contribution to postretirement plan Loss on disposal of land, buildings and equipment Change in cash surrender value of trust-owned life insurance Deferred income taxes Change in deferred rent Change in... -

Page 45

... SIGNIFICANT ACCOUNTING POLICIES OPERATIONS AND PRINCIPLES OF CONSOLIDATION The accompanying consolidated financial statements include the operations of Darden Restaurants, Inc. and its wholly owned subsidiaries (Darden, the Company, we, us or our). We own and operate the Red Lobster®, Olive Garden... -

Page 46

...is discounted using a weighted-average cost of capital that reflects current market conditions. The projection uses management's best estimates of economic and market conditions over the projected period including growth rates in sales, costs and number of units, estimates of future expected changes... -

Page 47

...฀related฀to฀projected฀sales฀from฀our฀annual฀long-range฀plan;฀ assumed฀royalty฀rates฀that฀could฀be฀payable฀if฀we฀did฀not฀own฀the฀trademarks;฀ and a discount rate. We recognize an impairment loss when the estimated fair value of the indefinite-lived... -

Page 48

...rate periodically and apply that rate to gift card redemptions. DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES We use financial and commodities derivatives to manage interest rate, compensation, commodities pricing and foreign currency exchange rate risks inherent in our business operations. Our use... -

Page 49

....9 million, $308.3 million and $257.8 million in fiscal 2010, 2009 and 2008, respectively. STOCK-BASED COMPENSATION We recognize the cost of employee service received in exchange for awards of equity instruments based on the grant date fair value of those awards. We utilize the Black-Scholes option... -

Page 50

... the exchange rates in effect at the balance sheet date. Results of operations are translated using the average exchange rates prevailing throughout the period. Translation gains and losses are reported as a separate component of accumulated other comprehensive income (loss) in stockholders' equity... -

Page 51

... periods presented. (Losses) earnings from discontinued operations, net of tax (benefit) expense on our accompanying consolidated statements of earnings are comprised of the following: (in millions) May 30, 2010 Fiscal Year Ended May 31, 2009 May 25, 2008 Sales (Losses) earnings before income taxes... -

Page 52

... exceeded their fair value. Fair value is generally determined based on appraisals or sales prices of comparable assets and estimates of future cash flows. The results of operations for all Red Lobster, Olive Garden and LongHorn Steakhouse restaurants permanently closed in fiscal 2010, 2009 and 2008... -

Page 53

.... We use financial and commodities derivatives to manage interest rate, compensation and commodities pricing and foreign currency exchange rate risks inherent in our business operations. Our use of derivative instruments฀is฀currently฀limited฀to฀interest฀rate฀hedges;฀equity฀forwards... -

Page 54

..., changes in the derivatives' fair value are not included in current earnings but are included in accumulated other comprehensive income (loss), net of tax. These changes in fair value will subsequently be reclassified into earnings as a component of food and beverage costs or selling, general and... -

Page 55

... value of the equity forward contracts would offset changes in the fair value of the Darden stock investments in the non-qualified deferred compensation plan within selling, general and administrative expenses in our consolidated statements of earnings. DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT... -

Page 56

... Financial Statements Darden The fair value of our derivative instruments as of May 30, 2010 and May 31, 2009, is as follows: Balance Sheet Location Derivative Assets May 30, 2010 May 31, 2009 Derivative Liabilities May 30, 2010 May 31, 2009 (in millions) Derivative contracts designated... -

Page 57

...63 billion and $1.49 billion, respectively. The fair value of long-term debt is determined based on market prices or, if market prices are not available, the present value of the underlying cash flows discounted at our incremental borrowing rates. DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT 55 -

Page 58

...operations. NOTE 12 FINANCIAL INSTRUMENTS Marketable securities are carried at fair value and consist of $31.7 million of available-for-sale securities related to insurance funding requirements for our workers compensation and general liability claims. The following table summarizes cost and market... -

Page 59

... Benefit plan funding position, net of tax Total accumulated other comprehensive income (loss) $ (2.2) 0.3 1.1 (70.3) $(71.1) $ (3.7) 0.3 1.1 (54.9) $(57.2) NOTE 14 LEASES An analysis of rent expense incurred related to restaurants in continuing operations is as follows: (in millions) 2010 Fiscal... -

Page 60

..., or non-U.S. income tax examinations by tax authorities for years before 2001. Included in the balance of unrecognized tax benefits at May 30, 2010 is $0.3 million related to tax positions for which it is reasonably possible that the total amounts could change during the next twelve months based on... -

Page 61

... Plans 2010 2009 Postretirement Benefit Plan 2010 2009 Components of the Consolidated Balance Sheets: Non-current assets Current liabilities Non-current liabilities Net amounts recognized Amounts Recognized in Accumulated Other Comprehensive Income (Loss), net of tax: Prior service cost (credit... -

Page 62

... defined benefit pension plans. A quarter percentage point change in the defined benefit plans' discount rate and the expected long-term rate of return on plan assets would increase or decrease earnings before income taxes by $1.4 million and $0.5 million, respectively. The assumed health care cost... -

Page 63

... return purposes. Stocks received from private equity distributions are valued by the trustee at closing prices from national exchanges on the valuation date. Investments in private companies are valued by management based upon information provided by the respective third-party investment manager... -

Page 64

...Asset Private Funds (in millions) Total Beginning balance at May 31, 2009 Actual return on plan assets: Relating to assets still held at the reporting date Relating to assets sold during the period Purchases, sales, and settlements Transfers in and/or out of Level 3 Ending balance at May 30, 2010... -

Page 65

... balance sheet at fair value until such time as it is settled. All stock options and other stock or stock-based awards that are part of the compensation paid or deferred pursuant to the Director Compensation Program are awarded under the 2002 Plan. DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT... -

Page 66

... our stock plans. This cost is expected to be recognized over a weighted-average period of 1.8 years. The total fair value of stock options that vested during fiscal 2010 was $17.4 million. Restricted stock and RSUs are granted at a value equal to the market price of our common stock on the date of... -

Page 67

... plans. This cost is expected to be recognized over a weighted-average period of 2.4 years. The total fair value of performance stock units that vested in fiscal 2010 was $0.1 million. We maintain an Employee Stock Purchase Plan to provide eligible employees who have completed one year of service... -

Page 68

...results of operations or liquidity. NOTE 20 SUBSEQUENT EVENT On June 22, 2010, the Board of Directors declared a cash dividend of 32 cents per share to be paid August 2, 2010 to all shareholders of record as of the close of business on July 9, 2010. 66 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT -

Page 69

... quarterly data for fiscal 2010 and fiscal 2009: Fiscal 2010 - Quarters Ended (in millions, except per share data) Aug. 30 Nov. 29 Feb. 28(1) May 30(1) Total(2) Sales Earnings before income taxes Earnings from continuing operations Losses from discontinued operations, net of tax Net earnings... -

Page 70

...' equity per outstanding share Other Statistics Cash flows from operations (1) (2) Capital expenditures (2) (4) Dividends paid Dividends paid per share Advertising expense (2) Stock price: High Low Close Number of employees Number of restaurants (2) (1) Fiscal year 2009 consisted of 53 weeks while... -

Page 71

...believe we are in compliance with the applicable corporate governance listing standards of the New York Stock Exchange, as of the date of this report. DARDEN RESTAURANTS BEING OF SERVICE REPORT To receive a copy of the 2010 Darden Restaurants Being of Service Report, mail a request to the Foundation... -

Page 72

1000 Darden Center Drive | Orlando, FL 32837 | 407-245-4000 | www.darden.com