Qantas 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 100

for the year ended 30 June 2010

Notes to the Financial Statements continued

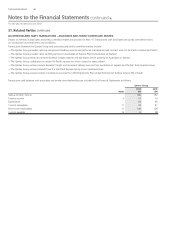

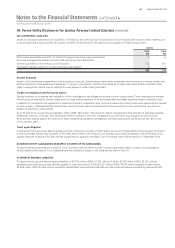

(F) CAPITAL MANAGEMENT

The Board’s policy is to maintain a strong capital base designed to maximise shareholder value, maintain creditor con dence and sustain future

development of the business. Qantas targets a capital structure consistent with an investment grade credit rating while maintaining adequate

liquidity.

The Board remains focussed on balancing funding requirements of the business and investing for future growth with providing dividends for

shareholders. The Board is committed to the resumption of dividend payments. The quantum and timing of this will depend on trading results,

prevailing market conditions, the maintenance of an investment grade credit rating and the level of capital expenditure commitments.

During the year ended 30 June 2010, the Qantas Group invested $1.7 billion in capital expenditure and maintained an investment grade credit rating

despite the pressures of the Global Financial Crisis.

In the year ended 30 June 2011, the Qantas Group estimates it will spend $2.6 billion on capital expenditure. The required funding will be met

primarily through operating cash ows, although further debt funding is planned within the objective of maintaining an investment grade credit

rating. As a consequence, the Board considers it prudent not to pay a dividend for the year ended 30 June 2010.

The Board monitors the level of returns relative to the assets employed in the business. A new performance measure, Return on Invested Capital

(ROIC) has been implemented from 1 July 2010. The target is for ROIC to exceed cost of capital over the long term while growing the business.

35. Events Subsequent to Balance Date

There has not arisen in the interval between 30 June 2010 and the date of this report any event that would have had a material effect on the

Financial Statements as at 30 June 2010.

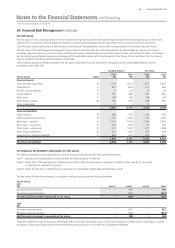

34. Financial Risk Management continued