Qantas 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page 47

Spirit of Australia

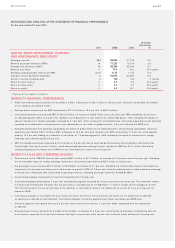

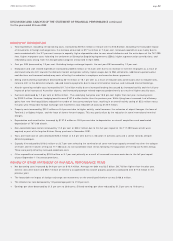

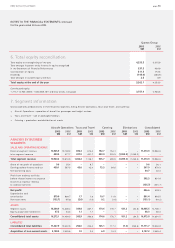

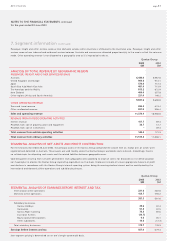

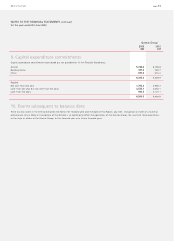

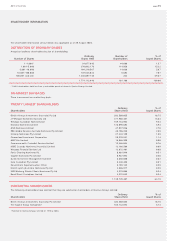

NOTES TO THE FINANCIAL STATEMENTS

for the year ended 30 June 2003

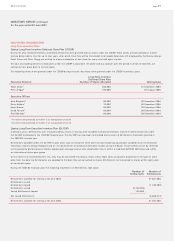

1. Basis of preparation of the concise financial report

The Concise Financial Report has been prepared in accordance with the Corporations Act 2001, Accounting Standard AASB 1039 “ Concise Financial

Reports” and applicable Urgent Issues Group Consensus Views. The Financial Statements and specific disclosures required by AASB 1039 have been

derived from the Qantas Group’s full Financial Report for the financial year. Other information included in the Concise Financial Report is consistent

with the Qantas Group’s full Financial Report. The Concise Financial Report does not, and cannot be expected to, provide as full an understanding

of the financial performance, financial position and financing and investing activities of the Qantas Group as the full Financial Report.

This Report has been prepared on the basis of historical costs and, except where stated, does not take into account changing money values

or fair values of assets.

These accounting policies have been consistently applied by each entity in the Qantas Group, being Qantas Airways Limited (Qantas) and its

controlled entities, and except where there is a change in accounting policy as set out in Note 2, are consistent with those of the previous year.

A full description of the accounting policies adopted by the Qantas Group may be found in the Qantas Group’s full Financial Report for the

financial year.

Where necessary, comparative information has been reclassified to achieve consistency in disclosure with current financial year amounts and

other disclosures.

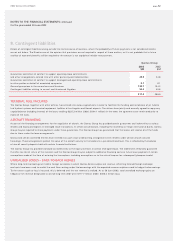

2. Change in accounting policies

EMPLOYEE BENEFITS

The Qantas Group has applied AASB 1028 “ Employee Benefits” for the first time from 1 July 2002.

The liability for wages and salaries, annual leave and sick leave is now calculated using the remuneration rates Qantas expects to pay

as at each reporting date, not wage and salary rates current at reporting date.

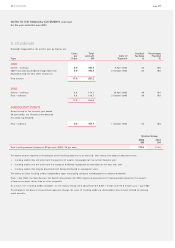

The initial adjustments to the Consolidated Financial Statements as at 1 July 2002 as a result of this change are:

$5.3 million increase in provision for employee benefits;

$3.7 million decrease in opening retained profits; and

$1.6 million increase in future income tax benefit.

There was no material impact on net profit for the financial year to 30 June 2003.

PROVISIONS AND CONTINGENT LIABILITIES

The Qantas Group has applied AASB 1044 “ Provisions, Contingent Liabilities and Contingent Assets” for the first time from 1 July 2002.

Dividends are now recognised at the time they are declared, determined or publicly recommended. Previously, final dividends were recognised

in the financial year to which they related, even though the dividends were announced after the end of that financial year.

The adjustments to the Consolidated Financial Statements as at 1 July 2002 as a result of this change are:

$140.7 million increase in opening retained profits; and

$140.7 million decrease in provision for dividends.

There was no material impact on net profit for the financial year to 30 June 2003.

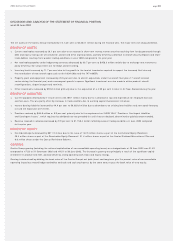

AIRCRAFT LEASES

The Qantas Group has applied Urgent Issues Group Abstract 50 “ Evaluating the Substance of Transactions involving the Legal Form of a Lease”

(issued September 2002) for the first time from 1 July 2002. The application of this abstract had no impact on net profit for the prior year and

an immaterial impact on net profit for the financial year to 30 June 2003.