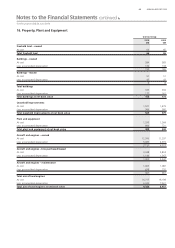

Qantas 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

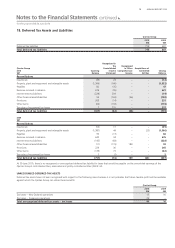

THE QANTAS GROUP 76

for the year ended 30 June 2010

Notes to the Financial Statements continued

Qantas Group

2010

$M

2009

$M

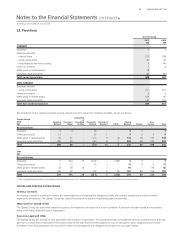

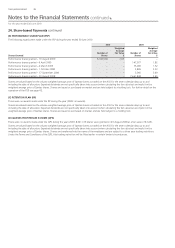

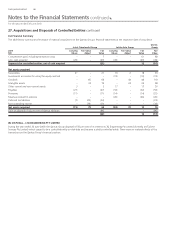

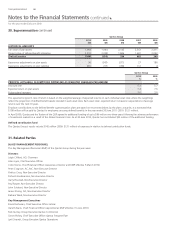

ISSUED CAPITAL

Issued and paid-up capital: 2,265,123,620 (2009: 2,265,123,620) ordinary shares, fully paid 4,729 4,729

Movements in the share capital of Qantas during the current and prior year were as follows:

Date Details

Number

of Shares

M$M

1 July 2008 Balance 1,894 3,976

1 October 2008 Dividend reinvestment plan 55 192

11 February 2009 Institutional share placement 270 491

17 March 2009 Share purchase plan 18 26

8 April 2009 Dividend reinvestment plan 28 44

30 June 2009 Balance 2,265 4,729

30 June 2010 Balance 2,265 4,729

Holders of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one vote per share at shareholders’

meetings.

In the event of wind-up, Qantas ordinary shareholders rank after all creditors and are fully entitled to any residual proceeds on liquidation.

Treasury shares consist of shares held in trust for Qantas employees in relation to equity compensation plans. As at 30 June 2010, 15,640,025

(2009: 14,677,697) shares were held in trust and classi ed as treasury shares.

Qantas Group

2010

$M

2009

$M

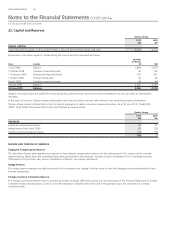

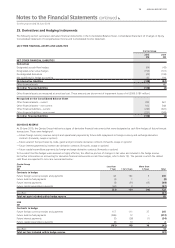

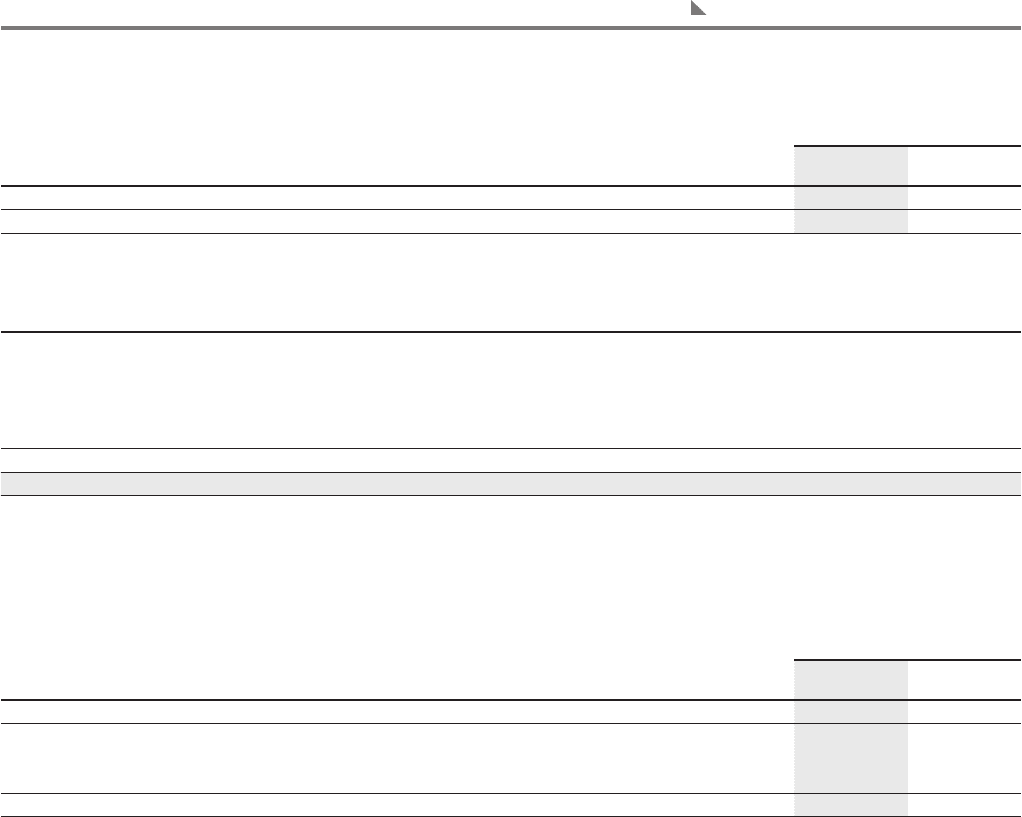

RESERVES

Employee compensation reserve 53 52

Hedge reserve (refer Note 25(B)) 85 (29)

Foreign currency translation reserve (29) (16)

109 7

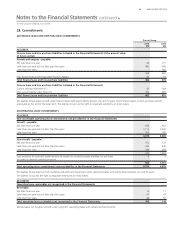

NATURE AND PURPOSE OF RESERVES

Employee Compensation Reserve

The fair value of equity plans granted is recognised in the employee compensation reserve over the vesting period. This reserve will be reversed

against treasury shares when the underlying shares vest and transfer to the employee. No gain or loss is recognised in the Consolidated Income

Statement on the purchase, sale, issue or cancellation of Qantas’ own equity instruments.

Hedge Reserve

The hedge reserve comprises the effective portion of the cumulative net change in the fair value of cash ow hedging instruments related to future

forecast transactions.

Foreign Currency Translation Reserve

The foreign currency translation reserve comprises all foreign exchange differences arising from the translation of the Financial Statements of foreign

controlled entities and associates, as well as from the translation of liabilities that form part of the Qantas Group’s net investment in a foreign

controlled entity.

23. Capital and Reserves