Qantas 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page 44

2003 Qantas Annual Report

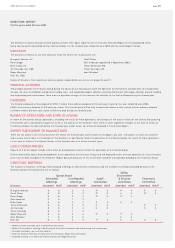

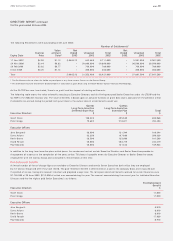

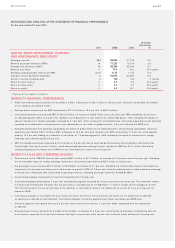

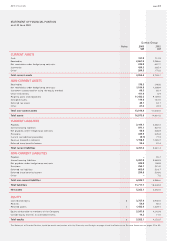

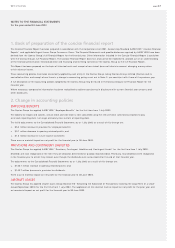

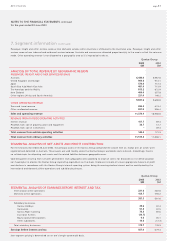

DISCUSSION AND ANALYSIS OF THE STATEMENT OF FINANCIAL POSITION

as at 30 June 2003

The net assets of the Qantas Group increased by 23.7 per cent to $5,262.1 million during the financial year. The major items are discussed below.

REVIEW OF ASSETS

Current receivables increased by 20.1 per cent due to an increase in short-term money market securities resulting from funds generated through

debt and equity raisings not yet utilised for aircraft and other capital projects, partially offset by a decrease in aircraft security deposits and lower

trade debtors resulting from weaker trading conditions in June 2003 compared to the prior year.

Net receivables/payables under hedge/swap contracts decreased by 36.7 per cent to $958.3 million mainly due to exchange rate movements

partly offset by new swaps taken out to hedge aircraft funding.

Inventory levels increased by 11.7 per cent due to the growth in the level of inventories required to support the increased fleet size and

the introduction of new aircraft types such as the A330-200s and the 747-400ERs.

Property, plant and equipment increased by 25.5 per cent due to aircraft acquisitions under the aircraft fleet plan (17 aircraft entered

service during the financial year) and a consequent growth in spares. Significant investment was also made in airline product, aircraft

reconfigurations, airport lounges and terminals.

Other investments increased by $93.0 million primarily due to the acquisition of a 4.99 per cent interest in Air New Zealand during the year.

REVIEW OF LIABILITIES

Current payables decreased by 11.5 per cent to $2,109.1 million mainly due to a decrease in accrued expenditure for employee bonuses

and fuel costs. This was partly offset by increases in trade creditors due to working capital improvement initiatives.

Interest-bearing liabilities increased by 44.4 per cent to $6,363.0 million due to drawdowns on existing loan facilities and new bond financing

to fund the expansion of the fleet.

Provisions reduced by $86.8 million or 9.9 per cent primarily due to the requirements of AASB 1044 “ Provisions, Contingent Liabilities

and Contingent Assets” , which requires that dividends are not provided for until they are declared, determined or publicly recommended.

Revenue received in advance decreased by 9.9 per cent to $1,158.4 million reflecting weaker trading conditions in June 2003 compared

to the prior year.

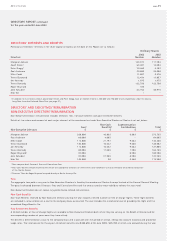

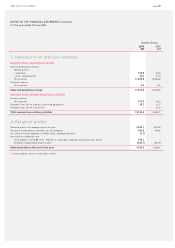

REVIEW OF EQUITY

Contributed equity increased by $811.3 million due to the issue of 142.5 million shares as part of the Institutional Equity Placement,

28.4 million shares as part of the Shareholder Equity Placement, 31.4 million shares as part of the Qantas Dividend Reinvestment Plan and

8.0 million shares under the Qantas Profitshare Scheme.

GEARING

Qantas Group gearing (including the notional capitalisation of non-cancellable operating leases) on a hedged basis at 30 June 2003 was 51:49

compared to 47:53 at 31 December 2002 and 49:51 at 30 June 2002. The increase in gearing was principally a result of the significant capital

investment in product and fleet, partially offset by strong operating cash flows and equity raisings.

Gearing is determined by dividing the book value of the Qantas Group’s net debt (short and long-term plus the present value of non-cancellable

operating leases less related hedge receivables and cash and cash equivalents) by the same amount plus the book value of total equity.