Qantas 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 80

for the year ended 30 June 2010

Notes to the Financial Statements continued

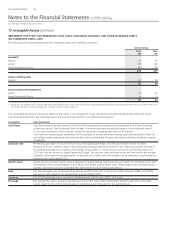

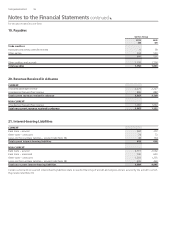

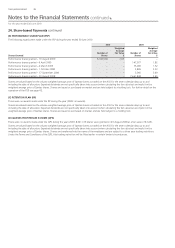

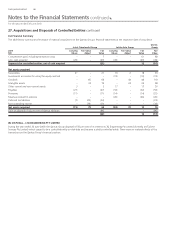

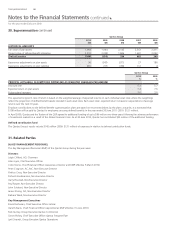

(C) DERIVATIVE INEFFECTIVENESS AND NON-DESIGNATED DERIVATIVES IN THE CONSOLIDATED INCOME STATEMENT

Amounts shown below re ect ineffectiveness on changes in the fair value of any derivative instrument in a cash ow hedge, or part of a derivative

instrument that does not qualify for hedge accounting. AASB 139 Financial Instruments: Recognition and Measurement (AASB 139) permits reporting

entities to separate the intrinsic value and time value of an option. AASB 139 allows for the intrinsic value of an option to be designated as part of

any hedging relationship. As a result, the time value component is not hedge accounted and changes in fair values are recognised immediately in the

Income Statement for the nancial period as it does not form part of a hedging relationship.

Qantas Group

2010

$M

2009

$M

INEFFECTIVE AND NON-DESIGNATED DERIVATIVES

Ineffective portion of cash ow hedges 15 72

Components of derivatives not hedge accounted (including time value of options) (188) 33

Ineffective and non-designated derivatives (173) 105

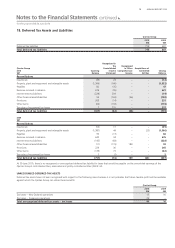

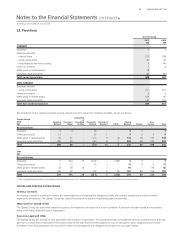

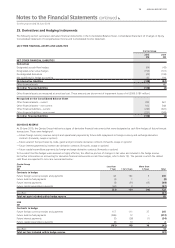

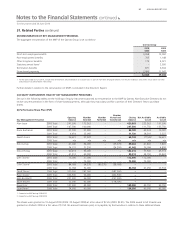

26. Notes to the Cash Flow Statement

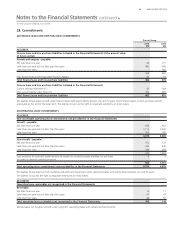

(A) RECONCILIATION OF STATUTORY PROFIT FOR THE YEAR TO NET CASH FROM OPERATING ACTIVITIES

Statutory pro t for the year 116 123

Add: depreciation and amortisation 1,199 1,390

Add: share of net loss of associates and jointly controlled entities 4 15

Add: dividends received from associates and jointly controlled entities 16 20

Add: impairment of goodwill and other intangibles –22

Add: share-based payments 21 59

Add: amortisation of deferred nancing fees 15 20

Add: impairment of property, plant and equipment 52 –

Less: net gain on disposal of impaired assets (4) –

Less: capitalised interest (44) (83)

Less: impairment of investments – (4)

Less: net gain on sale of Qantas Holidays – (86)

Less: interest payments on liabilities held at fair value (94) (120)

Add/(less): net loss/(gain) on disposal of property, plant and equipment 15 (17)

(Less)/add: realised hedging (loss)/gains on operating cash ows (292) 110

Add/(less): changes in fair value of nancial instruments 478 (86)

(Less)/add: other items (51) 5

Movements in operating assets and liabilities:

—Decrease in receivables 58 338

—Increase in inventories (69) (44)

—Increase in other assets (64) (55)

—Decrease in payables (83) (401)

—(Decrease)/increase in revenue received in advance (107) 44

—(Decrease)/increase in provisions (32) 133

—Decrease in current tax receivables/liabilities 128 (113)

—Decrease in deferred lease bene ts (17) (18)

—Increase/(decrease) in deferred tax liabilities 62 (103)

Net cash from operating activities 1,307 1,149

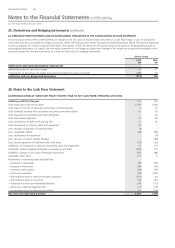

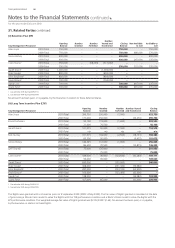

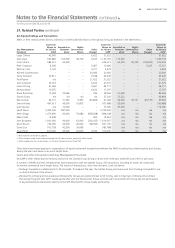

25. Derivatives and Hedging Instruments continued