Qantas 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 24

for the year ended 30 June 2010

Material risks and the effectiveness of risk management plans are

escalated to Executive Management, relevant Board Committees and/or

the Board as appropriate and are reported on as part of the quarterly

risk reporting process. During the quarterly risk reporting process, each

Qantas Group business unit prepares and submits a detailed risk register

outlining the key risks to achieving their objectives and mitigating actions.

Beyond reporting, the identi cation, assessment and management of

risks is also integrated into key business decision-making and activities,

such as strategy development, projects and change initiatives.

Management self-assessments, including self-assessments against the

different QMS elements, audits and risk management reviews are

undertaken to con rm that risks are being mitigated where possible.

On a quarterly basis, Executive Management is required to certify that

there is an effective risk management process in place within their area

of responsibility.

The internal auditor, through an independent third party validation, also

reports to the Board and relevant Board Committees that there is an

effective risk management process in place for the nancial period and

up to the date of signing the Financial Report.

Further details of the Framework and corporate governance structure

are captured in the Qantas Investor Data Book available in the Investors

section on the Qantas website.

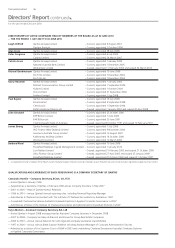

Safety, Health, Environment & Security Committee (SHESC)

The SHESC:

—Has six Members – the CEO and ve others who are Independent

Non-Executive Directors

—Is chaired by John Schubert, an Independent Non-Executive Director

—Has a written Charter which is available in the Corporate Governance

section on the Qantas website

—Is responsible for assisting the Board in ful lling its corporate

governance responsibilities in regard to:

– Safety, health, environment and security matters

– Compliance with related legal and regulatory obligations

– Enterprise-wide risk management

The experience and quali cations of Members of the SHESC are detailed

on pages 10 and 11. Membership of and attendance at 2009/2010

SHESC Meetings are detailed on page 29.

Internal Audit

The Internal Audit function provides independent, objective assurance

and consulting services on Qantas’ system of risk management, internal

compliance, control and governance. The Internal Audit charter is

approved by the Audit Committee and the Internal Auditor reports

functionally to the Audit Committee.

Internal Audit adopts a risk-based approach in formulating its audit plan

to align audit activities to the key risks across Qantas. The audit plan is

reviewed every six months to align audit activity to changes to the

Qantas Group business and risk pro le. The audit plan is approved by the

Audit Committee bi-annually and endorsed by the SHESC.

Audit projects performed by Internal Audit assist the Audit Committee

and the SHESC to promote sound risk management and good corporate

governance. Internal Audit assesses the design and operating

effectiveness of controls for key business processes to mitigate risks

identi ed in the Qantas risk pro le. Management is responsible for

ensuring that appropriate corrective actions are taken on the reported

areas for improvement arising from audit projects within the required

time frame. The status of audit Management actions are submitted

monthly to the Executive Management and quarterly to the Audit

Committee and the SHESC.

The Internal Audit function is independent of the external auditor, has

full access to Management and the right to seek information and

explanation. The Audit Committee oversees the scope of the Internal

Audit function and has access to the Internal Auditor without the

presence of Management.

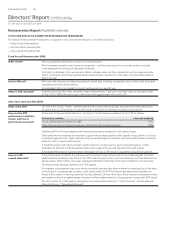

CEO/CFO Declaration

As required by section 295A of the Corporations Act, the CEO and CFO

have declared that:

“In our opinion:

a. the nancial records of Qantas and its controlled entities (Qantas

Group) for the nancial year ended 30 June 2010 (Financial Period)

have been properly maintained in accordance with section 286 of

the Corporations Act;

b. the nancial statements and the notes referred to in section 295(3)(b)

of the Corporations Act for the Financial Period comply with the

accounting standards and other mandatory professional reporting

requirements; and

c. the nancial statements and notes for the Financial Period give a true

and fair view of the nancial position and performance of the Qantas

Group in accordance with section 297 of the Corporations Act.”

In addition, in accordance with Recommendation 7.3 of the ASX

Principles, the CEO and CFO also state to the Board that, in respect

of the Qantas Group for the Financial Period:

a. “The declaration given in accordance with section 295A is founded

on a sound system of risk management and internal compliance and

control and the system is operating effectively in all material respects

in relation to nancial reporting risks; and

b. The statement given in accordance with Recommendation 7.3 (above)

regarding the risk management and internal compliance and control

system provide a reasonable, but not absolute level of assurance and

do not imply a guarantee against adverse events or more volatile

outcomes arising in the future.”

Corporate Governance Statement continued