Qantas 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 6

I am pleased to report that the Qantas

Group delivered a good result for

2009/2010 and laid the groundwork

for continuing and sustainable success.

Highlights

Highlights of the year were:

— Underlying Prot Before Tax

of $377 million

— Revenue of $13.8 billion

— Operating cash ow of $1.3 billion

— Cash held at year end of $3.7 billion

In 2008/2009 the Group stood out

in the global aviation sector by recording

a prot, due to its decisive response to

the global nancial crisis. This year the

Group trebled that prot by taking

rapid advantage of improving conditions,

and by maximising the strengths of

Qantas and Jetstar, its two complementary

ying brands.

Key factors

Key factors in the result this year included:

— A robust performance by Qantas, which

was Australia’s most protable and

punctual domestic airline, and which

achieved a signicantly improved

international performance despite

global uncertainty and the impact

of the volcanic ash disruptions

— A record prot by Jetstar, which grew

passenger revenue by 21 per cent

and increased international capacity

by 50 per cent

— A record performance by Qantas

Frequent Flyer, with all-time highs

in customer satisfaction and benets

deriving from enhanced alliance

relationships, notably with the

Woolworths Group

— Industry-leading nancial strength,

including cash holdings of $3.7 billion,

increased operating cash ow, and

the best credit rating of any airline

in the world

— Continuing investment in a modern and

simplied eet, with around 160 aircraft

on order, and an average of one delivery

per month planned for the next

eight years

— Continuing innovation and improvement

in the customer experience, including

the industry-leading Next Generation

Check-in

— Signicant progress towards $1.5 billion

in permanent savings over three years

through the QFuture program, with

$533 million in savings achieved this

year, allied to a business transformation

and simplication agenda

Industry context and outlook

In 2009/2010 global operating conditions

improved from historic lows, with recovery

in demand in both the passenger and

freight markets. International demand

improved across premium and leisure

sectors. Domestic business demand also

returned strongly, although domestic

leisure demand continued to be relatively

soft late in the nancial year.

Looking ahead, the Australian

commercial aviation sector will remain

highly competitive, both domestically

and internationally. Aviation is a complex

industry, subject both to long-term

economic cycles and short-term shocks,

with high xed costs and long investment

lead times. The industry is globalising

unevenly, and still suffers overcapacity

and high start-up and drop-out rates.

To succeed, the Qantas Group’s two

ying brands will be competing vigorously

every day in their different market

segments – the full service Qantas and

the low fares Jetstar.

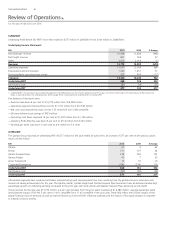

Reporting clarity

This year the Group introduced a new

primary reporting measure: Underlying

Prot Before Tax (PBT). This is a

non-statutory measure which is now

being used by the Board of Directors

and Executive Committee to assess and

improve the performance of the Group.

Underlying PBT makes it easier for the

Group – and its shareholders – to identify

how well the Group manages those

business factors it controls, by eliminating

the difculty statutory accounting

treatments pose in recording one-off

and high-change factors such as hedge

volatility in currencies and fuel.

Chairman’s Report

This year the Qantas Group trebled last year’s prot

by taking rapid advantage of improving conditions,

and by maximising the strengths of Qantas and Jetstar,

its two complementary ying brands.